- Google Wallet expands into India, marking a significant step in its global presence and digital payment offerings.

- Indian users gain access to secure and convenient digital transactions, including online purchases, bill payments, and peer-to-peer money transfers, through Google Wallet.

- The introduction of Google Wallet is poised to drive the country’s transition towards a cashless economy, modernising the nation’s financial infrastructure.

Google has officially rolled out its much-anticipated Google Wallet service in India, marking a significant milestone in the country’s digital payments landscape.

Google Wallet’s expansion

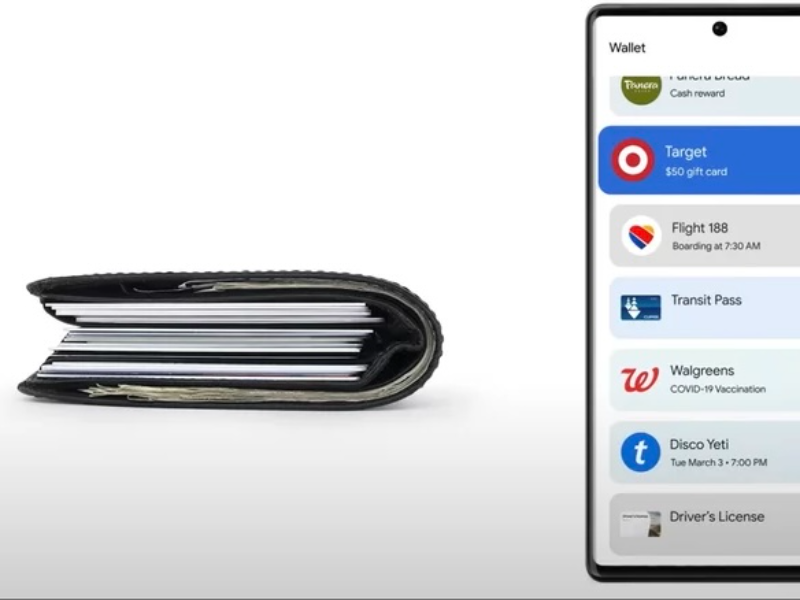

Google Wallet, the tech giant’s secure and versatile digital payment platform, offers users a convenient way to make online purchases, pay bills, transfer money, and more, all with just a few taps on their smartphones. Leveraging advanced encryption and security protocols, Google Wallet ensures that users’ financial information remains safe and protected.With this launch, Google aims to streamline and revolutionise digital transactions for millions of users across the nation.

Also read: Google incorporates cybersecurity into AI plan

Enhanced digital transactions

The introduction of Google Wallet in India comes at a time when the country is witnessing a surge in digital payments adoption, driven by factors such as increased smartphone penetration, improved internet connectivity, and a growing preference for cashless transactions. With its user-friendly interface and seamless integration with popular apps and services, Google Wallet is poised to become a game-changer in India’s digital economy.

Speaking about the launch, Sundar Pichai, CEO of Google’s parent company Alphabet Inc., expressed his excitement about bringing Google Wallet to India, stating, “We are thrilled to introduce Google Wallet to Indian users, empowering them to transact securely and conveniently in today’s digital world. With Google Wallet, we aim to simplify the way people manage their finances and make payments, ultimately driving financial inclusion and economic growth.”

Also read: Google Cloud and NetApp introduce enhanced data storage

Impact on India’s financial landscape

Google Wallet offers a wide range of features and functionalities designed to cater to the diverse needs of Indian consumers. From peer-to-peer money transfers to online shopping and utility bill payments, Google Wallet provides a comprehensive solution for managing everyday financial transactions with ease.

In addition to its consumer-facing services, Google Wallet also presents opportunities for businesses to expand their reach and enhance customer engagement through payment integration. By enabling merchants to accept payments directly through the Google Wallet platform, Google aims to foster greater digitisation of commerce and drive business growth in the Indian market.