- AMD’s stock price surged by 9.1% to surpass a $300 billion market cap milestone, ranking 22nd in the S&P 500.

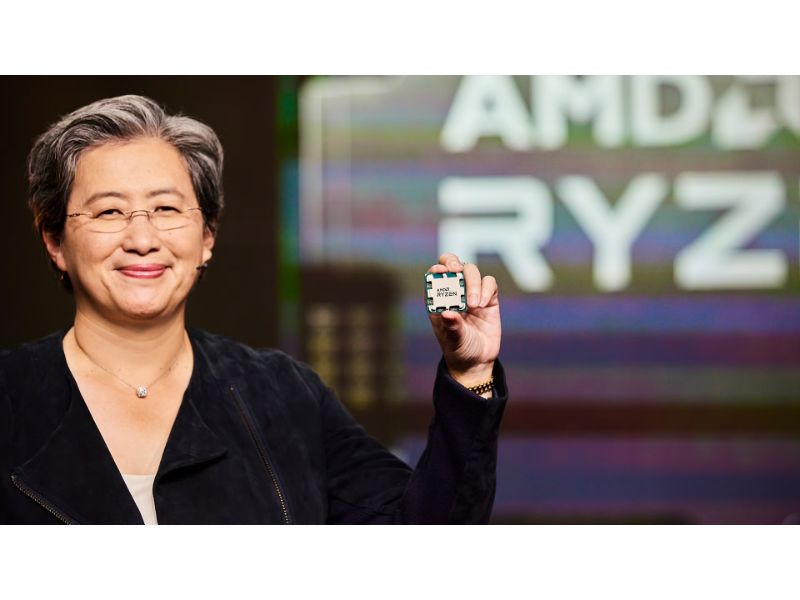

- CEO Lisa Su made an unusual move to cash out amidst the stock’s upward trajectory.

- Despite analysts’ optimism and Su’s sell-off, AMD remains in line with the average target price, signalling limited upside potential.

On Thursday, AMD’s stock price surged by 9.1%, surpassing the $300 billion market cap milestone to reach $311 billion.

With AMD’s stock price soaring, its market cap ranking in the S&P 500 components has risen from 222 five years ago to the current 22nd position. However, amid AMD’s rocketing stock price, AMD CEO Lisa Su made an unusual move to cash out recently.

AMD’s stock price has mostly been skyrocketing

Amidst the artificial intelligence boom, AMD’s stock price surged over 127% last year and another 30.6% this year. Since last October’s low point, AMD’s stock price has more than doubled.

In fact, over the past five years, AMD’s stock price has mostly been skyrocketing, with its market cap rising far beyond expectations. Five years ago, AMD ranked 222nd in market cap among the S&P 500 index components, and four years ago, it rose to 114th. A year ago, AMD’s market cap ranking further jumped to 58th. And now, this company’s market cap ranking in the S&P 500 components has reached 22nd.

AMD is seen as the second biggest beneficiary in the AI boom after Nvidia. Earlier on Thursday, Citigroup released a report stating that it still ‘very bullish on semiconductors,’ especially as various companies and organisations are competing to buy AI chips amid the continued growth of the AI market. The company listed AMD, along with Nvidia and Broadcom, as one of the stocks it is bullish on.

Also read: Chipmaker Groq and a former AMP VP accuse Nvidia of unfair practices

The market is turning to AMD with the shortage of Nvidia AI chips

Given the severe shortage of Nvidia AI chips, the market is increasingly turning to alternatives such as AMD chips. After the U.S. stock market on Thursday, similar signals were heard during Dell’s earnings conference call: Dell CEO Jeff Clarke stated during the company’s earnings conference call that shortages of high-end chips are hindering the industry’s development, with demand continuing to outstrip supply: ‘We also see strong interest and orders for AI-optimised servers equipped with next-generation AI GPUs, including Nvidia’s H200 and AMD’s MI300X.’

However, after the recent surge, AMD doesn’t appear to be cheap. The stock’s P/E ratio is currently close to 50 times, much higher than industry leader Nvidia, whose P/E ratio is relatively modest at 32 times.

The senior executives are selling off AMD shares internally

Although analysts generally hold a positive view on AMD – more than three-quarters of companies tracked by Bloomberg recommend buying AMD stock – the stock is now essentially in line with the average analyst target price, implying limited further upside from here.

At a time when AMD’s stock price is surging, the trend of senior executives selling off AMD shares internally is particularly noteworthy.

SEC filings show that AMD CEO Lisa Su sold 125,000 shares of non-option stock on February 21 at a price of $162.06 to $164.84 per share, worth over $20 million. This move is somewhat unusual: while Su had sold stocks before, they were mostly options expiring within two years. The last time she sold non-option stocks dates back to 2019.

Ben Silverman of VerityData pointed out that this move may reflect a deeper internal valuation perspective at AMD. When insiders sell stocks, especially when transitioning from options to direct shares, it often reflects their view on the company’s current valuation.

The market’s response to AMD’s stock sale has been mixed: some investors see it as a strategic financial decision, while others are concerned it may suggest internal doubts about AMD’s valuation prospects.

Although Su’s sell-off has raised some concerns, an AMD spokesperson emphasised that Su still holds about 4 million shares of AMD stock, and the recent sale ‘remains part of Su’s 10b5 plan, and she still holds a significant amount of shares after the transaction’.