- AMD’s stock dipped over 6% in extended trading despite an optimistic report on the sales of its new AI processors.

- The company projected first-quarter sales around $5.4 billion, missing analysts’ estimates of $5.73 million.

- AMD’s data centre division reported a robust 38% annual growth fueled by strong sales of AI-related instinct graphics processors.

Advanced Micro Devices’ stock declined following the chip manufacturer’s issuance of a less-than-anticipated revenue outlook for the March quarter.

AMD report overview

Advanced Micro Devices is a multinational semiconductor company based in the United States, specializing in the development of computer processors and associated technologies for both business and consumer markets.

In extended trading, AMD’s shares fell more than 6% despite the firm providing an optimistic update on the speed at which its new AI processors are selling.

AMD stated that it anticipates sales of around $5.4 billion for the first quarter, give or take $300 million, although analysts had projected revenue of $5.73 billion.

AMD also stated that it anticipated a sequential fall in certain of its key businesses throughout the quarter, including PC processors.

It predicted that its data center income would remain unchanged due to sales of graphics processing units (GPUs), which are required to develop and implement generative artificial intelligence models, offsetting decreases in server CPUs.

Also read: Intel, Nvidia, AMD: Who is going to win the AI chip race?

Also read: AMD unveils MI300 series intensifying rivalry with Nvidia

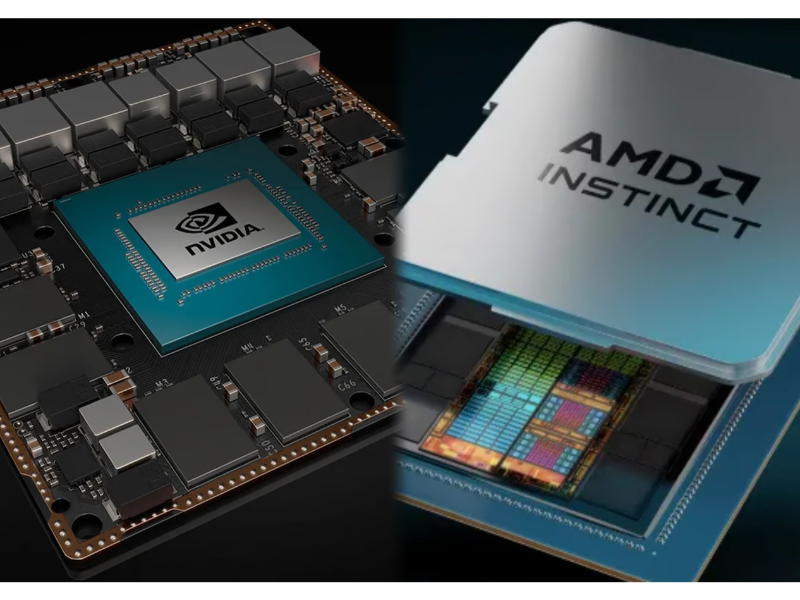

AMD challenges Nvidia dominance

Although Nvidia now controls the majority of the GPU industry, AMD has stated that, in some applications, its new AI processors, which were unveiled last year, will compete with Nvidia’s H100 GPUs. Over the next several years, investors anticipate the company’s data centre division to grow significantly.

“In cloud, we are working closely with Microsoft, Oracle, Meta and other large cloud customers on Instinct GPU deployments powering both their internal AI workloads and external offerings,” Lisa Su, AMD’s CEO, said.

AMD’s data centre division, which sells AI processors and server CPUs, increased 38% annually to $2.28 billion. It is now unquestionably AMD’s biggest market. According to AMD, “strong growth” in sales of its AI-related instinct graphics processors was largely responsible for the revenue boost.

AMD launched its AI accelerator last year: AMD Instinct MI300. AMD can simply fit more onto a single GPU and can run larger models in memory without having to go over to other GPUs link.

“It’s very simple: The more compute you have, the more capable the model, the faster the answers are generated. And the GPU is at the center of this generative AI world,” Su said.