- Intel itself lists risks—from legal to international—that may result from government involvement.

- The move blurs the line between private enterprise and state control, with possible fallout in foreign markets.

What happened: US takes 10% of Intel, sparking risk fears

US chipmaker Intel has handed over 10 percent of its shares to the US government, marking a highly unusual and contentious affront to its traditionally independent status. The firm issued a risk warning in its SEC filing, saying that government involvement might shift drastically, even render the agreement illegal, and hurt existing shareholders.

It cautioned that its non-US business could suffer, as partners or rival governments might hesitate to work with a state-influenced company.

Intel detailed how the pact might provoke litigation, extra scrutiny, negative reactions from investors, employees, customers, suppliers or competitors, and create political backlash.

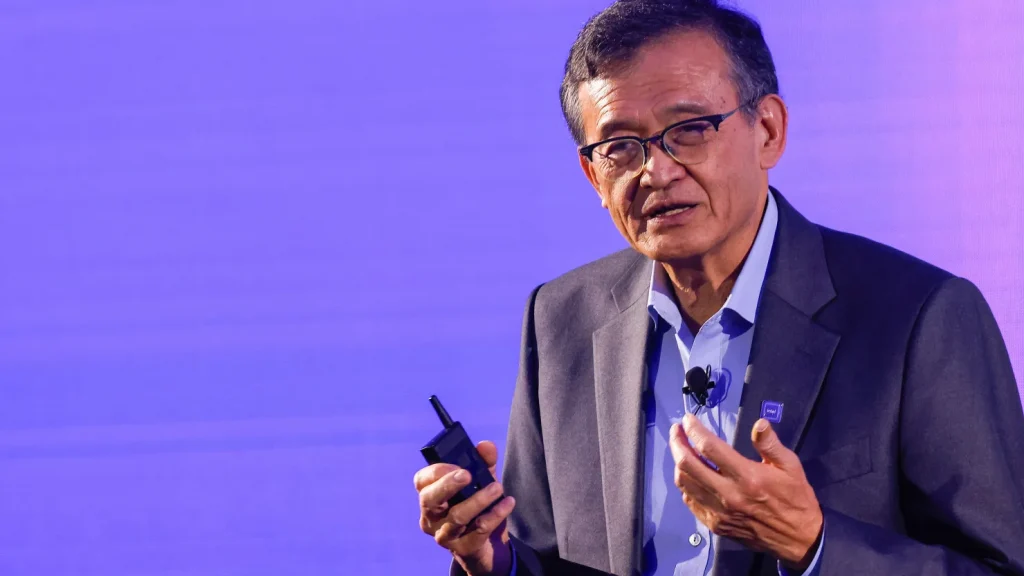

The deal’s optics were made sharper when Intel’s CEO, Lip-Bu Tan, appeared on X (formerly Twitter) for the first time to post a message widely viewed as sycophantic to the current US President. He also appeared in a video with US Secretary of Commerce Howard Lutnick.

Also Read: US state seeks stake in Intel

Also Read: US trades Intel stake for chips act funds

Why it’s important

This arrangement muddies the line between government and private business in the US. If the US criticises Chinese firms like Huawei for alleged state control, then Intel may now face similar accusations—and be judged under that same logic.

That could inhibit its ability to operate in key foreign markets, especially in countries sensitive to state influence.

The deal also signals a shift in how national security and industrial strategy are managed. State equity in a prime private tech firm gives the government leverage that goes beyond regulation; it invites political strings and control over strategic decisions.

The risks Intel itself flagged—legal, financial, reputational—illustrate how complex and unpredictable such agreements can be.

Extra factual note: The US government’s move mirrors prior reports of intent to acquire a stake in Intel, with estimations ranging between 8–20 percent based on its $100 billion market value.