- A routing and transit number is a nine-digit number on a check that identifies the institution and is typically used by banks to process transactions.

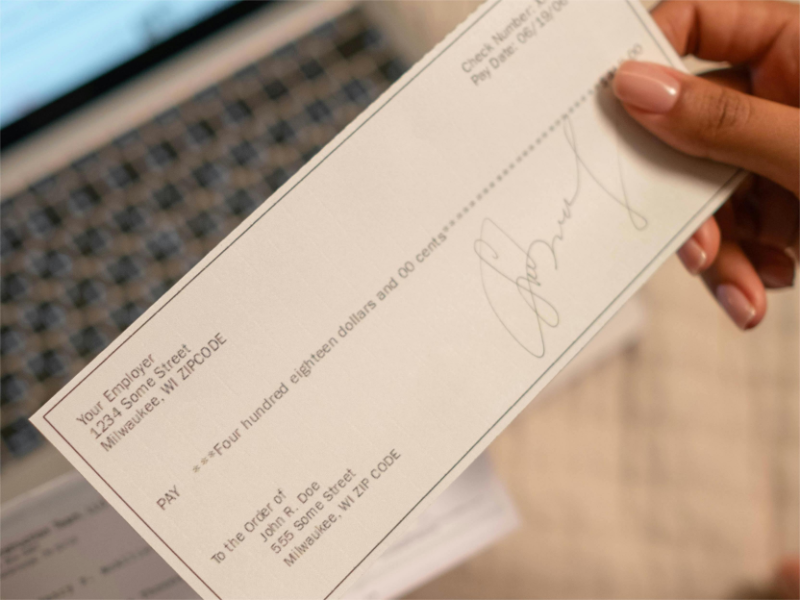

- The routing and transit number is the leftmost nine digits, and the number on the bottom of the check matches the number on the top right.

- Financial institutions use routing and transit numbers to communicate between banks. This number identifies the institution you are using so that the transaction party knows where your account is located.

OUR TAKE

When using the routing and transit number, please pay attention to its accuracy and confidentiality. Make sure the number you enter is correct, otherwise it may lead to incorrect fund transfers. At the same time, you must keep it safe to prevent others from misusing it.

–Sissy Li, BTW repoter

In 1910, the American Bankers Association (ABA) created the routing and transit and transit number. Routing and transit numbers are usually nine digits long and identify banks or financial institutions when clearing funds or processing checks. These numbers are also used for online banking and the ACH Clearing House. Not all accounts are eligible for routing and transit and transit numbers. Only federally chartered banks and state-chartered banks that have accounts at the Federal Reserve Bank are eligible.

How do I find a routing and transit number?

Find a check: Routing and transit numbers are usually nine digits long, but bank account numbers are usually different lengths, so you need to be careful when using them. When using it, you need to pay attention to the routing number at the bottom of the check, and you need to use the first nine digits. The first four digits represent the Federal Reserve Bank in the region where the institution is located, the fifth to eighth digits represent the bank itself, and the last digit represents the classifier of the check or negotiable instrument. The following digits are the account number and check number of the bank where the funds are withdrawn.

Online search: The American Bankers Association (ABA) allows users to search numbers through the online search tool, but users can only use the online search tool to search twice a day and a maximum of ten times a month.

How routing and transit numbers are used?

Wire transfers are commonly used in international transactions to make electronic funds payments, and are managed by hundreds of banks around the world. Routing and transit numbers are often used when an individual establishes a wire transfer relationship with a bank. Banks use routing numbers to process transactions because the number tells all parties involved which institution is accepting or distributing funds.

For example:

If your bank transit number is only four digits long, add a 0 in front of the number. Example: Branch 1011 is 01011.

If your account number only has nine digits but a form requires 11, simply add two zeros in front. For example, 123456789 is 00123456789.

Routing and transit numbers and other bank numbers

Routing and transit numbers were originally created for checking accounts, but later evolved to identify banking institutions during electronic transactions.

In addition, SWIFT and IBAN are used for international transactions.

SWIFT: SWIFT is similar to a routing and transit number, which is an identification code mainly used in international transfer transactions.

IBAN: The International Bank Account Number (IBAN) is a long string of alphanumeric codes used to identify the country, bank code, check number, etc. of the transaction. Currently, many banks in Europe have issued IBAN, and banks in other regions are gradually beginning to use IBAN.

Some banks to choose from

ATB; Citizens Bank; Coast Capital; Desjardins; CIBC; Laurentian Bank; Bank of America; Bank of Canada BMO; HSBC; Chase Bank; RBC; TD Bank; PC Financial, etc.