- With losses of several million euros forecast for each of the next three years, CFO Simon-Jan Haytink calls for change.

- Fee structure is still a problem though; could a GDP-based formula be the answer?

The dust has settled after an engaging few days at the 87th RIPE meeting, returning this year to Rome, Italy, and two key items from the sessions have been at the heart of member conversations in the proceeding days: budget and fees.

The RIPE budget will be cut from EUR40 million (US$43.15 million) in 2022/23, to EUR38 million in 23/24, due to less income and higher inflation, as well as more uncertainty from war-torn areas such as Ukraine. And how fees should be calculated is still a topic of debate.

RIPE needs to increase its fees, but how?

Increasing the member fees would seem to be an obvious and perhaps inevitable way out of the budget doldrums. As chief financial officer Simon-Jan Haytink noted in a report looking ahead to 2024, “We’re now facing greater uncertainty in terms of our finances. IPv4 run-out has resulted in fewer new LIR applications and the consolidation of multiple LIR accounts has led to a reduction in expected income. Our inability to collect fees from members in Ultra High-Risk Countries and sanctioned members due to restrictions from our banks have had a considerable impact on our activities and budget.”

This has meant cutting costs and has resulted in forecasts for the next few years of expenses exceeding income. “I am confident that the RIPE NCC can face uncertainty as we have in the past. However, many questions remain,” Haytink added. “If we do not take action to change the Charging Scheme for 2025, we will be forced to cut activities or take other drastic actions. Cutting costs is not something we can do year on year without eliminating activities.”

So, fee increases would appear to be more likely than not for RIPE members. But if so, how best to accommodate the broad variety of members? One member noted during the general meeting in Rome that under the previously suggested categorisation of fees, he would lose out, and RIPE managing director Hans Petter Holen quickly remarked that this was one of those issues where it was impossible to keep everyone satisfied.

Members have already voted against a recommended categorisation of fees, so this will be something that will need to be placed back on the drawing board. Holen told BTW in an email: “This is difficult to answer because of course it is very subjective. We did our best to explain the rationale behind the proposed fee structure but in the end it is the members who decide.”

Should RIPE fees be charged based on GDP?

One option could be a a GDP-based fee structure. Using the member country to determine a fair price for membership could have several benefits:

- Economic fairness: Organizations from countries with higher GDPs are generally expected to have a larger economic capacity, and proportionally tying fees to GDP can make the cost of membership more equitable.

- Accessibility for smaller economies: Organizations from developing regions may find it more affordable to participate. This would also make for a more inclusive and global representation within the organization.

- Financial sustainability: It allows RIPE to generate revenue in a way that scales with the economic capacity of its members, ensuring the continued availability of services and resources.

- Simplicity: GDP is a widely recognized measure of a country’s economic strength, it simplifies fee calculation and adds transparency.

But as was noted during the general meeting in Rome, keeping all sides happy with something as sensitive as membership fees can be a tricky ask. And GDP is certainly no magic bullet, as it is also subject to volatility (as has happened in Ukraine over the past two years) and time lag, as well as introducing arguably unnecessary bureaucracy.

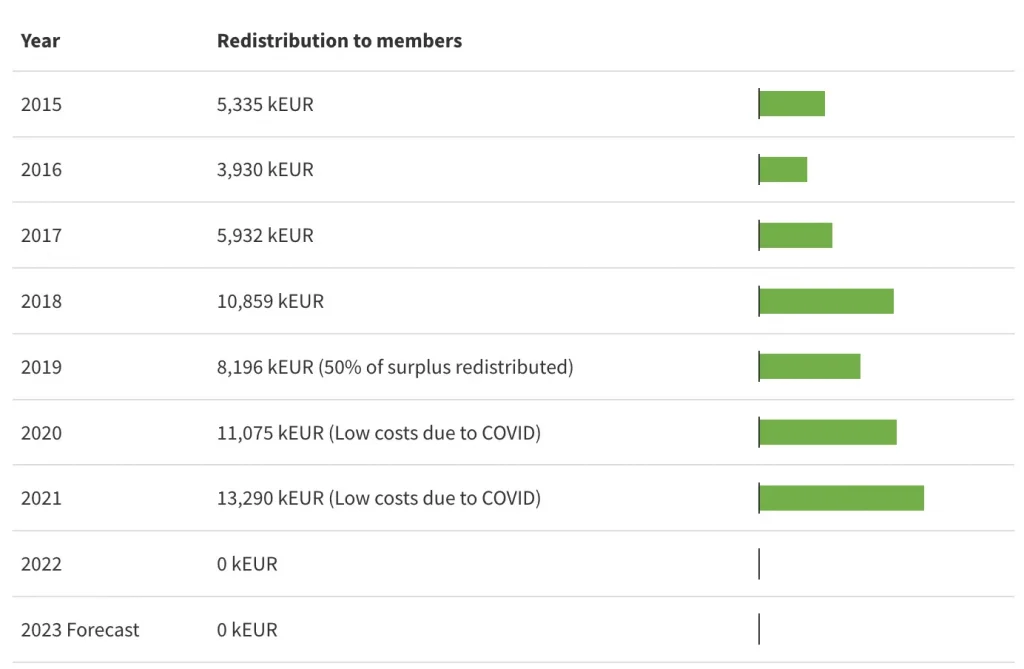

Nevertheless, with RIPE’s income dropping, and with losses forecast for the next few years of EUR4-8 million each year, the RIPE NCC executive board would do well to listen to Haytink, who said on at least two occasions during the Rome event: “Something needs to change.”

GDP already used in other areas

GDP is already used in other facets of life to determine funding levels.

International aid: Some international aid and development assistance programs consider a country’s GDP when determining the amount of aid or financial assistance it receives. Countries with lower GDP per capita may be eligible for more assistance.

International trade agreements: In certain trade agreements, tariffs or trade concessions may be linked to a country’s economic indicators, including GDP. The economic strength of a trading partner may influence the terms of trade agreements, including tariff rates and market access.

World Bank and IMF contributions: Member countries’ contributions to institutions like the World Bank and the International Monetary Fund (IMF) are often based on their GDP. Countries with larger economies contribute more significant financial resources to these institutions.

Global health funding: Some international health organisations allocate funding for global health initiatives based on the economic capacity of countries, which can be reflected in their GDP.

Climate change funding: Discussions around climate change funding and contributions to climate change mitigation efforts may involve considerations of GDP. Developed countries with higher GDPs may be expected to contribute more to global climate change initiatives.

Insurance premiums: In some cases, insurance premiums for certain types of coverage may be influenced by a country’s GDP. For instance, premiums for political risk insurance might be adjusted based on the economic stability and strength of a country.

Development impact bonds: In the realm of impact investing, some financial instruments, like development impact bonds, may tie returns or payments to the economic performance of a targeted region, which could include GDP growth.