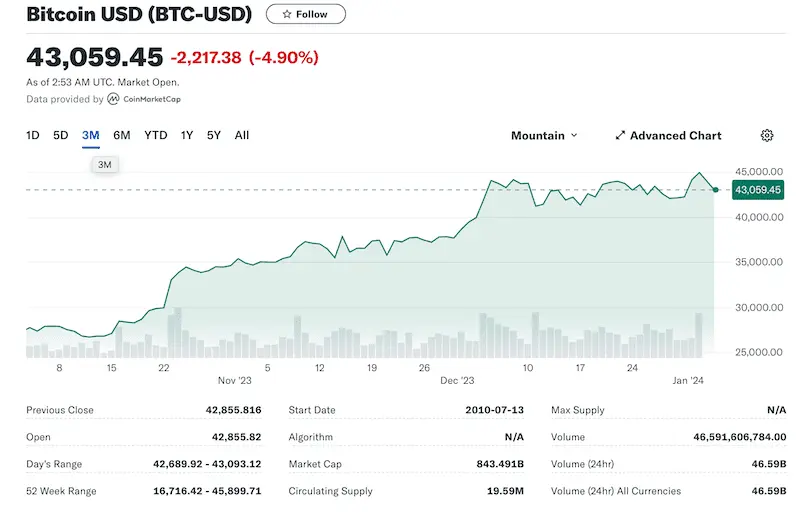

- The price of bitcoin galloped past $45,000 on Tuesday, surging a 21-month high, but fell 5.07% to $42,689 on Wednesday, down 7% from the year’s high on 2nd January.

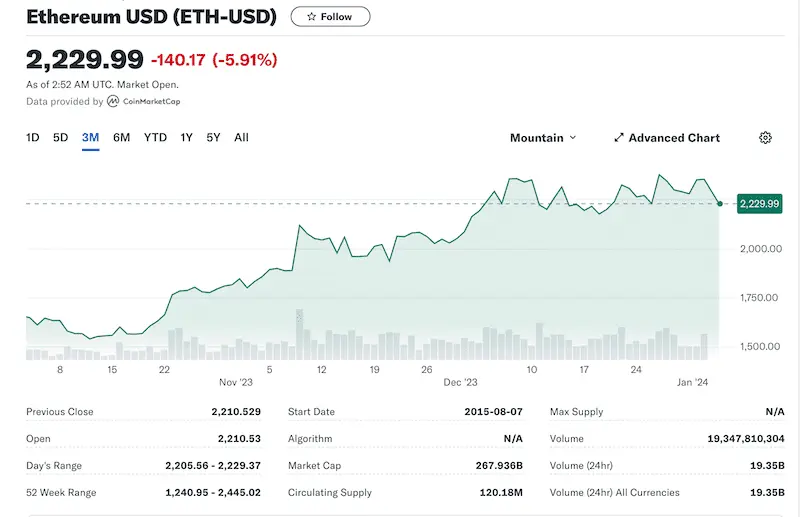

- Ether rose 1.2% to $2,386.50, achieving a 91% surge in 2023.

- Crypto market trend remains in doubt.There are expectations that at least some of the Bitcoin spot ETFs could be approved by early January.

Lumpy market dynamics

Bitcoin has kicked off the new year with a bang, reminiscent of a rollercoaster ride, surging past $45,000 on Tuesday, a level not seen since April 2022. The enthusiasm is fueled by the prospect of exchange-traded spot bitcoin funds gaining approval, injecting fresh optimism into the world’s largest cryptocurrency. This surge marks a momentous start, with Bitcoin reaching a 21-month peak at $45,922, marking a staggering 156% gain in the past year – its most robust performance since 2020. However, despite this impressive rally, it still lingers far below its peak of $69,000 in November 2021.

Not to be outshone, the second-largest cryptocurrency, Ether, made its mark, standing 1.2% higher at $2,386.50 on Tuesday, having experienced a remarkable 91% surge throughout 2023. The enthusiasm spilled over into crypto stocks, reflecting Bitcoin’s trajectory. Riot Platforms, Marathon Digital, and CleanSpark saw gains between 7% and 10%, rebounding from the sharp declines witnessed on the final trading day of 2023. Notable players like MicroStrategy and ProShares Bitcoin Strategy ETF also rode the crypto wave, adding 13.4% and 7.8%, respectively.

However, the rollercoaster ride took a dip on Wednesday, with Bitcoin sliding 5.07% to $42,689, shedding $2,281 from its previous close. The world’s leading cryptocurrency is now down 7% from its peak on January 2. Ether, following suit, dipped 6.54% to $2,202.4, losing $154.1 from its previous close. The volatile nature of the cryptocurrency market continues to keep investors on the edge, emphasizing the need for caution and strategic decision-making in the ever-evolving landscape of digital assets.

Also read: Where can you pay with bitcoin? The brands and platforms that accept crypto payments

Uneven market regulation

All eyes are on the U.S. securities regulator, gauging the likelihood of approving a spot bitcoin ETF. The potential approval could democratize the market, inviting millions of new investors and attracting billions in investments. Despite the heightened anticipation, Bitcoin, at $45,509, remains shy of its peak, emphasizing the volatility that characterizes the cryptocurrency market.

The regulatory landscape has been a pivotal factor in the cryptocurrency sphere, with the U.S. Securities and Exchange Commission (SEC) historically rejecting spot bitcoin ETF applications. The concerns have revolved around the susceptibility of the cryptocurrency market to manipulation. However, recent signals suggest a shift in stance, with expectations mounting for the approval of at least some of the 13 proposed spot bitcoin ETFs, potentially in early January.

”The crypto market is set to experience notable growth this year, with key influencing factors being the influx of investment funds from spot ETFs, Bitcoin halving, and a more accommodative monetary policy both in the United States and worldwide.”

Jupiter Zheng, partner of liquid funds at HashKey Capital

Cryptocurrencies have also found support in the anticipation of major central banks reducing interest rates in the coming year. This positive outlook has helped dispel the gloom lingering from the 2022 collapses of FTX and other crypto businesses. “The crypto market is set to experience notable growth this year, with key influencing factors being the influx of investment funds from spot ETFs, Bitcoin halving, and a more accommodative monetary policy both in the United States and worldwide,” remarked Jupiter Zheng, partner of liquid funds at HashKey Capital.