- Cash App now offers Pools, enabling group payments via Apple Pay or Google Pay—even from users not on the platform.

- The feature formalises popular user behaviour and helps Cash App compete with PayPal and Venmo in the group-payment space.

What happened: Cash App opens up to Apple Pay and Google Pay for the first time

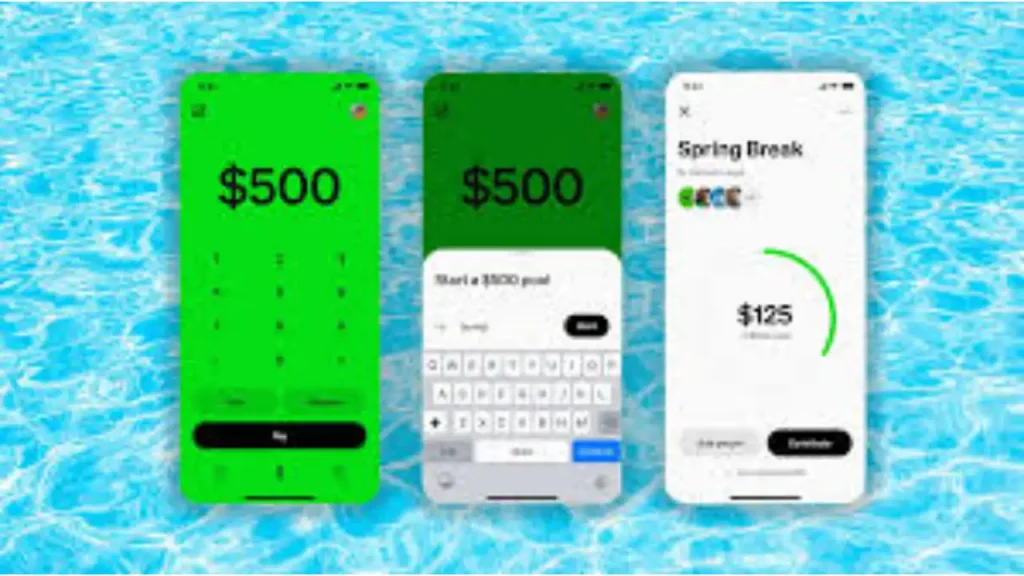

Cash App has launched a new feature called Pools, designed to simplify group payments for users—even those not on the platform. Pool organisers can invite contributors via in‑app $Cashtag, text message or shareable link. Importantly, people without Cash App accounts can participate using Apple Pay or Google Pay to contribute to the pool. Organisers can set a funding target, track contributions in real time, and transfer the pooled money instantly to their Cash App balance once closed. The feature is currently available to a limited set of U.S. users, with a broader rollout planned later this year.

Also read: ACI Worldwide launches ‘ACI Connetic’ to revolutionise payments

Also read: Venmo gains ground as Cash App stumbles

Why it’s important

This launch positions Cash App more directly in competition with group payment tools offered by Venmo, PayPal, and Splitwise. Unlike some rivals, Cash App now accepts contributions from non-users, making it more accessible for collecting money from mixed groups. Given that around 60% of U.S. adults participate in group payment activities and Cash App already plays a role in about half of those cases, Pools formalises existing user behaviour into a dedicated feature offering greater convenience.

Moreover, the move reflects Cash App’s broader strategy to deepen engagement, particularly among younger and underserved customers. By integrating with mainstream payment methods like Apple Pay and Google Pay, the feature expands Cash App’s reach beyond its existing ecosystem and aims to capture group payment flows that might otherwise go through competitors.