- The AI Powered Global Opportunities Index (AiGO) is a fictional index designed to analyse global markets and investment opportunities using artificial intelligence technology.

- AiGO uses economic indicators, company earnings reports, industry news, policy changes, and other data sources to help the model analyse and forecast global market dynamics from multiple perspectives. The index can be updated in real time to reflect the latest market conditions and trends.

- The AiGO Index offers many potential advantages but also faces challenges such as data quality issues, algorithmic bias, and unpredictability of market dynamics.

The AI Powered Global Opportunities Index (AiGO) index is a highly innovative idea that involves the use of artificial intelligence technology to analyse and identify global investment opportunities. The index aims to provide a real-time, dynamic view of potential opportunities in global markets by combining various data sources and algorithms to help investors.

Concept and objectives of the AiGO Index

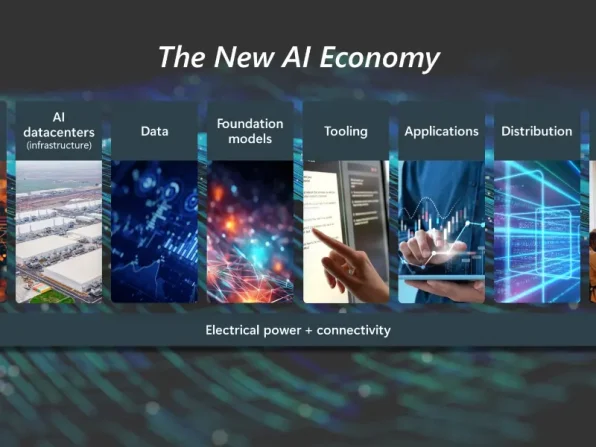

The core concept of the AiGO Index is to use advanced data analytics, particularly machine learning, and big data analytics, to identify investment opportunities in global markets. It is to provide investors with a scientific, data-driven investment decision-making tool to help them identify markets and sectors with high growth potential.

Also read: Why does AI consume so much electricity?

AiGO Index construction methodology

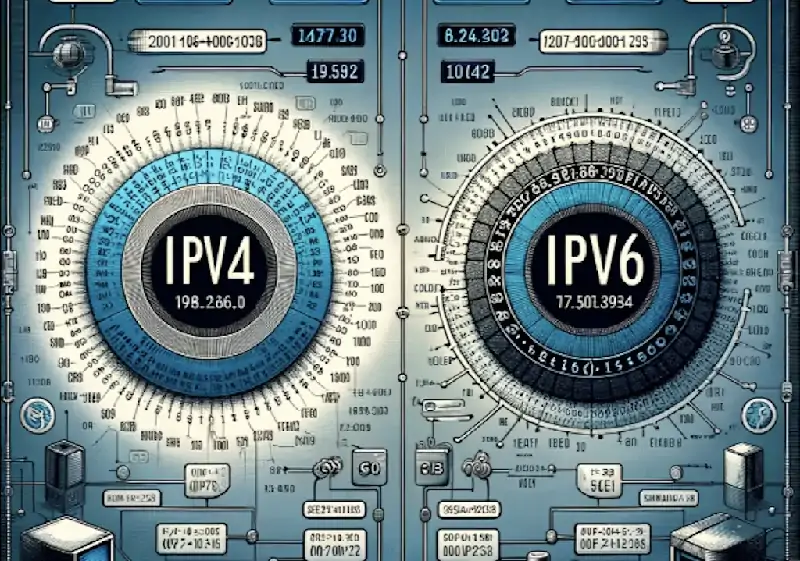

The first step in the construction of the AiGO Index is data collection, including economic data, company financial statements, market sentiment indicators, and political risk data. These data are collected from all corners of the globe. These data are collected from all corners of the globe to ensure that as many variables as possible are covered.

The collected data will be cleaned and normalised through a series of pre-processing steps. Afterwards, the data is analysed using machine learning models, which may include methods such as regression analysis, cluster analysis, principal component analysis.

Based on the output of the model, the AiGO Index will score and rank different investment opportunities. This process includes setting weights and parameters to determine the contribution of each factor to the final index.

The AiGO Index is not static. The index is updated regularly as market conditions change and new data is added. In addition, the algorithm itself will be adjusted and optimised based on back testing results and market feedback.

Also read: How will AI affect different industries?

Scenarios for the AiGO Index

The AiGO Index can be used by individual investors, investment companies, fund managers, and other users to assist in making more informed investment decisions. For example, fund managers may use the index as a tool for portfolio selection, while individual investors may use it to screen potential stocks or bonds.

Challenges and risks

Effective AI analysis relies on comprehensive and accurate data. If data sources are limited or biased, the results of analyses can lead to misleading results. The collection and processing of large amounts of personal and corporate data may touch on privacy issues and require strict adherence to data protection regulations.

An over-reliance on AI for decision-making can overlook the value of human intuition and experience, especially when faced with new situations that the models have not encountered before.