- Demand for artificial intelligence to hold strong in the second half, driving sales of memory chips and tech devices.

- Samsung posted its highest operating profit since the third quarter of 2022, thanks to the boom in artificial intelligence.

- Samsung says it will step up offerings of high-end solid-state drive (SSD) products to meet AI server demand, and expected high-end memory chip supply to become tighter toward year-end due to capacity being focused on HBM.

Demand for generative AI in the first quarter consolidated Samsung’s memory chip market recovery. Samsung will focus on the supply of the latest HBM3E products, which are expected to account for two-thirds of the total HBM production by the end of the year.

Demand for Generative AI

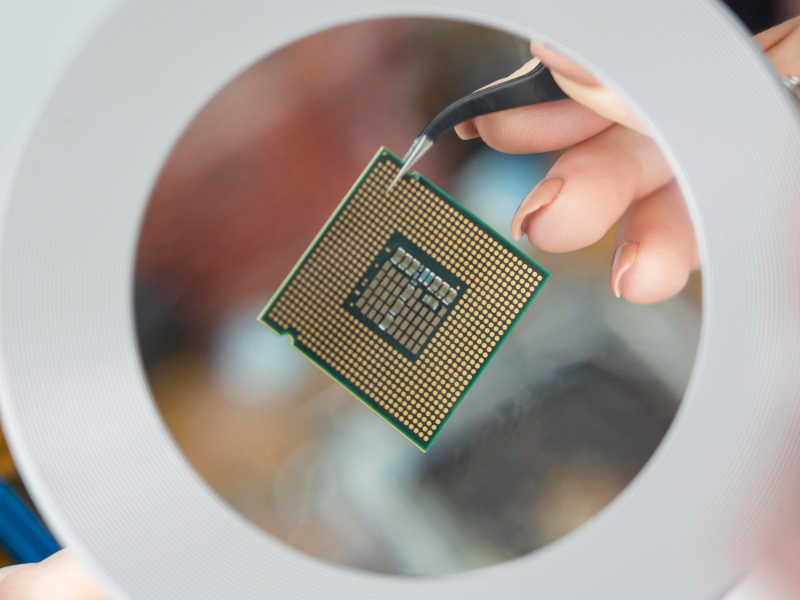

High-performance memory chips are becoming more and more necessary since generative AI demands large amounts of processing and storage capacity. Samsung may simultaneously boost memory technology innovation, such as the creation of more effective storage solutions, in order to satisfy the demands of generative AI. The market for memory chips has grown thanks to the widespread use of generative AI, which has also given Samsung new business prospects. Due to the increasing use of generative AI, Samsung has had to streamline its memory chip supply chain in order to increase productivity and adaptability to market fluctuations.

Memory chip profit

Samsung’s chip division posted a profit of Won1.91 trillion in the March quarter, up from a loss of Won4.58 trillion in the same period last year. This is Samsung’s memory chip business reported a profit for the first time since the third quarter of 2022. Prices of NAND flash chips used to store data increased by 23% to 28% during the first quarter versus the previous quarter, while prices of DRAM chips used in tech devices rose by about 20%, according to data provider TrendForce. South Korean rival SK Hynix (000660.KS), opens new tab said last week it expected a full recovery in the memory chip market on AI demand as it posted its highest profit in nearly two years.

Also read: Samsung to get US$6-7 billion in chip subsidy next week

Samsung’s targets

“We plan to increase supply of HBM-related chips in 2024 by more than three-fold versus last year,” Jaejune Kim, a Samsung vice president in charge of the memory division, said on an earnings call.

Samsung said it began mass production this month of the latest HBM chips for use in generative AI chipsets, called 8-layer HBM3E. It is attempting to profit from the AI boom that has helped SK Hynix, which was Nvidia’s only source of HBM3 processors. Samsung said it planned to start making the 12-layer version during the second quarter, and expected the latest HBM3E products to account for two-thirds of its HBM output by year-end.

Also read: Samsung to enhance Bixby virtual assistant with gen AI

Analysts said the targets were aggressive. Samsung’s 8-layer HBM3E appears to be supplying Nvidia, while the 12-layer may go to AMD (AMD.O), opens new tab and Nvidia, said Jeff Kim, head of research at KB Securities. “As Samsung’s technology is advantageous for high-stacking, while SK Hynix has its advantages in the 8-layer, there may be a segmentation where Nvidia gets 12-layer products from Samsung and most 8-layer products from SK Hynix,” Kim said.

“Samsung is working hard to improve the yield of its 12-layer product.” Samsung did not respond immediately to a request for comment on its HBM customers. Samsung also said it will step up offerings of high-end solid-state drive (SSD) products to meet AI server demand, and expected high-end memory chip supply to become tighter toward year-end due to capacity being focused on HBM, echoing comments from SK Hynix last week.