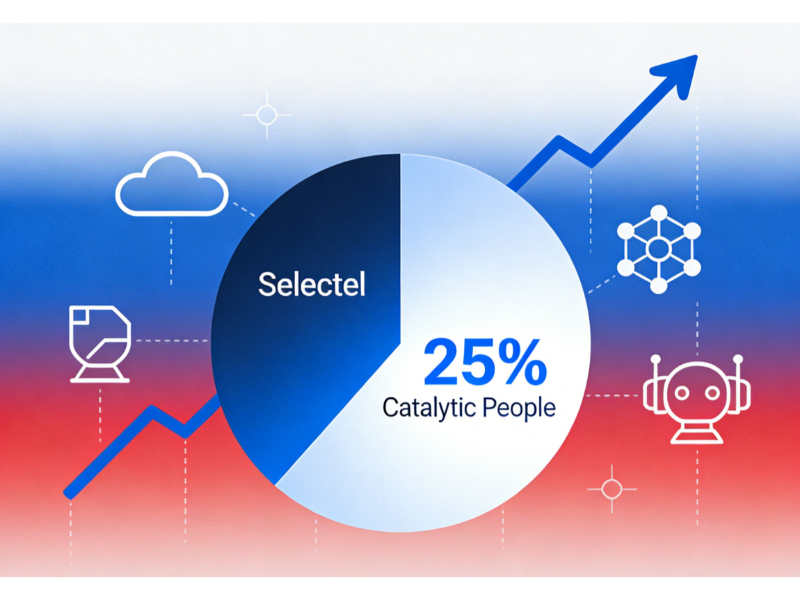

• Russian billionaire Vladimir Potanin’s joint venture Catalytic People has acquired a 25% stake in cloud infrastructure provider Selectel valued at around 16 billion roubles ($206 million).

• The deal underscores Moscow’s push for domestic AI and tech capabilities as Selectel posts strong revenue growth and Potanin expands tech investments.

What happened: Russian tycoon Vladimir Potanin expands tech footprint with minority Selectel dea

Russian billionaire Vladimir Potanin, through his joint venture Catalytic People — a collaboration between his holding company Interros and T-Technologies — has acquired a 25 % stake in Russian cloud and IT infrastructure provider Selectel in a deal valued at about 16 billion roubles ($206 million).

The acquisition was announced by T-Technologies, which also owns online lender T-Bank, reflecting Potanin’s interest in broadening his technology sector footprint. Earlier in the year, Potanin expanded his tech investments by buying a 9.95 % stake in internet company Yandex, a firm often compared to “Russia’s Google.”

Selectel has demonstrated robust performance, with revenue for the first nine months of 2025 rising by 42 % year-on-year, to 13.5 billion roubles, according to T-Technologies.

The acquisition aligns with the Russian government’s stated aim of bolstering domestic artificial intelligence (AI) and cloud computing capabilities. President Vladimir Putin has emphasised the importance of home-grown AI models to maintain national technological sovereignty and encouraged Russian tech firms to close gaps with international competitors.

Also Read: Putin directs Russian bank to partner with China on AI

Also Read: Germany warns of Russian space threat to military satellites

Why it’s important

Potanin’s investment is significant for the Russian tech ecosystem because it brings major private capital into cloud infrastructure, an area usually dominated globally by US and Chinese providers. Given ongoing geopolitical tensions and restrictions on Western cloud services in Russia, strengthening local cloud platforms could be seen as a strategic priority. Analysts might question how effectively domestic cloud services can compete with global leaders in terms of technology and scalability, especially as many enterprises rely on established international providers for advanced cloud and AI workloads.

For Selectel, having a high-profile investor like Potanin could boost confidence among Russian customers and partners, while providing additional resources to scale offerings in infrastructure-as-a-service (IaaS) or platform-as-a-service (PaaS). Nonetheless, sceptics may point out that strong revenue growth in the first three-quarters of the year does not necessarily translate into global competitiveness, and reliance on state-aligned strategies for tech sovereignty could create market inefficiencies.

Potanin’s broader tech investment strategy, including stakes in other large Russian technology firms, reflects a trend among wealthy investors to diversify beyond traditional sectors such as metals and mining. Still, whether this will materially advance Russia’s AI and cloud ambitions remains to be seen, especially in light of international competition and innovation cycles.