- A new study reveals the sectors that offer cryptocurrency as a payment method. The retail & e-commerce sector ranks first.

- The mainstream adoption of bitcoin and other cryptocurrencies in the USA is hampered by regulatory uncertainty, value volatility, and scalability issues causing slower transactions and higher fees.

- Mainstream adoption of bitcoin unlikely.

TLDR:Explore the fascinating world of Bitcoin! From digital gold to the revolution of future currency, this video delves deep into the mysteries of Bitcoin.

Ignite your curiosity about cryptocurrency and unravel the new era of digital finance!

The current state of bitcoin adoption

A recent study by CoinLedger has revealed the top 10 sectors and more than 300 companies that offer cryptocurrencies as a payment method.

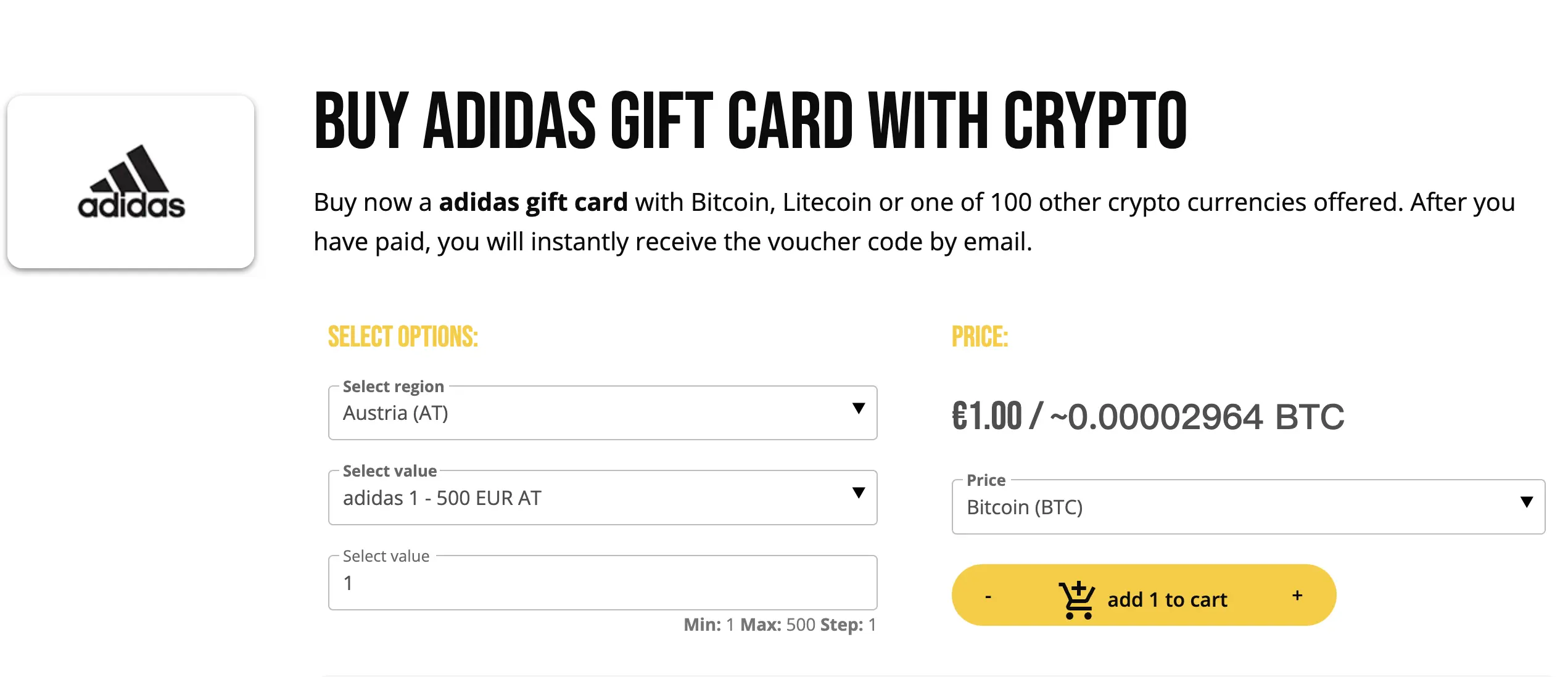

Retail & E-commerce ranks first as a sector, with 60 companies accepting bitcoin, including clothing and accessories stores like Adidas, Yankee Candle, and H&M, and online shopping platforms like Etsy.

Erika Wykes-Sneyd, global VP and general manager of Adidas, emphasizes that merely accepting cryptocurrency does not mean a company has fully embraced this domain. Instead, she notes how Adidas has gone further than merely accepting crypto payments, and has embarked on an extensive series of Web3 ventures.

Adidas has drawn on its crypto experiences, promoting communities that allow only those who meet the requirements to access certain content. This creates a more loyal and fair user base, and allows for unique discount options.

The Food and Dining sector, which includes big names like Chipotle, Chuck E. Cheese’s, Domino’s, and Hard Rock Café, along with services like DoorDash and Uber Eats, ranks second in adopting cryptocurrency payments with 54 companies. Following closely behind are the Luxury Retail sector with 35 companies, and the Travel & Hospitality sector with 31 companies. Brands like Gucci and Ralph Lauren, luxury watch retailer Hublot, private jet services Fast Private Jet, LunaJets, and PrivateFly, and cruise lines Royal Caribbean and Princess Cruises all accept bitcoin.

David Kemmerer, co-founder and CEO of CoinLedger, commented positively on the findings: “The increasing number of companies accepting cryptocurrency payments reflects the growing acceptance and adoption of digital currencies in the mainstream economy.”

“I can’t blame users and merchants for not wanting to use them. They are all basically the same clunky product that links to a card…a 60 year old legacy technology. There is limited utility for the user at best, and zero incentive for the merchant. ”

Shane Rodgers ,CEO/founder at PDX Global

However, the overall adoption rate remains limited.

Shane Rodgers, CEO/founder at PDX Global, shared his opinions: “I am surprised and shocked that these merchant adoption numbers are still so low, to the point that I seriously question them. For starters, the current so-called crypto payment options are appallingly bad. I can’t blame users and merchants for not wanting to use them. They are all basically the same clunky product that links to a card… a 60-year-old legacy technology. There is limited utility for the user at best, and zero incentive for the merchant. On top of that, merchants quite rightly don’t want to be in the crypto business… taking the crypto, holding it, trying to sell it, hoping that they get the same net amount out of the transaction when the crypto is sold… putting up with the holding risk of a volatile asset etc. etc.”

Pop quiz :

Which industry has the most companies accepting cryptocurrency payments?

a.Luxury Retail

b.Technology & Electronics

c.Retail & E-commerce

d.Food & Dining

Find the answer at the bottom of this article.

Barriers to mainstream bitcoin adoption

There are a number of reasons why bitcoin and other cryptocurrencies have not been widely adopted in the USA.

“Additionally, the latest adverse news about FTX, Celcius, Binance, and many other marketplaces coupled with regulatory uncertainty creates a level of discomfort for many merchants.”

Felix Shipkevich, special professor of Law at Hofstra Law

Felix Shipkevich, special professor of Law at Hofstra University asserted, “Many retailers are still concerned about the bitcoin price volatility and, as such, conversion to USD. Additionally, the latest adverse news about FTX, Celsius, Binance, and many other marketplaces, coupled with regulatory uncertainty, creates a level of discomfort for many merchants.”

Uncertainty appears to be a significant obstacle. This was evident in 2012 when James Zhong illegally obtained over 50,000 bitcoins through the Silk Road darknet, valued at over $3.36 billion at the time, or in 2014 when Mt. Gox, once the largest bitcoin exchange, suffered a catastrophic hack, resulting in the theft of more than 850,000 bitcoins. These severe incidents undeniably exposed the vulnerabilities and limitations of centralized exchanges and underscored the need to enhance security measures within the ecosystem.

Also read: the Jimmy Zhong story: how a $3B bitcoin heist collapsed after one fatal mistake

This volatility in the value makes it very difficult for business owners to price goods and services. For most, they need to convert the coin into their local currency for banking and other purposes.”

Rod Skyles, the unconventional economist

Another challenge is the volatility of bitcoin’s value, which makes it difficult to achieve widespread adoption. Until now, bitcoin has been seen as a “rich man’s game”, and the extreme volatility of the cryptocurrency market may be beneficial for investment, but it discourages merchants from accepting bitcoin payments.

Here’s what Rod Skyles , the unconventional economist (at econrecon.blog) said: “One of the big challenges bitcoin has in everyday transactions is that many business owners are concerned with the volatility of the coin. This year, it has traded at a low of under $17,000 to a high currently of well over $37,000. This volatility in the value makes it very difficult for business owners to price goods and services. For most, they need to convert the coin into their local currency for banking and other purposes.”

In addition, bitcoin’s scalability issues and transaction speeds hinder its ability to efficiently handle large numbers of transactions. As more users join the network, the blockchain’s capacity is strained, resulting in slower transaction times and higher fees. This limitation reduces the practicality of using it for everyday transactions.

The unpredictable future of crypto payments

“it is unlikely these changes will come anytime in the foreseeable future.”

Rod Skyles, the unconventional economist

Skyles believes that the transition to bitcoin for businesses is hindered by the need for traditional banking products and ingrained habits. Potential solutions could include hybrid banks that accept bitcoin and offer traditional products, or cryptocurrency banks that operate outside of the Federal Reserve system. “However, in the US, current regulations may very well prevent these types of institutions. Given the existing banking laws in the US and the monetary monopoly the Fed enjoys, it is unlikely these changes will occur anytime in the foreseeable future. ” He also points to the incompatibility of US regulations with bitcoin.

Rodgers suggests a number of ways to make bitcoin mainstream: “(1) continued regulatory clarity and clear rules, (2) increased consumer trust over time, (3) development of clear use cases and the infrastructure to support them, (4) greater banking industry acceptance, (5) smoother and superior payment options, which PDX is developing and soon to launch.”

“First, significant regulatory certainty would be a key factor. Second, Tier 1 banks need to offer this crypto more widely to merchants, particularly integrating it with their PoS solutions. Finally, there needs to be less adverse or negative press on this subject matter.” Shipkevich believes that if all these conditions are met, bitcoin could still become the payment of choice for the masses.

Bitcoin’s historical evolution

Bitcoin, the revolutionary cryptocurrency, emerged in 2009 and has since gained significant attention and value. As the birthplace of bitcoin, the United States has played a crucial role in its development and adoption. However, despite its potential, bitcoin and other cryptocurrencies have not yet become mainstream in everyday transactions.

In 2009, bitcoin was quietly introduced by an enigmatic figure or group known as Satoshi Nakamoto. The whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” laid the foundations for this decentralized digital currency.

In 2021, bitcoin experienced another historic high, soaring close to $65,000 in April. This milestone was fueled by growing institutional adoption, increased recognition as a store of value, and heightened interest from mainstream investors. However, its meteoric rise was followed by a substantial correction, with prices hovering in the $20,000–$30,000 range by now.

Also read: bitcoin miners post record-high numbers in September

“Do you think it will ever happen?- Possibly. It all depends on the three factors I described.”

Felix Shipkevich, special professor of Law at Hofstra Law

The correct answer to the pop quiz is c. Retail & E-commerce. The Retail & E-commerce sector, with 60 companies, was the sector that most widely accepted bitoin payments. Brands included clothing and accessories stores like Adidas, Yankee Candle and H&M, and online shopping platforms like Etsy.