- Explore the major carbon emission exchanges in 2024, such as CTX, ACX, Xpansive’s CBL, and Toucan Protocol, shaping the landscape of global carbon trading.

- Witness the growth and impact of carbon exchanges on combatting climate change, with key players contributing to the substantial increase in the global carbon market’s value.

- Understand the role of carbon emission exchanges in incentivizing carbon reduction, featuring top platforms like CTX, ACX, Xpansive’s CBL, and Toucan Protocol at the forefront of this transformative market.

Major carbon emission exchanges in 2024

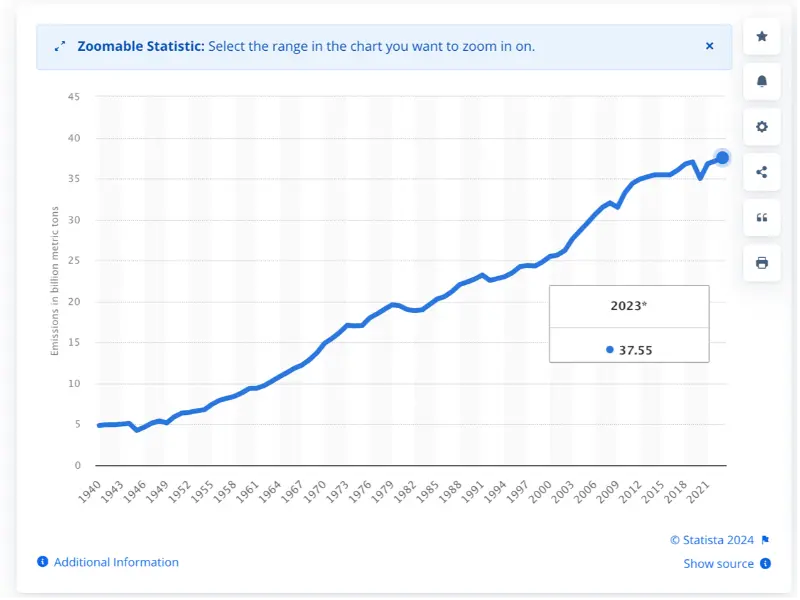

Climate change has been arguably the most important and most discussed topic of recent decades. Data from Statista shows that Since 1990, global CO₂ emissions have increased by more than 60%. In 2023, the world’s total carbon dioxide emissions from fossil fuels and industry reached 3.755 GtCO₂.

Here is the rise of annual carbon dioxide (CO₂) emissions worldwide from 1940 to 2023:

Carbon emission exchanges were introduced in the 1990s when the concept of carbon offsetting began to emerge as a way to try to combat this potentially hazardous rise.

What is carbon emission exchanges?

Before we can understand carbon emission exchanges, we first need to figure out what carbon trading is.

Carbon trading refers to the buying and selling of permits or credits that allow the right to emit a certain amount of greenhouse gases, typically measured in terms of carbon dioxide equivalent (CO2e).

Then let’s move to “Carbon Emission Exchanges”.

“Carbon emission exchange” is often used interchangeably with carbon exchange. Both refer to platforms or marketplaces where carbon credits or allowances are bought and sold. It serves as a centralized location for participants to engage in carbon trading.

In summary, carbon trading allows the buying and selling of emission permits, and carbon emission exchanges are the marketplaces facilitating this trade.

Using these exchanges, entities with lower emissions can sell their unused allowances to those exceeding their allocated limits – giving a financial incentive to reduce carbon emissions.

Key events in the development of carbon exchanges include:

1989: The first carbon offset project was initiated by Applied Energy Services, an American electric power company, which financed an agriforest in Guatemala to offset the emissions of their new power plant.

1995: The Kyoto Protocol was signed, which set legally binding emission reduction targets for developed countries.

2005: The European Union Emissions Trading Scheme (EU ETS) was established, becoming the world’s first major carbon market.

2015: The Paris Climate Agreement was signed, which set a global goal to limit global warming to well below 2°C above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5°C.

2016: The Paris Climate Agreement created new opportunities for voluntary carbon markets, as Article 6 raised the possibility of countries using carbon offsets toward their emission reduction targets and created new opportunities for voluntary carbon markets.

Since then, carbon exchanges have grown substantially, with the global voluntary carbon market reaching nearly $2 billion in market value in 2021.

The effects of carbon emission exchanges

Carbon emission exchanges serve as operational hubs for carbon trading.

The introduction of carbon exchanges, such as Emission Trading Schemes (ETS), has had a significant impact on global carbon emissions. Research has shown that the adoption of ETS can lead to a positive effect on the reduction rate of carbon emissions, particularly for developed economies, and slower carbon emission increment for non-developed economies.

Therefore, the introduction of carbon exchanges has played a role in shaping efforts to reduce carbon emissions and combat climate change.

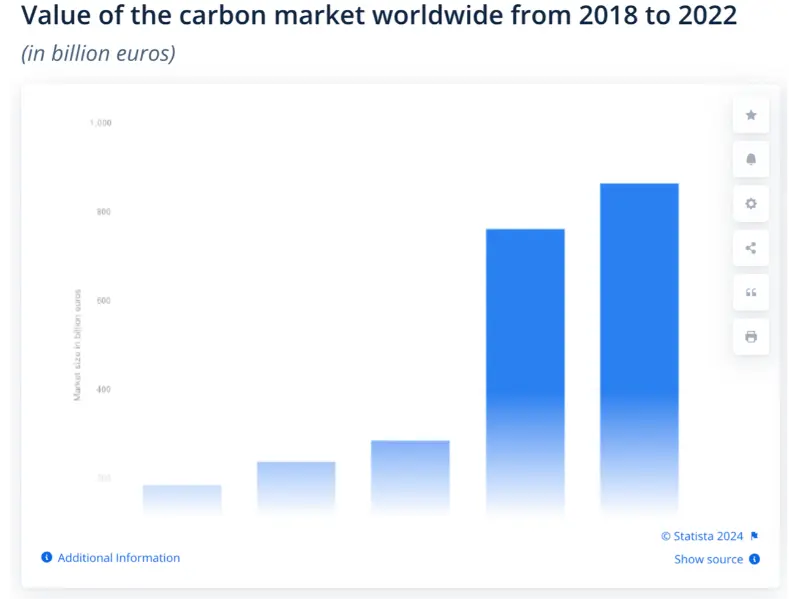

The global carbon market has experienced significant growth in recent years. This substantial increase in value reflects the growing importance of carbon markets in the fight against climate change.

Data from Statista shows that the value of the global carbon market soared 13.5 percent in 2022 to a record high of 865 billion euros. This growth was mainly due to an increased demand for carbon permits, which culminated in surging prices.

The European Union Emissions Trading System (EU ETS) has been a major contributor to this growth, with the EU remaining the world’s largest carbon market in terms of both traded volume and value.

The EU ETS covers around 45% of the EU’s greenhouse gas emissions and its carbon market value accounted for roughly 87 percent of the global market size in 2022.

Also read: Google invests $1 billion in green UK data centre

Global emissions trading and carbon market situation and future

In 2022, some 12.5 billion metric tons of carbon dioxide (GtCO₂) were traded in global carbon markets. This was a decline of over 20 percent from the previous year. However, when compared to 2019 levels, this figure represented an increase of 18.2 percent. Europe accounted for roughly 74 percent of the traded volume of CO₂ worldwide in 2022.

Global trade volume of CO₂ in carbon markets 2019-2022

Top 4 carbon emission exchanges in 2024

Among the different carbon credit exchanges available, we’ve identified the top 4 that are worthy to consider.

Carbon Trade eXchange (CTX)

One of the early participants in the global carbon market, the Carbon Trade Exchange (CTX), has its headquarters in London, England. CTX was founded in London by Wayne Sharpe in 2009, after two years of research and development.

In contrast to previous carbon exchanges, CTX is a member-based spot exchange that welcomes a wide range of market players.

Single brokerages and project developers to multinational conglomerates can use the platform.

Buyers can buy and retire credits in lots of 100 tons of CO2e, which is CTX’s minimum trading volume. Other carbon exchanges have minimums of at least 1,000 tons equivalent, or 1,000 credits.

CTX has reported a notable increase in trade volume, with over 140 trades recorded in November and December in 2023. Despite facing challenges in the market, including a dip to 50 cents for certain older CERs, prices rebounded with trades reaching 80 cents (+60%). Some trades even exceeded $4 and $5, with volumes reaching up to 250,000. The 52-week average transaction size remains over 6,000 credits.

Additionally, it mentions the acquisition of the Global Carbon Registry (GCR) by the Global Carbon Council, with details expected to unfold in early 2024.

Here are CTX’s trading data in 2023:

AirCarbon Exchange (ACX)

AirCarbon Exchange was launched in Singapore in 2019 as a digital exchange platform for airlines to trade carbon credits.

The firm has raised a total of $3.6M in funding over 3 rounds. This carbon exchange is funded by Deutsche Borse.

ACX has worked with over 130 different companies. Businesses, investors, stockbrokers, and those working on carbon projects all fall under this category. This carbon exchange implements DLT in an established commodities market framework.

Similarly, it uses the most up-to-date blockchain technology to produce carbon credits that can be traded like stocks.

In November 2022, ACX Abu Dhabi became the first entity to be licensed under this framework, being the world’s first regulated Recognised Investment Exchange and Recognised Clearing House offering Environmental Instruments in the form of carbon credits.

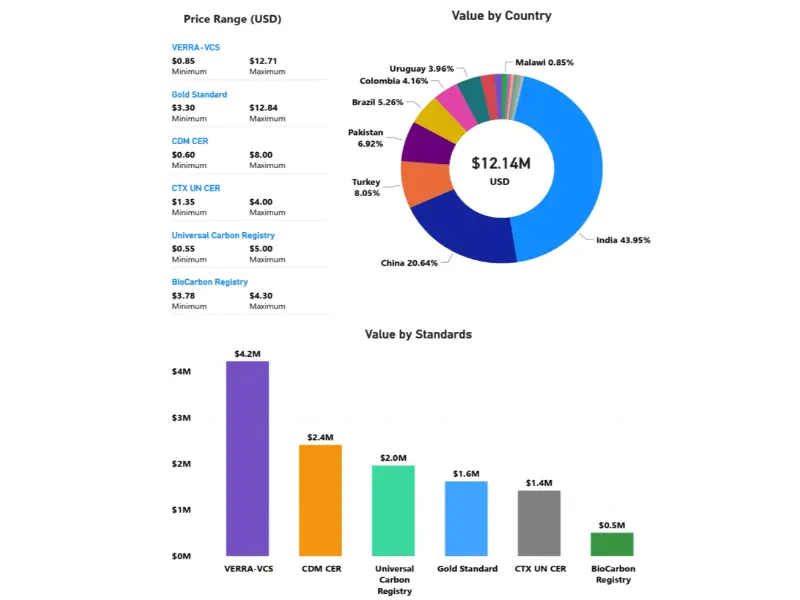

The table below shows the recent price for each carbon asset.

Also read: Automotive giants choose Mississippi for battery production

Pop quiz

Which carbon exchange was founded in London and reported a notable increase in trade volume, recording over 140 trades in November and December of 2023?

A. AirCarbon Exchange (ACX)

B. Xpansive’s CBL platform

C. Carbon Trade eXchange (CTX)

D. Toucan Protocol

The answer is in the bottom of the article.

Xpansive

In 2019, Xpansive, based in the United States, helped form the Australian platform CBL. The company’s CBL division is the largest spot exchange for environmental, social, and governance (ESG) commodities.

This firm had proven wildly popular with investors, having raised $178.5M in total funding over 7 rounds.

On Xpansiv’s CBL platform, clients can trade a broad range of carbon offset projects from major registries around the world. The long list of customers includes big organizations like airlines and major financial institutions.

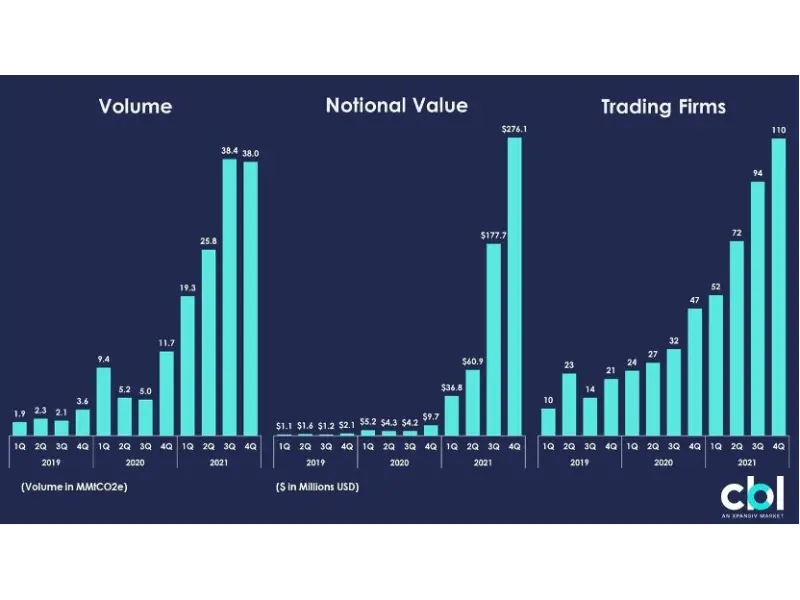

CBL recorded a trade volume of over 120 million mtCO2e of carbon credits on its platform for 2021, and Velasquez said this could touch 130 million mtCO2e for 2022.

S&P Global claims that CBL’s traded volume of 120 million mtCO2e accounted for more than 95% of globally exchange traded spot carbon credits, making it the single largest exchange for carbon credits.

The below chart shows the Xpansiv CBL’s carbon exchange’s volume, value, and trading firms from 2019 to 2022. There is a strong trend of very rapid growth across all three metrics.

Toucan Protocol

The Toucan Protocol was founded in Berlin, Germany, in 2020. It creates the foundation for carbon markets to fund climate crisis solutions.

Since that time, it has raised $7.5 million in investment. Its goal is to establish programmable carbon as a new kind of money to make DeFi (decentralized finance) functional.

In essence, it turns Verified Carbon Units or VCUs into crypto via its own proprietary Toucan Bridge. It’s the first generalized bridge to tokenize carbon credits. It allows anybody to tokenize their carbon offsets and make them available in the world of DeFi.

Toucan’s infrastructure rapidly scaled to support $4 billion in carbon credit trading volume. Today, they represent 85% of all digital carbon credits.

Here are what Toucan had achieved so far:

Conclusion

In summary, carbon emission exchanges play a crucial role in the global effort to combat climate change by providing platforms for the buying and selling of carbon credits.

These exchanges, such as the Carbon Trade eXchange (CTX), AirCarbon Exchange (ACX), Xpansive’s CBL platform, and Toucan Protocol, are significant players in the carbon market. The growth of carbon exchanges, especially driven by initiatives like the European Union Emissions Trading System (EU ETS), has contributed to a substantial increase in the global carbon market’s value.

Overall, these exchanges are instrumental in shaping the future of carbon trading and influencing global efforts to address the climate crisis.

The answer to the quiz is C. Carbon Trade eXchange (CTX).