- Bank of America integrates banking, investing, and retirement services into a single app, streamlining financial management for its customers.

- With a “massive update,” Bank of America consolidates multiple mobile apps into one unified platform, offering enhanced convenience and accessibility to users.

- Bank of America’s release of the enhanced app follows a year of record-breaking digital interactions, with customers accessing their accounts over 12.8 billion times and receiving 10.6 billion proactive notifications digitally.

OUR TAKE

Bank of America’s introduction of a “massive update” to its mobile banking application, consolidating banking, investing, and retirement functionalities into a single, integrated app, puts convenience and accessibility first, providing customers with a seamless and comprehensive digital banking experience. Today, consumers expect to manage all aspects of their financial lives conveniently from their smartphones or tablets. Therefore, embracing digital innovation not only enhances customer satisfaction but also enables banks to remain competitive in today’s fast-paced digital landscape. Additionally, digital banking offers cost-saving benefits for financial institutions by reducing the need for physical infrastructure and streamlining operational processes.

–Sylvia Shen, BTW Reporter

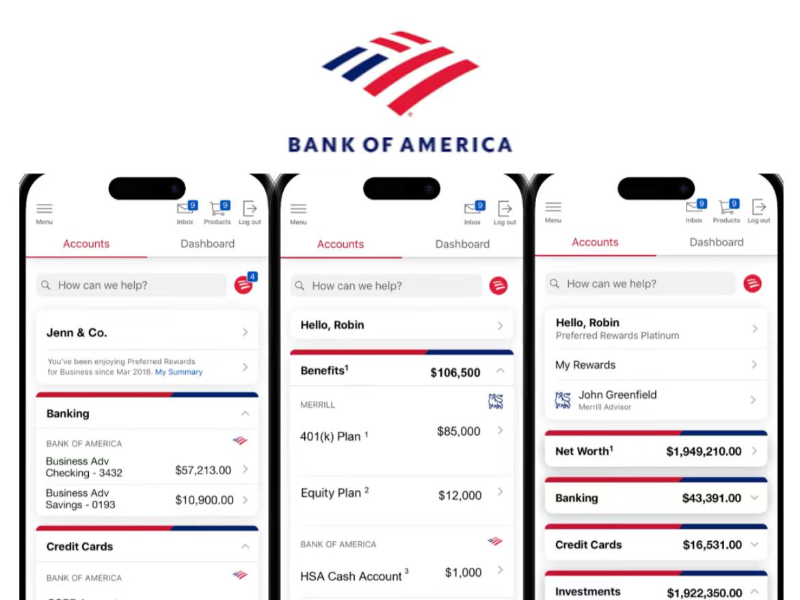

Bank of America has introduced a “massive update” to its mobile banking application, consolidating banking, investing, and retirement functionalities into a single, integrated app.

BoA launched single integrated app

In a press release issued on Thursday, March 21, the bank unveiled its latest innovation: a unified digital platform merging the features of five distinct mobile apps—Bank of America, Merrill Edge, My Merrill, Bank of America Private Bank, and Benefits OnLine—into a single, cohesive platform.

Head of digital at Bank of America, Nikki Katz said in the press release: “Our mission is to continuously innovate and evolve our digital capabilities to provide best-in-class solutions for all our clients. By combining five apps into one, we’re putting clients at the center of the experience, with our full enterprise and next-gen technology at their fingertips.”

The new app has a simplified accounts overview that gives users a single, individualised financial picture that includes a rundown of their retirement, investment, and banking accounts.

Also read: Neobank Revolut launches iPad point-of-sale app for hospitality

The bank also establishes a “payment and transfer hub” where users may divide bills with pals, pay bills, move money between accounts, receive payments, and send and receive wire transfers both domestically and internationally.

Users of the app will also be able to conduct wire transfers to 200 countries worldwide in more than 140 currencies starting this month.

Also read: Digital bank Onyx Private shuts down retail services, shifts focus to B2B

Surge in digital enhancement

The release of this enhanced app follows a year where Bank of America saw a record-breaking 23.4 billion digital interactions, marking an 11% increase. Customers accessed their accounts 12.8 billion times and received 10.6 billion proactive notifications digitally.