- The South Korean e-commerce market, one of the largest in the world, faces turmoil as two major platforms, Ticket Monster (TMON) and WeMakePrice, are under investigation.

- Qoo10’s aggressive acquisition strategy aimed at expanding its market presence has backfired.

OUR TAKE

The Korean e-commerce scene is really in chaos right now. Two major players, Ticket Monster and WeMakePrice, which are owned by the Singaporean e-commerce giant Qoo10, are being accused of failing to pay merchants a staggering amount of money. We’re hearing that over 60,000 merchants are collectively owed over $123 million. This financial strain has caused both companies to halt issuing refunds to consumers, which is just making the situation worse. Additionally, South Korean banks have temporarily suspended loan services to TMON and WeMakePrice due to these payment delays. Local media reports are highlighting the companies’ liquidity problems, suggesting that a series of acquisitions by Qoo10 may have exacerbated their financial difficulties. It looks like the ‘buy, buy, buy’ strategy in the e-commerce world has backfired, and these companies may have bitten off more than they can chew.

–Miurio huang, BTW reporter

What happened

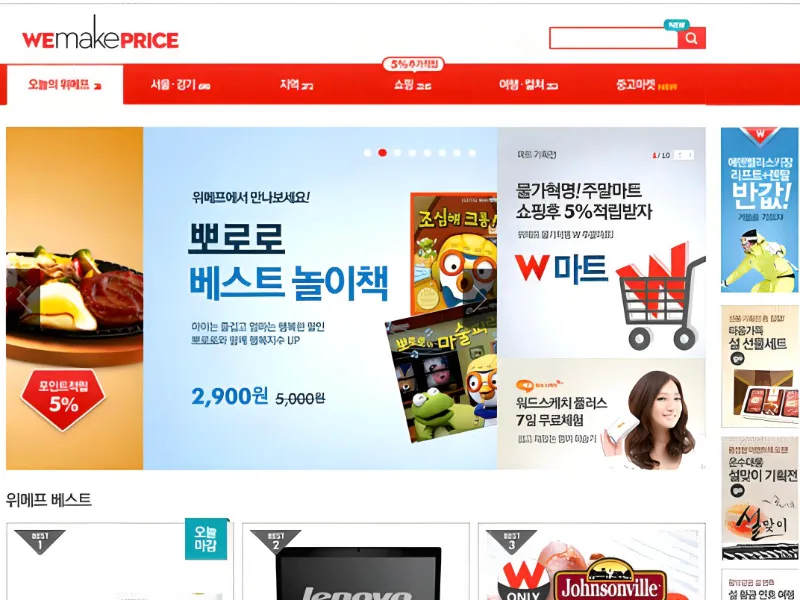

The South Korean e-commerce market, one of the largest in the world, faces turmoil as two major platforms, Ticket Monster (TMON) and WeMakePrice, are under investigation. These platforms, owned by Singaporean e-commerce firm Qoo10, are accused of failing to pay merchants. On Thursday, South Korea’s Fair Trade Commission announced the investigation, revealing that around 60,000 merchants are collectively owed 170 billion KRW ($123 million).

The financial strain has led both companies to halt issuing refunds to consumers, further aggravating the situation. South Korean banks have also temporarily suspended loan services to TMON and WeMakePrice due to these payment delays. Local media reports highlight the companies’ liquidity problems, pointing to a series of acquisitions by Qoo10 that may have exacerbated their financial woes.

Also read: Web vulnerabilities: Risks to data and reputation

Also read: What is RTP and RPO in disaster recovery?

Why it’s important

The predicament of Qoo10’s Korean units underscores the precarious nature of the e-commerce landscape in South Korea. Despite being home to some of the world’s largest e-commerce platforms, the market is fiercely competitive and fraught with financial challenges. Leading players like Naver, Coupang, and SSG hold only 45% of the market share, leaving numerous smaller platforms vying for survival.

Qoo10’s aggressive acquisition strategy aimed at expanding its market presence has backfired. Since August 2022, Qoo10 acquired TMON, WeMakePrice, InterPark Commerce, Korchina Logistics, Wish, and AK Mall. These moves were intended to bolster Qoo10’s footprint and prepare for a Nasdaq IPO. However, these acquisitions have led to significant financial and operational burdens, culminating in the current liquidity crisis.

The immediate impact on the ecosystem is evident. InterPark Triple, a travel product seller, has threatened to cease operations on TMON and WeMakePrice if payments are not made by July 25. Yanolja, InterPark Triple’s parent company, has already halted sales on these platforms. This ripple effect illustrates the broader ramifications of financial instability within the e-commerce sector.

Personal view

Founded in 2010, Qoo10 emerged as a joint venture between eBay and Gmarket founder Young Bae Ku, a prominent figure in the South Korean e-commerce industry. Despite its expansive reach across Asia and backing from investors like KKR, Qoo10’s recent troubles highlight the risks inherent in rapid expansion without adequate financial safeguards.

The investigation by the Fair Trade Commission could lead to further scrutiny and regulatory action, potentially impacting Qoo10’s operations and its planned IPO. The situation also raises concerns about the sustainability of e-commerce platforms that prioritize aggressive growth over financial stability.

Qoo10’s current crisis serves as a cautionary tale for the e-commerce industry. It underscores the importance of balanced growth strategies and financial prudence, especially in highly competitive markets. The outcome of the investigation and Qoo10’s ability to navigate this turbulent period will be closely watched by industry observers and stakeholders.