- Macquarie Technology Group completed a five-year A$450 million refinancing to expand its data centre projects, including the IC3 Super West Phase 1 development.

- The refinancing deal attracted substantial interest from international lenders, securing competitive terms to support future growth initiatives.

What happened

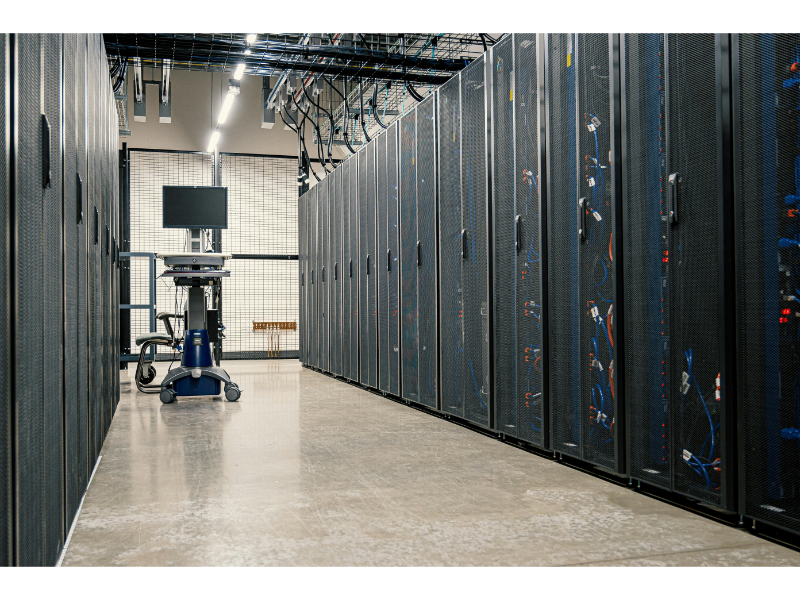

Macquarie Technology Group has secured a major financial boost to accelerate its data centre expansion efforts. The Sydney-based company recently completed a successful debt refinancing, securing a five-year revolving loan facility worth A$450 million—an increase of A$260 million over its previous financing arrangement. The deal attracted significant interest from both domestic and international lending institutions, allowing the company to lock in competitive commercial terms that will support its ambitious growth agenda. This infusion of capital will help Macquarie Technology Group complete the first phase of its IC3 Super West data centre project while maintaining ample liquidity to fund future initiatives.

Also read: Amazon bets on nuclear power to fuel future data center growth

Also read: Penguin Random House blocks AI training on its books

CEO and co-founder David Tudehope highlighted the importance of this refinancing for the company’s strategic plans. “Following the acquisition of the Macquarie Park Data Centre Campus and the commencement of the IC3 Super West construction, we have marked another milestone with this successful debt refinance process,” Tudehope said. He further highlighted the robust interest from financial institutions, which has positioned the company to deepen relationships with new lenders.

The group has been steadily growing its footprint in the data centre sector, with the IC3 Super West project representing a key part of its long-term vision. RBC Capital Markets acted as the financial advisor for this transaction, while DLA Piper provided legal counsel.

Why this is important

Macquarie Technology Group’s latest refinancing marks a crucial step in the company’s journey to become a major player in the data centre market. The additional A$260 million in financing not only reflects strong market confidence in the group’s operations but also provides the necessary flexibility to pursue its expansion projects at scale. The IC3 Super West project, once completed, will significantly enhance Macquarie’s capacity to meet growing demand for data centre services, particularly from large enterprises and cloud service providers.

This move also speaks to the broader trend in the technology infrastructure sector, where companies are racing to expand data centre capacity to keep pace with the exponential growth of data consumption and cloud computing. Macquarie Technology Group is well-positioned to capitalise on this trend, especially given its track record and the competitive terms it secured with the new loan facility. With A$118 million in cash reserves, the company not only has the financial muscle to complete its ongoing projects but is also well-placed to explore new growth opportunities.

The strong interest from international lenders indicates the global appeal of the data centre market and the rising investor appetite for infrastructure projects tied to the digital economy. As the sector continues to evolve, companies like Macquarie are finding themselves at the forefront of a rapidly changing landscape where financial partnerships and strategic investments are crucial for long-term success.