- AI technologies revolutionise the banking industry by providing personalised services and enhancing the customer experience.

- AI-powered chatbots and virtual assistants offer 24/7 real-time customer support, improving accessibility and response times.

- AI-driven predictive analytics help banks understand customer behaviour, generate insights, and create targeted offerings.

AI is revolutionising the banking industry by providing personalised customer experiences, enhancing fraud detection and security, improving credit scoring and risk assessment, streamlining legal contract analysis, and enhancing market risk management. AI technologies like chatbots and virtual assistants provide real-time support, enhancing security measures and protecting customer data. Credit scoring models use AI to evaluate borrowers’ creditworthiness, while natural language processing aids in contract management and regulatory compliance. AI-driven risk assessment tools help banks manage market risks by analysing trends, predicting potential risks, and providing data-driven insights for informed decision-making.

Enhanced customer experience

AI technologies are revolutionising the banking industry by providing personalised services and enhancing the customer experience. AI chatbots and virtual assistants, utilising natural language processing and machine learning algorithms, offer real-time customer support and personalised recommendations based on individual preferences and financial goals. These agents are available 24/7, ensuring seamless and continuous support for customers.

Predictive analytics powered by AI is a game-changer for banks, allowing them to understand and anticipate customer behaviour, preferences, and needs. By analysing vast amounts of data, AI algorithms can generate valuable insights to create targeted offerings and personalised experiences. By analysing historical customer data, banks can tailor their services to meet individual needs, such as by recommending personalised financial products, services, or promotions.

AI-driven predictive analytics also allows banks to engage proactively with personalised offers, notifications, and alerts, enhancing customer satisfaction and loyalty. In conclusion, leveraging AI technologies for personalised services through chatbots and virtual assistants, as well as predictive analytics for customer behaviour analysis and targeted offerings, enables banks to deliver superior customer experiences, strengthen relationships, and drive customer engagement and loyalty.

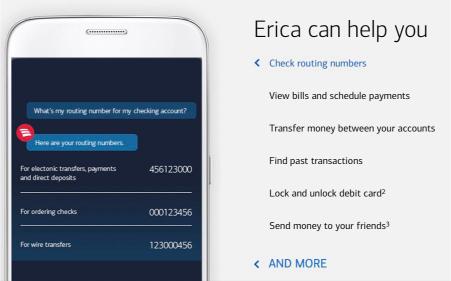

Case: Bank of America’s Erica virtual assistant

The AI-powered Erica virtual assistant from Bank of America offers individualised financial advice and support via the Bank of America Mobile Banking app. In addition to making recommendations, it provides individualised insights into users’ spending patterns, financial objectives, and budgeting practices. Additionally, it provides resources for financial education to help users become more financially literate and make wise decisions. Erica helps customers with a range of financial chores, including tracking spending, arranging automatic transfers, and setting up bill payments.

In addition, it keeps an eye on account activity and sends out notifications for any suspicious or unexpected transactions. It assists consumers in making more informed financial decisions by providing tailored recommendations based on unique spending habits and objectives.

Fraud detection and security

AI plays a crucial role in fraud detection and security in the banking sector. By analysing vast amounts of transaction data in real-time, AI algorithms can identify anomalies, perform behavioural analysis, and recognise atterns. These systems can flag suspicious transactions for further investigation and establish a baseline of normal activity. AI tools can also recognise complex patterns across multiple accounts and transactions, enhancing the detection of sophisticated fraud schemes.

AI-powered fraud detection systems continuously monitor transactions for signs of fraudulent activity, such as unusual spending patterns, unauthorised account access, or suspicious transfers. They can assist in identity verification processes by analysing biometric data, facial recognition, and behavioural biometrics to authenticate users and detect fraudulent identities.

Financial fraud is a complex and constantly evolving problem, making it difficult for humans alone to identify all the signs of fraudulent activity. This is where artificial intelligence comes in as a highly effective tool in detecting fraudulent activities.

Claudia Pincovski, Author of voice of the industry

AI technologies also ensure security and trust for customers by encrypting sensitive customer data, implementing multi-factor authentication methods, and developing proactive fraud prevention strategies. By analysing historical fraud data and predicting potential fraud scenarios and vulnerabilities, AI algorithms can strengthen security protocols and thwart fraudulent activities.

Case: JPMorgan Chase’s Contract Intelligence (COiN)

JPMorgan Chase’s Contract Intelligence (COiN) platform is a blockchain-based tool that streamlines and automates the review and analysis of legal contracts within the bank. The platform uses blockchain technology to create a secure digital ledger for storing and sharing contract data, reducing the risk of fraud or manipulation. It also integrates smart contracts, enabling automated execution of predefined contract terms and conditions. COiN uses machine learning algorithms to analyse and extract key information from complex legal contracts, enhancing efficiency and accuracy.

Natural language processing (NLP) techniques are used to interpret and understand legal documents, reducing manual effort and accelerating decision-making. The platform implements automated workflows for document routing, approvals, and revisions, improving operational efficiency and collaboration among legal teams.

Risk management

AI-driven credit scoring and market analysis have significantly transformed risk management in the banking sector. These technologies provide advanced tools to analyse data, predict trends, and make informed decisions to manage risks effectively. AI-powered credit scoring models analyse vast amounts of data to evaluate borrowers’ creditworthiness, providing more accurate and objective assessments. They also use predictive analytics to forecast the likelihood of default or delinquency on loans based on historical data and borrower profiles.

AI-driven credit scoring solutions automate the credit evaluation process, reducing manual effort and decision-making time. This improves operational efficiency, enhances consistency in lending practices, and reduces the risk of human error in credit decisions.

AI-powered risk assessment tools analyse market trends, economic indicators, and asset prices to assess market risks and fluctuations. They use machine learning techniques to anticipate market movements, identify potential risks, and optimise investment strategies. They also use sophisticated algorithms to model and simulate different risk scenarios, evaluating the potential impact of adverse events on portfolios and optimising risk management strategies.

AI technologies provide real-time insights and decision support for market analysis and risk assessment, enabling banks to make proactive decisions, adjust risk strategies, and capitalise on opportunities in dynamic market environments.

Case: Goldman Sachs’ Marcus lending platform

Goldman Sachs’ Marcus lending platform is an online consumer lending platform that offers personal loans and savings accounts. It is part of the company’s digital banking initiative, providing a user-friendly experience for accessing financial products and services. The platform offers competitive interest rates, flexible repayment terms, and high-yield savings accounts with no fees or minimum deposit requirements.

Marcus prioritises transparency and simplicity, offering no hidden fees or charges. It also provides excellent customer service, offering assistance throughout the banking journey. The platform is designed for a seamless digital experience, allowing customers to access accounts, apply for loans, make payments, and track their savings. It also offers resources to improve financial literacy and ensure the security and privacy of customer data.

Pop quiz

How do AI chatbots and virtual assistants enhance customer support in the banking sector?

A. By providing physical branches for in-person support

B. By offering personalised services, real-time chat support, and automated responses

C. By conducting market research and analysis to improve services

D. By focusing on traditional banking methods while incorporating AI features

E. By integrating predictive analytics for tailored customer assistance

The correct answer is at the bottom of the article.

Operational efficiency

Operational efficiency is a critical aspect of the banking sector, enabling financial institutions to streamline processes, reduce costs, enhance productivity, and provide superior customer service. AI technologies are driving significant advancements in operational efficiency by automating manual tasks, optimising processes, and predicting maintenance needs.

AI-powered robotic process automation (RPA) solutions automate repetitive tasks in banking operations, improving operational speed, accuracy, and efficiency. AI algorithms analyse workflow patterns, identify bottlenecks, and streamline processes, leading to time and cost savings. AI-driven chatbots and virtual assistants automate customer inquiries, provide real-time support, and enhance customer service experiences.

Predictive maintenance and optimisation in banking operations involve AI-powered predictive analytics tools that analyse historical data, machine performance metrics, and maintenance records to predict equipment failures and maintenance needs. These tools can schedule maintenance tasks in advance, prevent downtime, and optimise asset performance.

Resource planning and allocation are also enhanced by AI technologies, such as workforce management, branch operations, and IT infrastructure. The business benefits of operational efficiency with AI technologies include cost savings, enhanced productivity, and an improved customer experience. By automating customer service interactions, optimising processes, and ensuring seamless operations, banks can deliver a superior customer experience, increase satisfaction, and build long-term relationships with clients.

Case: DBS Bank’s robotic process automation (RPA)

DBS Bank, a Singapore-based financial institution, has implemented robotic process automation (RPA) to streamline and automate various operational tasks. The bank faced challenges in managing high volumes of repetitive tasks, such as data entry, customer onboarding, account reconciliations, and compliance reporting. To address these issues, DBS Bank adopted RPA technology to automate routine tasks and streamline processes. RPA software robots were deployed to mimic human actions, interact with applications, and perform tasks with speed, accuracy, and consistency.

DBS Bank collaborated with RPA vendors to identify key processes suitable for automation, design RPA workflows, and deploy software robots across different departments. The implementation was gradually rolled out, starting with pilot projects to test and refine automation workflows before scaling up the deployment. The benefits of RPA technology include operational efficiency, cost savings, enhanced customer service, and compliance and accuracy. The bank plans to continue expanding RPA across various business functions, exploring new automation opportunities to further streamline operations and drive digital transformation initiatives.

RPA in banking means using advanced business process automation tools to automate many mundane and repetitive tasks, allowing employees to focus on more value-adding and customer-centric activities. In a nutshell, RPA emulates human actions interacting with the software while exponentially increasing efficiency.

Kate Aleksandrovich, Head of RPA center of excellence

Compliance and regulatory compliance

AI tools have revolutionised compliance processes in the banking sector, enhancing anti-money laundering (AML) monitoring, detecting suspicious activities, and streamlining regulatory reporting. These tools analyse transaction data in real-time to detect unusual patterns, suspicious activities, and potential money laundering activities. Machine learning algorithms can identify anomalies, trends, and red flags that may indicate illicit transactions, enabling banks to mitigate AML risks and comply with regulatory requirements.

AI systems also assess customer profiles, transaction histories, and risk factors to assign risk scores and identify high-risk individuals or entities. Behavioural analytics help banks identify unusual behaviours, money laundering schemes, and fraudulent activities, improving AML monitoring capabilities and reducing false positives in suspicious activity alerts.

Regulatory data management is streamlined by AI systems, automating data integration, validation, and submission processes. RegTech solutions leverage AI and data analytics to simplify compliance tasks, monitor regulatory changes, and generate regulatory reports in compliance with industry standards. Natural Language Processing (NLP) tools can extract, analyse, and interpret regulatory texts, guidelines, and documents to ensure banks comply with regulatory requirements.

Case: Wells Fargo’s compliance automation

Wells Fargo, a prominent US financial institution, has implemented compliance automation to streamline its operations and ensure compliance with regulatory requirements. The bank used advanced automation technologies such as artificial intelligence (AI), robotic process automation (RPA), and RegTech solutions to automate key compliance tasks and reporting requirements. The implementation was phased, starting with pilot programmes to test the effectiveness of automated processes.

The benefits of this automation include improved compliance accuracy, enhanced monitoring and reporting, cost reduction, and efficient risk management. Wells Fargo continues to invest in compliance automation technologies to stay ahead of evolving regulatory requirements and drive compliance excellence. The bank’s successful implementation demonstrates its commitment to adopting innovative solutions to address compliance challenges, streamline processes, and deliver sustainable compliance practices that meet regulatory expectations and industry standards.

The correct answers are B. By offering personalised services, real-time chat support, and automated responses.