- IPv4 addresses have become a scarce digital resource with active markets where prices are driven by supply and demand dynamics akin to property markets

- Differences in regional policies, slow IPv6 adoption and case studies of enterprise holdings show both opportunities and challenges in treating IPv4 as an asset

Scarcity reshapes IPv4 markets

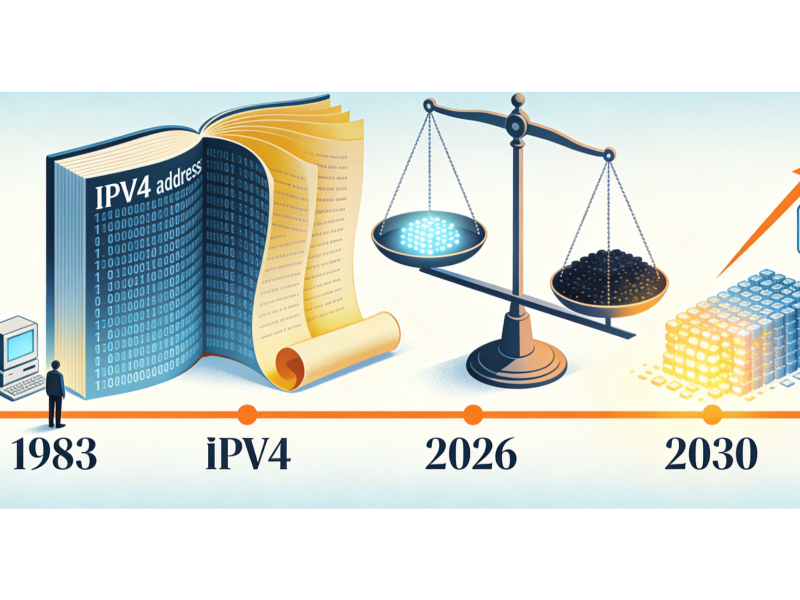

Internet Protocol version 4 (IPv4) addresses are 32-bit numerical identifiers that enable devices to communicate over the internet. The finite nature of IPv4 — limited to about 4.3 billion unique addresses — has meant that free pools of addresses have been exhausted since the early 2010s, and allocations by the Internet Assigned Numbers Authority (IANA) and Regional Internet Registries (RIRs) now occur only through transfers and secondary markets.

This scarcity has had profound effects on how organisations value and trade IPv4 resources. Markets have emerged where IPv4 blocks are bought, sold and leased much like physical real estate in a growing city: demand persists even as supply tightens. Prices per IP address in recent years have tended to range from approximately $30 to more than $50, depending on block size and regional conditions, reflecting strong competition for limited space.

One significant factor is slow adoption of IPv6, a successor protocol designed to provide a vastly larger address space. Although IPv6 use has grown over time, interoperability challenges and legacy system dependencies mean that many networks still require IPv4 addresses, maintaining demand.

A case study in the secondary market highlights how these trends translate into economic value. Major cloud providers such as Amazon Web Services hold extensive IPv4 estates. For example, based on market rates of around $35 per address, AWS’s allocation of over 128 million IPv4 addresses has been estimated in the billions of dollars, turning what was once a technical necessity into a significant asset for large technology companies.

Meanwhile, 2025 market data shows that larger IPv4 blocks — once commanding high premiums — have seen price stabilisation or decline as supply fluctuations occur, partly due to organisations returning unused space or selling large blocks on the open market. This has led to volatility in valuations, analogous to shifts in real estate when new developments reduce scarcity pressures.

Also Read: Breaking the centralised choke point: Why IP addresses must be decentralised

Also Read: Who holds the Internet’s address book? Why digital sovereignty may be a mirage

Economic and governance implications

The transformation of IPv4 addresses into a tradable commodity raises questions about how core internet infrastructure resources should be managed. The analogy with real estate is useful but imperfect. While scarcity and demand drive valuation, IPv4 markets are heavily shaped by policy frameworks set by RIRs. These registries govern how transfers occur, with rules that vary across regions and can restrict or facilitate monetisation. For example, some regions have more flexible transfer policies than others, affecting local price differences.

These differences mean that IPv4 values vary not just because of supply and demand but because of regulatory and governance structures. Critics argue that treating IPv4 as a quasi-financial asset can disadvantage smaller organisations that cannot afford high-priced blocks or ongoing leasing costs, creating barriers to entry similar to those seen in property markets when prices escalate beyond reach.

While IPv6 promises relief from scarcity, its gradual adoption means IPv4 will remain relevant for the foreseeable future, keeping the market active. This ongoing relevance prompts debate: should internet number resources be subject to speculative markets, or should governance frameworks be adapted to prioritise accessibility and equitable distribution? The answer will shape how this form of “digital real estate” evolves and who gains or loses from its appreciation.