- Cyabra, a Tel Aviv-based startup specialising in detecting disinformation, announced plans to go public by merging with special purpose acquisition company (SPAC) Trailblazer Merger Corporation I.

- As misinformation continues to pose a threat to both public and private sectors, Cyabra’s services are becoming essential for maintaining the integrity of information and protecting reputations.

OUR TAKE

The startup Cyabra is set to go public through a merger with Trailblazer Merger, valuing the company at $70 million. In just a few years since its inception, Cyabra has managed to attract major investors like OurCrowd and Founders Fund, collaborated with 19 governments to safeguard elections, and even provided services to Warner Media and Elon Musk. Notably, before Musk’s acquisition of Twitter, he relied on Cyabra’s technology to analyse fake accounts. However, with the abundance of social media noise today, it remains to be seen if Cyabra’s sharp sword can continue to cut through the clutter. The path to protecting truth is never a straight and easy one.

–Miurio huang, BTW reporter

What happened

Cyabra, a Tel Aviv-based startup specialising in detecting disinformation, announced plans to go public by merging with special purpose acquisition company (SPAC) Trailblazer Merger Corporation I. This merger will list Cyabra on the Nasdaq, valuing the company at $70 million. Founded in 2018, Cyabra has attracted notable investors, including OurCrowd, which led its $5.6 million Series A round, as well as Founders Fund, Harpoon Ventures, and several others. The merger is expected to be completed by the end of the year.

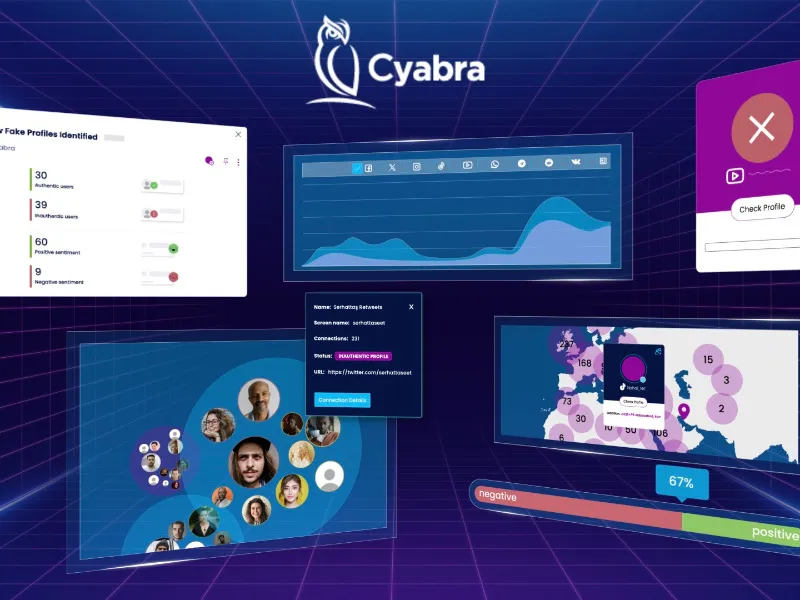

Cyabra has developed technology to identify and combat fake social media accounts and disinformation campaigns. Over the past year, the company has collaborated with 19 governments to safeguard their elections. Corporate clients, such as Warner Media, have used Cyabra’s services to protect their brand reputation from fake profiles, as seen with the release of “Wonder Woman 1984.” Additionally, Elon Musk utilised Cyabra’s technology to analyse bot activity prior to his acquisition of Twitter.

CEO and co-founder Dan Brahmy highlighted Cyabra’s sophisticated algorithms and data analytics, developed by veterans from the Israeli special operations command (SOCOM), to detect automated bots spreading misinformation. Brahmy emphasised the importance of Cyabra’s technology in providing actionable insights to prevent damage and protect both brands and citizens from disinformation.

Earlier this year, former CIA director and U.S. Secretary of State Mike Pompeo joined Cyabra’s board. He praised Cyabra’s efforts in uncovering inauthentic accounts and false narratives, emphasising the startup’s role in protecting democracy and national security.

Also read: Cybersecurity firm Wiz scraps $23B merger agreement with Google

Also read: IX Telecom: Telecom industry fortifies cybersecurity against rising threats

Why it‘s important

Cyabra’s decision to go public via a SPAC is significant for several reasons. Firstly, it underscores the startup’s growth and the increasing demand for technologies that combat disinformation. As misinformation continues to pose a threat to both public and private sectors, Cyabra’s services are becoming essential for maintaining the integrity of information and protecting reputations.

The valuation of $70 million reflects investor confidence in Cyabra’s potential and the value of its technology. The successful completion of this merger will provide Cyabra with the capital needed to expand its operations and enhance its technology, positioning it for further growth in the disinformation detection market.

Cyabra’s partnerships with governments and major corporations highlight the practical applications and effectiveness of its technology. The collaboration with Warner Media to address fake profiles during the release of “Wonder Woman 1984” demonstrates how companies can leverage Cyabra’s tools to protect their brand and engage with genuine influencers. Similarly, the work with Elon Musk on bot activity analysis showcases the versatility and impact of Cyabra’s technology in various high-profile scenarios.

The involvement of notable figures like Mike Pompeo adds credibility and underscores the importance of Cyabra’s mission. Pompeo’s endorsement highlights the strategic value of Cyabra’s capabilities in safeguarding national security and democratic processes. His presence on the board will likely attract more attention and potentially more clients to the startup.

The use of a SPAC for going public is noteworthy given the current regulatory landscape. SPACs have faced increased scrutiny and regulatory changes aimed at making the process more akin to traditional IPOs. Cyabra’s choice to proceed with a SPAC merger signals confidence in navigating these changes and leveraging the benefits of this route to public markets.

Cyabra’s plan to go public via SPAC marks a pivotal moment for the company. It not only highlights the growing need for advanced disinformation detection technologies but also positions Cyabra as a key player in this critical field. The successful merger and subsequent public listing will provide the necessary resources for Cyabra to continue its mission of protecting brands, citizens, and democratic processes from the pervasive threat of disinformation.