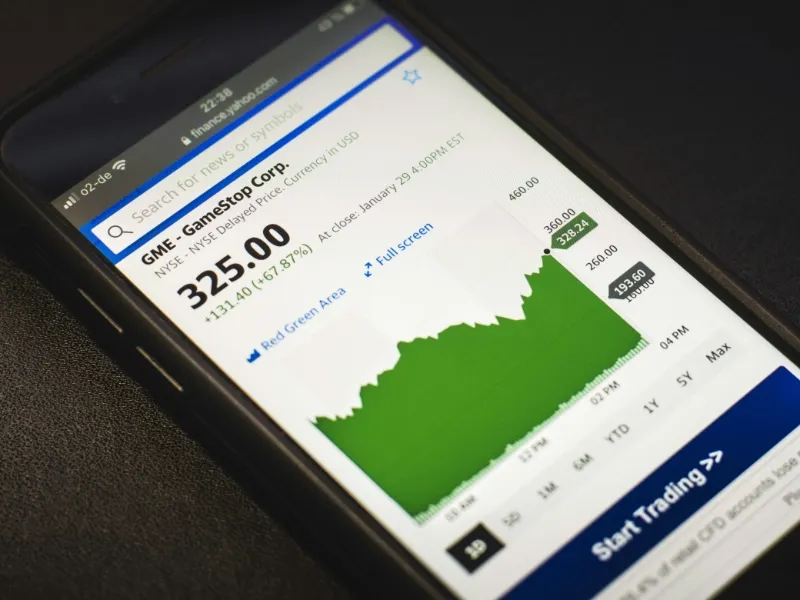

- Shares of GameStop plummeted by 11.6% to $25.38 on Monday afternoon after CEO Ryan Cohen addressed investors at the annual general shareholder meeting.

- Cohen’s lack of specifics on strategic acquisitions and future plans left investors disappointed, contributing to the sharp decline in stock value.

OUR TAKE

This news is important as it not only impacts GameStop’s stock performance in the short term but also raises critical questions about the company’s long-term viability in a rapidly evolving industry. The reaction from investors and analysts signals the need for more transparency and strategic clarity from GameStop’s leadership to restore confidence and outline a clear path forward.

–Jinny Xu, BTW reporter

GameStop’s stock plummeted on Monday following CEO Ryan Cohen‘s announcement that the company aims to run a reduced number of stores without specifying how it will use its significant cash reserves. The stock fell by 11.6% to $25.38 after the brief annual general meeting, which lasted around 20 minutes.

What happened

GameStop shares dropped by 11.6% to $25.38 on Monday afternoon following CEO Ryan Cohen’s announcement at the annual general shareholder meeting. The brief 20-minute meeting included Cohen’s outline of plans to reduce the number of GameStop stores and focus on offering more value-added items. Despite investor expectations, Cohen did not provide details on how the company plans to utilize its roughly $4 billion in cash reserves, built up through share sales in June and May.

Also read: Unauthorised GameStop Memes attracts $4M, but investors left hanging

Also read: Gamestop CFO Resigns Amid Executive Turnover

Why it’s important

Impact on investor confidence

The significant drop in GameStop’s share price reflects the market’s reaction to the perceived lack of direction from the company’s leadership. Investors had high expectations for a comprehensive strategic plan, especially given the volatile trading history of the stock and the heightened interest from retail investors driven by figures like Keith Gill (Roaring Kitty). Cohen’s failure to provide a detailed roadmap has eroded investor confidence, raising concerns about the company’s future profitability and growth prospects.

Business enlightenment

The news underscores the broader challenges facing traditional retailers in the gaming industry. As consumers increasingly prefer digital downloads and streaming, companies like GameStop must pivot their business models to remain competitive. The decline in net sales and the shrinking market for used software highlight the urgent need for GameStop to reinvent itself. Cohen’s general statements about operating with a smaller network and focusing on value-added items, without clear execution plans, do not address these pressing issues effectively.