- Plum, the UK-based money management app, has successfully secured $17.4 million in new investment.

- The $17.4 million investment is a significant milestone for Plum and underscores its impressive growth trajectory since its launch in 2017.

OUR TAKE

Plum really knows how to charm investors. It’s like they’ve hit the jackpot with that $17.4 million haul. And Eurobank doubling down with their second investment. That’s a vote of confidence, for sure. But let’s not forget, remember when Revolut also raised a whopping round and then faced some growing pains? Plum needs to use this money wisely to avoid any stumbles. With AUM over £1B and revenue skyrocketing, the pressure’s on to keep delivering. Crowdfunding success is impressive, but real test is scaling up gracefully. Let’s see if they can maintain this momentum.

–Miurio huang, BTW reporter

What happened

Plum, the UK-based money management app, has successfully secured £16.1 million ($17.4 million) in new investment. This funding includes £13.4 million ($17.4 million) from a Series B round led by Eurobank, Venture Friends, Ventura Capital, and new investor iGrow Venture Capital. Additionally, Plum raised £2.7 million ($3.5 million) through a highly successful Crowdcube crowdfunding campaign, which attracted more than 5,500 investors and was described as the “most popular campaign of the year.”

This latest round marks the second investment from Eurobank, following an earlier £8.4 million ($10.8 million) investment in December. The latest funds will support Plum’s continued growth and development, following a period of notable performance. Plum’s recent success includes a significant increase in assets under management (AUM), which now exceed £1 billion ($1.5 billion), and nearly doubled year-on-year revenues as of March.

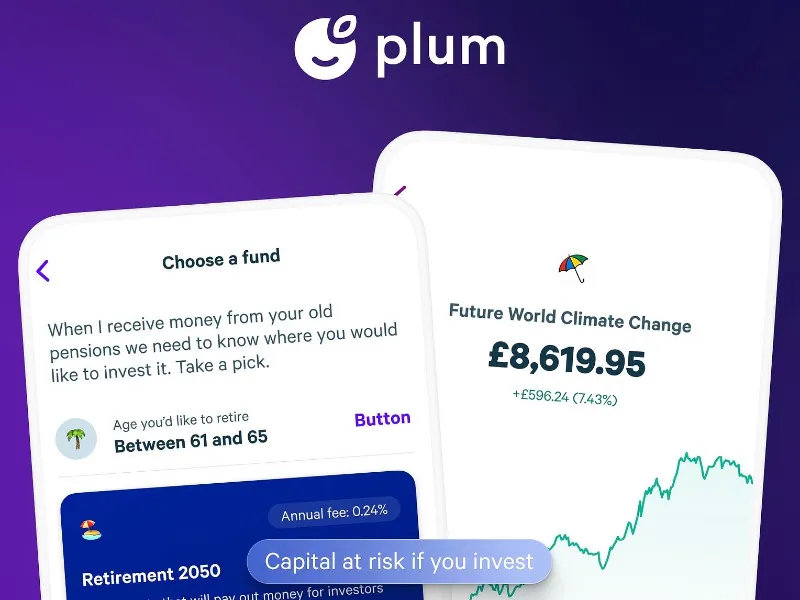

Plum, a UK-based money management app, was founded in 2017 by Victor Trokoudes. It uses AI and automation to help users manage their finances, offering services like automated savings, investments in ETFs, and budgeting tools. Plum’s recent additions include competitive Cash ISA products, enhancing its appeal. Initially UK-focused, it now draws over 30% of customers and revenue internationally. The company plans to integrate generative AI and aims for profitability by 2025, continuing its innovative approach to personal finance management.

Also read: Who is Philip Belamant? CEO of Zilch, combining fintech and social causes

Also read: UK poised to lead fintech growth and scalability in Europe

Why it’s important

The investment is a significant milestone for Plum and underscores its impressive growth trajectory since its launch in 2017. The combination of Series B funding and a highly successful crowdfunding campaign highlights the strong investor confidence in Plum’s business model and future prospects.

Plum’s recent achievements reflect its growing appeal in the competitive money management space. The app’s ability to secure substantial funding amidst a challenging investment environment demonstrates its strong market position and the value it provides to users across Europe. The new funds will be instrumental in driving Plum’s expansion efforts and developing new features, including upcoming “game-changing products” hinted at by CEO Victor Trokoudes.

The recent introduction of Plum’s Cash ISA product and ETFs has been a key factor in its financial success. By expanding its product offerings, Plum has attracted more users and increased its AUM, positioning itself for profitability by 2025. The investment also highlights Plum’s potential to continue growing its customer base and enhancing its service offerings, further solidifying its position in the market.

Plum’s successful fundraising rounds reflect both the company’s strong performance and its potential for future growth. As Plum continues to innovate and expand its offerings, it is well-positioned to remain a significant player in the money management sector, with the support of its investors paving the way for continued success.