- Buy now, pay later (BNPL) allows consumers to make purchases and pay for them over time, often without interest, providing a convenient short-term financing option.

- BNPL programs offer fixed payments and no interest, typically with a down payment at the time of purchase and subsequent interest-free installments over several weeks or months, making it a popular choice for budget-conscious shoppers.

- Leading BNPL providers, including Klarna, PayPal, and Affirm, offer consumers diverse payment options tailored to their preferences and financial needs, reshaping the landscape of online and in-store shopping experiences.

Have you ever found yourself faced with the decision of whether to pay for a large purchase all at once or in installments right at the checkout counter? This type of offer, known as “buy now, pay later” (BNPL), is increasingly prevalent in shops.

As online shopping continues to rise in popularity, it is becoming more important to grasp the workings of BNPL, its benefits, and the expanding array of businesses embracing it as a payment option.

What is buy now, pay later?

One of the biggest reasons merchants like BNPL financing – and often end up paying the fees that make these loans interest-free for consumers – is that this financing option enables many consumers to spend when they otherwise wouldn’t.

Austin Kilgore, an analyst with the Achieve Centre for Consumer Insights

Buy now, pay later (BNPL) enables consumers to purchase items in installments through a third-party organisation, typically online. It functions as a form of short-term financing, allowing buyers to spread payments over time without incurring interest charges.

Let’s say you’re looking to buy the latest Samsung Galaxy S24 series and use it regularly. If you’re considering spreading the payment over time, you might finance your purchase through Affirm, a third-party company, rather than through Samsung.

Credit card companies have also joined the trend, allowing cardholders to repay their debt in fixed-price installments instead of accruing interest on a revolving balance.

As Austin Kilgore, an analyst with the Achieve Centre for Consumer Insights, points out: “One of the biggest reasons merchants like BNPL financing – and often end up paying the fees that make these loans interest-free for consumers – is that this financing option enables many consumers to spend when they otherwise wouldn’t.”

Also read: American Express launches ‘Plan It’ in the UK for personalised payment

How buy now, pay later works?

Buy now, pay later vary in terms and circumstances but often provide fixed-rate, interest-free short-term loans. To make the transaction, users can utilise a BNPL app, or credit card may provide BNPL choices.

When using BNPL, a purchase can be made at a participating retailer with the option to BNPL at checkout. Upon approval, a small down payment, typically around 25% of the total purchase amount, is required. The remaining balance is paid off in interest-free installments over a specified period, often spanning several weeks or months.

Automatic withdrawals for payments will be arranged from a credit card, bank account, or debit card. Although paying by check or bank transfer is possible in rare cases, most BNPL lenders typically offer only autopay, as noted by the Consumer Financial Protection Bureau.

A key difference between a credit card and BNPL is that credit cards typically accrue interest on any unpaid balances carried forward to the next billing cycle. With a credit card, users have the flexibility to utilise credit limit or maintain a balance for an indefinite period.

BNPL applications typically have a set payback timeline and no fees or interest. The number of payments remains constant and predetermined, providing clarity in advance.

Pop quiz

What is buy now, pay later?

A. A type of long-term financing

B. A method of making purchases without immediate payment

C. A credit card reward program

D. A saving account option

The correct answer is at the bottom of the article.

Unlocking the benefits of BNPL

Offering several advantages, BNPL services have become increasingly popular among consumers.

One notable benefit is the ability to split up payments, making the purchase of expensive items more attainable without the need for a lump sum payment or incurring interest charges.

Additionally, BNPL options do not result in a harsh credit inquiry, making them easier to qualify for compared to applying for a new credit card. This accessibility makes BNPL particularly appealing to individuals with weak credit or no credit history.

Moreover, the simplicity and convenience of BNPL transactions, especially when shopping online, provide instant gratification to customers, making it an attractive shopping method.

Furthermore, utilising BNPL can aid in cash flow management by allowing individuals to make budget-friendly purchases with a payment plan that aligns with their financial situation.

Also read:

Understanding the risks of BNPL

A key potential risk for BNPL services is fraud, which can come in many forms. Examples include someone opening up a new account with a stolen identity, a fraudster taking over a legitimate account, or nefarious actors having products shipped to a drop address with no intention of paying for the order.

Kathy Stares, executive vice president of Provenir North America

It’s crucial to be mindful of potential pitfalls associated with this type of financing.

Firstly, the terms of BNPL loans can vary significantly, depending on factors such as state of residency or the BNPL provider. For instance, late payment grace periods may differ based on location, while the amount of late payment charges can be determined by address with BNPL companies.

Additionally, some BNPL programs impose fixed fees on monthly payments, potentially increasing the overall cost of the loan compared to purchasing the item outright.

Moreover, managing multiple BNPL payments could result in overlooking due dates, potentially leading to bank fees for insufficient funds if automatic withdrawals coincide with low account balances.

Kathy Stares, executive vice president of Provenir North America, an AI-powered credit risk decisioning platform, highlighted the multifaceted nature of fraud, stating: “A key potential risk for BNPL services is fraud, which can come in many forms. Examples include someone opening up a new account with a stolen identity, a fraudster taking over a legitimate account, or nefarious actors having products shipped to a drop address with no intention of paying for the order.”

Therefore, understanding the terms and potential fees associated with BNPL financing is essential for making informed financial decisions.

3 popular BNPL companies

In modern retail, BNPL services have surged in popularity, with many startups emerging as prominent players. These platforms offer consumers flexible payment options, revolutionising the shopping experience.

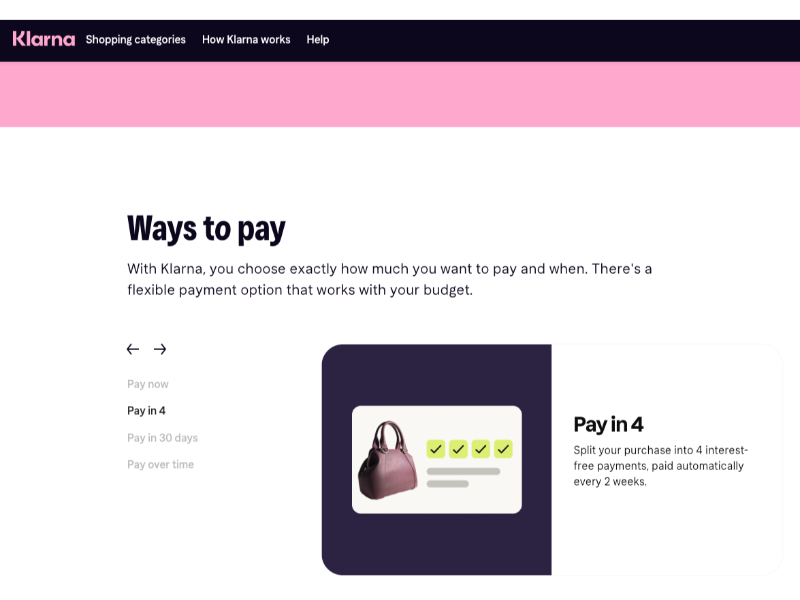

1. Klarna

Klarna is a Swedish fintech firm that offers digital financial services over the Internet. Klarna provides several payment options, including its interest-free “Pay in 4” plan, allowing shoppers to divide purchases into four installments.

Additionally, Klarna offers a “Pay in 30” plan for certain purchases and extended payment plans ranging from six to 24 months, with interest rates ranging from 7.99% to 33.99%.

2. PayPal

PayPal, an American multinational fintech company, operates an online payment system available in many countries for facilitating money transfers.

With PayPal Pay Later, its BNPL option, users may choose between two distinct payment plans: Pay in 4 or Pay Monthly. Pay in 4 demands four equal installments, made every two weeks following the first down payment, for purchases up to $1,500 that are interest-free.

For larger purchases, pay monthly loans up to $10,000 that are repaid over six, twelve, or twenty-four installments each month. Although PayPal claims rates can occasionally be as low as 4.99%, Pay Monthly charges interest because it’s a longer term for a higher amount.

The annual percentage rate (APR) for both plans varies from 9.99% to 35.99%, contingent upon the user’s creditworthiness. While there are no late penalties associated with either plan, missed payments on the Pay Monthly option could negatively impact credit score.

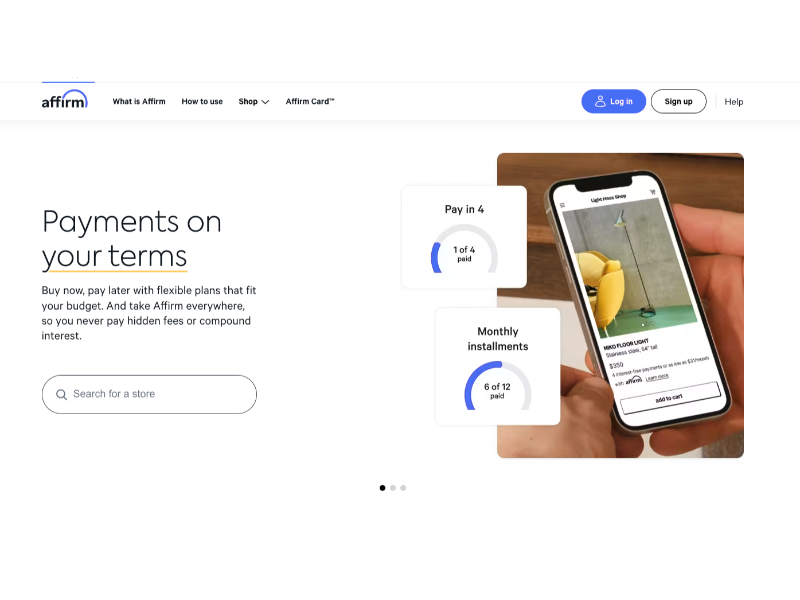

3. Affirm

Affirm offers a popular buy now, pay later service for online and in-store shopping in the United States, serving over 17 million users.

Affirm collaborates with various reputable brands like Pottery Barn and Expedia, providing customers with options at checkout, including short-term 0% interest offers or up to 12 months with an APR ranging from 0% to 36% based on creditworthiness.

There are no late fees, prepayment fees, or deferred interest charges associated. If the preferred retailer doesn’t already partner with Affirm, customers can obtain a virtual card number from Affirm for their purchase, repaying Affirm according to the chosen payment plan.

The correct answer is B, a method of making purchases without immediate payment.