- The cross-border e-commerce market has experienced rapid growth due to advancements in Internet technology, evolving consumer demands, and increased international trade facilitation.

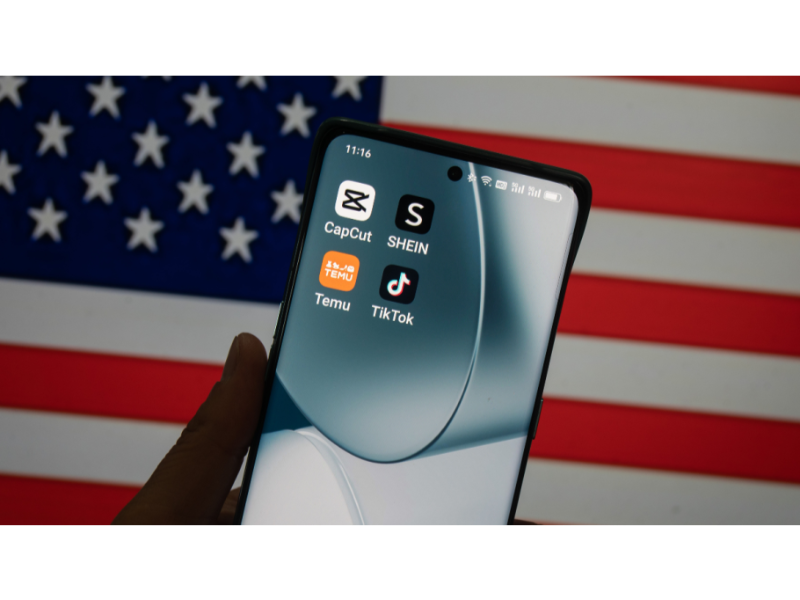

- Chinese e-commerce giants TikTok, Temu, and Shein are significant players in this market, operating as cross-border platforms catering to global consumers, albeit with distinct development models and competitive strategies.

- Despite aspiring to rival Amazon, they face challenges such as Amazon’s established global supply chain and logistics network, yet the eventual victor may disrupt Amazon’s dominance by building a comprehensive global supply chain.

With thanks mainly going to the internet, global cross-border e-commerce volumes reached $4.29 trillion in 2022, and are expected to reach $6.38 trillion by 2025.

While the likes of Amazon and eBay have been the go-to and front-of-mind brands for this massive market, it is three Chinese e-commerce giants, TikTok, Temu, and Shein, that are expected to push e-commerce sales further as we move toward the second half of the 21st century.

These three platforms are all based in China as primary supply chain bases, operating as cross-border e-commerce platforms serving global consumers, but they each have different development models and competitive strategies.

The questions are: do they have what it takes to topple the incumbent US market leaders, and who of these three will most likely come out ahead?

TikTok: E-commerce via short video content

TikTok is a globally leading short video social platform operated by a U.S. subsidiary of ByteDance. Its primary function is to allow users to create and share short videos ranging from 15 to 60 seconds, along with various music, effects, filters, and editing tools. TikTok’s user base is primarily young people, especially Generation Z, covering content across music, dance, beauty, food, travel, comedy, education, and more. As of December 2022, TikTok has reached 1.05 billion monthly active users globally, with the U.S. market accounting for 250 million. TikTok’s e-commerce business is a crucial component of its commercialisation process and a core advantage in competition with traditional e-commerce platforms like Amazon.

Also read: TikTok Ventures into E-Commerce

Here is the analysis of the advantages and disadvantages of TikTok.

TikTok advantages

- Traffic Advantage: TikTok boasts a vast user base and high user engagement, providing robust traffic support for its e-commerce business. Statistics show that TikTok users spend approximately 82 minutes on the platform daily and open the app about 100 times per month. This means TikTok has more opportunities to convert user attention into purchasing behaviour, as well as chances for user retention and repeat purchases.

- Content Advantage: TikTok’s content format and style are more suitable for the preferences and consumption habits of young people, providing stronger content appeal and conversion power for its e-commerce business. TikTok’s short video content is more entertaining, creative, and interactive, sparking user interest and emotions while showcasing product details and effects, thereby increasing user trust and purchase intent. TikTok’s live streaming e-commerce content is more authentic, interactive, and urgent, creating a social and shopping atmosphere for users while offering discounts and promotions to stimulate impulse buying.

- Influence Advantage: TikTok boasts numerous high-quality creators and influencers, providing stronger influence and trust for its e-commerce business. TikTok’s creators and influencers not only have large fan bases and followers but also possess high levels of professionalism and authority, offering valuable information and recommendations to users and providing influential promotion and word-of-mouth for brands. These creators and influencers help users discover and choose products while reinforcing user identification and affinity for the products.

TikTok disadvantages

- Regulatory Risks: Due to its rapid global expansion and significant influence, TikTok faces regulatory risks from various countries and regions concerning politics and laws. Especially in the U.S. market, TikTok has faced bans and demands for divestment from former President Trump, although these were later revoked and resolved, uncertainties and variables remain. TikTok’s regulatory risks not only affect its platform operation and development but also impact the stability and sustainability of its e-commerce business.

- Competition from Traditional E-commerce Platforms: TikTok’s e-commerce business also faces competition from traditional e-commerce platforms like Amazon. These platforms have more comprehensive e-commerce infrastructure, such as product catalogues, payment systems, and logistics networks, providing users with more comprehensive and professional e-commerce services. Additionally, traditional e-commerce platforms continuously innovate and invest in content and social features, such as introducing short videos, live streaming, communities, and collaborating with platforms like TikTok, attempting to capture market share among young users.

- User Experience Issues: TikTok’s e-commerce business also encounters some user experience issues, such as product quality, after-sales service, and privacy protection. Since TikTok’s e-commerce business relies mainly on third-party sellers and suppliers rather than self-operated products, ensuring the quality of goods and service levels is challenging, leading to issues like discrepancies between products and descriptions, difficulty in returns and exchanges, and lack of after-sales service. Moreover, since TikTok’s e-commerce business involves the collection and processing of users’ personal and payment information, users may be concerned about whether their privacy and security are adequately protected, especially considering differences and changes in laws and regulations across different countries and regions.

TEMU: Pricing authority over products

TEMU is a cross-border e-commerce platform owned by China e-comm company Pinduoduo, and launched in the United States in September 2022, targeting markets such as North America, Europe, and Asia. It offers cost-effective products including clothing, beauty, home goods, and pet supplies.

TEMU’s business model is a self-operated model, where the platform has final pricing authority over products, generating revenue through product sales. Product costs include procurement costs, fulfilment expenses (express logistics), and marketing expenditures (advertising and platform subsidies).

TEMU’s core competitiveness lies in leveraging big data and artificial intelligence technologies to achieve intelligence and optimization in product design, recommendation, pricing, inventory, logistics, etc., enhancing efficiency and effectiveness, reducing costs and risks, and providing users with more precise and personalised shopping experiences.

Here are the TEMU’s development opportunities and challenges.

TEMU’s development opportunities

- Increased penetration of overseas e-commerce: Influenced by the pandemic, overseas consumers have developed and strengthened their online shopping habits, leading to a continuous increase in e-commerce penetration, particularly in the apparel category, providing TEMU with a larger market space and potential.

- Growth potential in emerging markets: In addition to maintaining strong growth momentum in mature markets like the US and Europe, TEMU is actively expanding into emerging markets such as Southeast Asia, the Middle East, and Latin America. While these markets have relatively low e-commerce penetration rates, they exhibit fast growth rates and strong consumer demand, offering TEMU more business opportunities and incremental users.

- Category expansion and platformisation: TEMU not only holds a leading position in the fashion apparel sector but has also expanded into multiple categories like beauty, home goods, and pet supplies. This diversification caters to users’ diverse and one-stop shopping needs, enhancing user stickiness and loyalty. Additionally, TEMU is endeavouring to build its platform ecosystem by onboarding more brands and merchants, providing users with more choices and value, laying the foundation for its profit model and sustainable development.

TEMU’s development challenges

- Online transformation of traditional fast fashion brands: Confronted with the impact of emerging fast fashion e-commerce platforms like TEMU, traditional fast fashion brands such as Zara and H&M are accelerating their online transformation. They are optimising their websites and apps, enhancing their digital capabilities and user experiences, and strengthening their social media operations and influencer marketing to regain and compete for users’ attention and spending power.

- Competition from similar fast fashion e-commerce platforms: TEMU is not the sole player in the fast fashion e-commerce arena; it faces competition from counterparts like SHEIN, ASOS, Boohoo, and Fashion Nova. These brands have similar product characteristics and operational models and continuously innovate and optimise their supply chains, traffic, brands, etc., engaging in fierce competition with TEMU.

- Changes in cross-border trade policies: As TEMU involves cross-border transportation and customs clearance, its operations are influenced and constrained by trade policies of various countries, such as import tariffs, value-added taxes, anti-dumping measures, intellectual property protection, etc. If a country or region implements unfavourable trade policies or trade disputes and wars occur, TEMU may face additional costs and losses or even be prohibited or restricted from entering certain markets.

- Regulation of cybersecurity and data protection: As an internet-based e-commerce platform, TEMU deals with a vast amount of user data and online information, subject to regulations and constraints of cybersecurity and data protection laws and regulations in various countries, such as the EU’s GDPR, the US’s CCPA, etc. In the event of data breaches, cyberattacks, or violations of cybersecurity and data protection laws and regulations in a country or region, TEMU may face significant fines and compensations or even lawsuits or bans

Also read: TikTok Sets Up Massive Black Friday Sale Vs. Giant Rivals

Pop quiz

Which e-commerce platform spent Millions on Six Super Bowl Ads?

A. Temu

B. Shein

C. TikTok

D. Amazon

The correct answer is at the bottom of the article.

SHEIN: E-commerce via fast fashion

SHEIN is a fast fashion platform focusing on cross-border e-commerce. Its main function allows users to browse and purchase fast fashion products from China, such as clothing, footwear, and accessories, via its website or mobile app. SHEIN’s user base mainly comprises young women, especially Generation Z, with content covering various fields like fashion, trends, and personality. As of December 2022, SHEIN has reached 300 million global monthly active users, with 120 million in the US market.

Affected by the pandemic, overseas consumers’ online shopping habits have been cultivated and strengthened, leading to a continuous increase in e-commerce penetration, especially in the apparel category, providing SHEIN with greater market space and potential. According to Euromonitor International, the global e-commerce penetration rate for apparel reached 29% in 2021, projected to reach 37% by 2026.

Also read: Shein Launches Gravity Scheme

Emerging markets offer growth potential: In addition to maintaining strong growth momentum in mature markets like the US and Europe, SHEIN is actively expanding into emerging markets such as Southeast Asia, the Middle East, and Latin America. These markets have relatively low e-commerce penetration rates but exhibit fast growth rates and strong consumer demand, bringing more business opportunities and incremental users to SHEIN.

Category expansion and platformisation: SHEIN not only holds a leading position in the fashion apparel sector but has also expanded into multiple categories like beauty, home goods, and pet supplies. This caters to users’ diverse and one-stop shopping needs, enhancing user stickiness and loyalty. Additionally, SHEIN is attempting to build its platform ecosystem by onboarding more brands and merchants, providing users with more choices and value, and laying the foundation for its profit model and sustainable development.

Here is SHEIN’s e-commerce analysis of strengths and weaknesses.

Shein advantages

- Data advantage: SHEIN possesses massive user and product data, providing robust support for its e-commerce business. By continuously collecting and analysing user behaviours and feedback, SHEIN can promptly understand user needs and preferences, thereby offering more satisfactory products and services. Additionally, by analyzing sales and review data, SHEIN can promptly assess product performance and effectiveness, facilitating quicker and more accurate product design and updates.

- Price advantage: SHEIN offers low-priced products, supported by direct cooperation with Chinese suppliers and manufacturers, reducing costs and intermediaries to provide users with affordable prices. Additionally, SHEIN’s frequent promotions increase user willingness to purchase and frequency, offering more choices and consumption opportunities.

- Fashion advantage: SHEIN boasts a fashionable brand image and product style, staying synchronised with global fashion trends and user demands to provide stylish products, fostering individuality and expression. Collaborations with global fashion influencers and media enhance product credibility and reputation.

Shein innovation

- Application of big data and artificial intelligence: SHEIN utilises big data and AI to intelligently optimise product design, recommendation, pricing, inventory, and logistics, offering users more accurate and personalised shopping experiences while enhancing efficiency and reducing costs and risks.

- Development of social e-commerce and live shopping: Leveraging social e-commerce and live shopping trends, SHEIN strengthens social media operations and influencer marketing, collaborating with overseas celebrities, influencers, and bloggers for endorsements, collaborations, and product showcases to boost brand exposure and reputation.

- Moreover, SHEIN explores its social e-commerce and live shopping platforms like Shein Community and Shein Show, encouraging users to share outfits, experiences, and reviews, fostering brand loyalists and advocates, and building brand social attributes and emotional connections.

- Exploration of new retail and consumption: SHEIN continually explores new retail and consumption models and scenarios, such as seamlessly integrating online and offline through AR, and VR technologies to offer users more immersive shopping experiences like Shein Fitting Room and Shein Beauty.

- Shein Fitting Room is an AR-based virtual fitting app where users scan their body parameters via phone camera, select Shein apparel, visualise how they look in the outfits, and adjust colours, sizes, and styles, saving time and costs while boosting confidence and satisfaction.

- Shein Beauty, a VR-based virtual makeup app, lets users scan facial features, try Shein makeup products, and adjust colours, brightness, and styles, offering more experimentation, creativity, and enjoyment in purchasing.

Shein disadvantages

- Quality risks: Due to SHEIN’s pursuit of low-cost and fast product strategies, it faces risks and challenges regarding product quality. Since SHEIN’s products mainly originate from Chinese suppliers and manufacturers rather than its own brands and factories, ensuring quality and standards becomes difficult, leading to issues such as product discrepancies, poor quality, and sizing problems for users. Additionally, relying on overseas logistics and warehousing rather than its own logistics and warehousing makes product delivery and after-sales service difficult to guarantee, potentially resulting in delayed deliveries, damages, and difficulties in returns and exchanges for users.

- Legal risks: Due to SHEIN’s rapid expansion and significant influence in global markets, it also faces legal risks and challenges from various countries and regions. Particularly in Europe and America, SHEIN has faced investigations and penalties related to taxation, customs, intellectual property rights, and consumer rights from some countries and regions. Although some of these issues have been resolved and improved later, uncertainties and variables still exist. These legal risks not only affect the platform’s operation and development but also impact the stability and sustainability of its e-commerce business.

- Brand risks: SHEIN’s pursuit of fast and low-cost product strategies also poses risks and challenges to its brand image and brand loyalty. Targeting primarily young women rather than all consumers makes it challenging for SHEIN to establish and expand its brand influence and awareness among other consumer groups. Additionally, SHEIN’s focus on fashion and trends rather than quality and value makes it difficult to build and maintain its brand image and loyalty among users, as well as to differentiate and compete with other high-end brands.

Competitive pressure

- Traditional fast fashion brands’ online transformation: Faced with competition from emerging fast fashion e-commerce platforms like Shein, traditional fast fashion brands such as Zara and H&M are accelerating their online transformations. They aim to enhance their digital capabilities and user experiences, strengthen their social media operations and influencer marketing, attempting to regain and compete for user attention and purchasing power.

- Competition from similar fast fashion e-commerce platforms: Shein is not the only player in the fast fashion e-commerce market; there are also competitors like Asos, Boohoo, Fashion Nova, and others with similar product characteristics and operating models. These brands continuously innovate and optimize their supply chains, traffic, and branding, engaging in fierce competition with Shein.

- Threat from third-party platform sellers: In addition to independent fast fashion e-commerce platforms, there are also fast fashion sellers selling through third-party platforms such as Amazon, Wish, etc., such as Zibuyu, Anrabess, etc. Although these sellers do not have their own brands and platforms, they leverage the traffic and trust of third-party platforms, as well as their product advantages and cost-effectiveness, to attract and retain some users and consumers.

The ‘internal’ and ‘external’ battle among Shein, Temu, and TikTok

TikTok’s e-commerce advantage lies in its traffic, content, and influence, but it also faces issues regarding regulation, competition, and user experience.TEMU’s e-commerce advantage lies in its ultra-low prices, ecosystem, and heavy investment in marketing, but it also faces challenges regarding innovation, expansion, and user loyalty.SHEIN’s e-commerce advantage lies in its data, pricing, and fashion, but it also faces risks related to quality, legalities, and brand image. The future development of these three platforms will depend on how effectively they leverage their advantages, overcome their weaknesses, and adapt to the ever-changing market environment and user demands.

The e-commerce warfare sparked by Shein, Temu, and TikTok is both an ‘internal’ and ‘external’ battle. These companies are competing for cross-border trade while also vying against each other for merchants, factories, and market share, leading to mutual accusations in the public sphere. Their heavy advertising spending on overseas social media platforms has driven up advertising costs, increasing operational expenses. Currently targeting similar markets, primarily in low-priced apparel and various household goods, they aspire to surpass Amazon and become a global e-commerce platform, although they still have a long way to go compared to Amazon’s established global supply chain and logistics network. However, the eventual winner of this battle may accumulate enough user base to establish a comprehensive global supply chain, challenging Amazon on a global scale. To achieve this goal and challenge Amazon’s dominance, these three companies not only need to outperform each other but also overcome larger obstacles. A business entrepreneur once believed TikTok was the ‘uncrowned king’ among Chinese companies going global, only policy could correct it. Today, the same statement applies to Shein and Temu.

The right answer is A.