- Nvidia shares surged 3.5%, reaching a market value of $3.34 trillion (£2.65 trillion).

- Driven by AI demand, Nvidia’s stock has risen 170% this year, cementing its position as a tech powerhouse.

OUR TAKE

Nvidia’s astonishing ascent is more than a financial milestone—it’s a testament to human ingenuity and the transformative power of AI. Their journey to the top sparks a thrilling vision of the future, where technology continues to break barriers and redefine possibilities. This isn’t just about numbers; it’s about dreaming big and pushing the boundaries of what we can achieve.

—Dudu, BTW reporter

What happened

Nvidia’s rise to the top

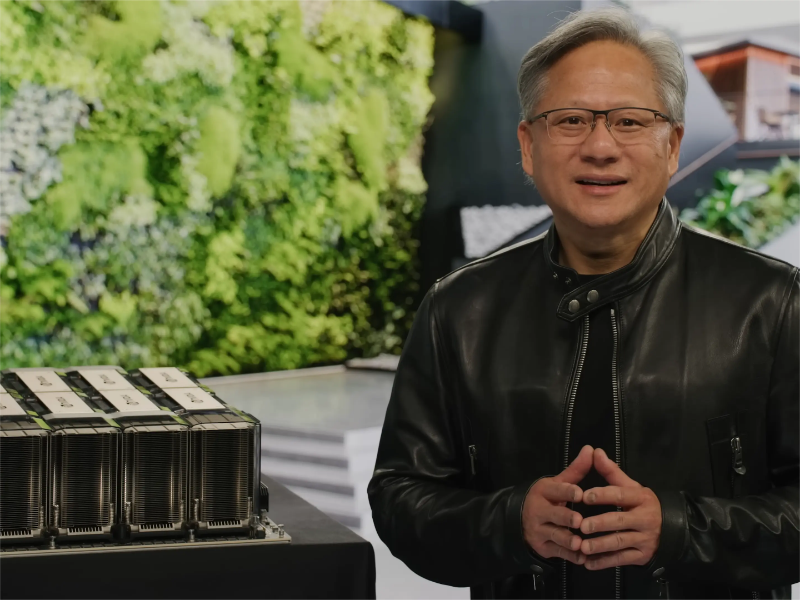

Nvidia has ascended to the pinnacle of the global market, becoming the world’s most valuable company. The semiconductor giant’s shares surged 3.5% on Tuesday, propelling its market value to an astounding $3.34 trillion (£2.65 trillion). This leap has placed Nvidia ahead of tech titans Microsoft and Apple, emphasising the crucial role investors expect artificial intelligence to play in the global economy in the coming years.

The catalyst for Nvidia’s unprecedented growth is the soaring demand for its AI-optimised chips, now considered the gold standard in the industry. The company’s stock has skyrocketed by over 170% this year and a staggering 1,100% since its low in October 2022. This explosive growth underscores a broader investor enthusiasm for AI, which has dramatically inflated Nvidia’s market value. Remarkably, Nvidia reached the $3 trillion mark in just 96 days, a feat that took Microsoft 945 days and Apple 1,044 days to accomplish, according to Bespoke Investment Group.

Also read: Nvidia’s market value reaches $3T, surpassing Apple

Also read: Rebellions and Sapeon merge to challenge chips giants NVIDIA

Why it’s important

Implications for the tech industry

Nvidia’s extraordinary performance is not just a testament to its technological prowess but also a reflection of the burgeoning AI market. Investors are betting heavily on the potential profits AI can generate, leading to substantial gains for other tech companies like Super Micro Computer and Arm Holdings. For Nvidia, this means maintaining its growth trajectory and fending off competition is crucial to sustaining its stellar returns. As Bespoke analysts noted, Nvidia’s run is “incredible” but maintaining its lead will require continued innovation and strategic growth.

A cautionary tale from the past

Historical precedents offer cautionary tales for Nvidia. Companies like Microsoft and Exxon Mobil, which previously held the top market position, faced significant challenges after their peaks. Cisco, another tech giant, saw its shares plummet post-dotcom bubble, illustrating the volatile nature of tech valuations. Therefore, while Nvidia’s current earnings and forecasts are robust, predicting sustained success in the rapidly evolving tech landscape remains complex.

Personal appeal

Nvidia’s rise signifies more than just a corporate achievement; it represents the pinnacle of human innovation. Consider how Nvidia’s AI advancements are already revolutionising industries: from healthcare, where AI algorithms assist in diagnosing diseases, to transportation, where autonomous driving technologies are becoming a reality. Seeing Nvidia lead this revolution of technology is profoundly inspiring. Their success demonstrates the limitless potential of AI to enhance and simplify our lives.

Furthermore, Nvidia’s ascent highlights the importance of continuous innovation. Reflecting on history, companies like Apple have thrived by consistently pushing the boundaries of what technology can achieve. Nvidia is following this path by not only developing cutting-edge products but also by setting new standards in the tech industry. I see Nvidia’s journey as a powerful reminder of the incredible feats we can accomplish when creativity and technology intersect.