- IP addresses have quietly shifted from background infrastructure to a factor that can influence enterprise costs, growth and operational resilience.

- As address scarcity and secondary markets expand, companies are discovering that returns increasingly rest on parts of the internet they rarely examine.

- The business dependency few executives talk about

- When abundance quietly turned into scarcity

- The economics enterprises encounter without naming them

- Governance shapes outcomes more than ownership

- How assumptions differ from reality

- Coordination, not enforcement, keeps the system running

- Why this rarely reaches the boardroom

- The growing link between address space and returns

- An infrastructure layer that stayed out of the way

- Looking forward without predictions

- FAQs

The business dependency few executives talk about

In most enterprises, IP addresses sit firmly outside strategic conversation. They are configured by network engineers, bundled into hosting or cloud contracts and assumed to be endlessly available. Senior leadership tends to encounter them only when something goes wrong, often framed as a technical issue rather than a business one.

Yet IP addresses underpin every digital interaction an enterprise relies on to generate revenue. Websites, customer portals, internal systems, cloud workloads and third-party integrations all depend on routable address space. Without it, nothing moves across the network, no matter how sophisticated the application layer may be.

What makes this dependency unusual is not its importance, but its invisibility. Return on investment models typically treat connectivity as a constant, much like electricity or water. The assumption is that the internet simply works, and that its basic identifiers are neutral, interchangeable and readily available.

That assumption is becoming less accurate.

Also Read: Why number registry stability is under scrutiny

When abundance quietly turned into scarcity

For much of the internet’s history, IPv4 addresses were sufficiently abundant that organisations rarely considered them a constraint. Networks expanded organically, address blocks were assigned as needed and few questioned whether availability would ever become an issue.

That changed as the global IPv4 pool was exhausted. Once the remaining free space was depleted, addresses stopped behaving like an unlimited technical resource and began to resemble a finite input. Secondary markets emerged, leasing arrangements became common and address blocks acquired monetary value.

This transition did not arrive with a single disruptive event. Instead, it unfolded gradually, which is one reason many enterprises failed to notice it happening. Costs increased incrementally. Network planning required more coordination. Address management became more complex, particularly for companies operating across regions or growing through acquisition.

What had once been digital plumbing began to exert pressure on business decisions.

Also Read: IPv4: The digital real estate of the 21st century

The economics enterprises encounter without naming them

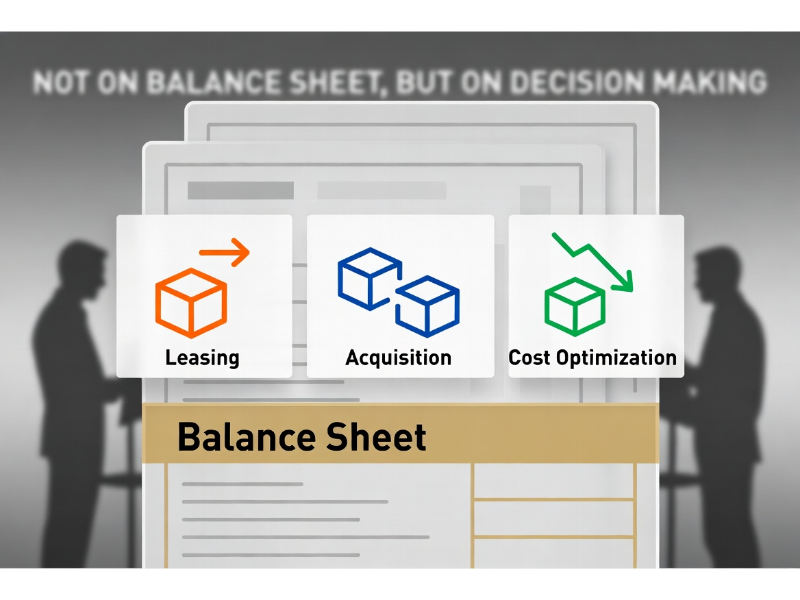

Today, many organisations participate in the IP address economy without explicitly acknowledging it. Some lease unused address space to offset operational costs. Others acquire additional blocks to support expansion or reduce reliance on network address translation. In mergers and acquisitions, address holdings are increasingly scrutinised, even if they do not appear as formal assets on balance sheets.

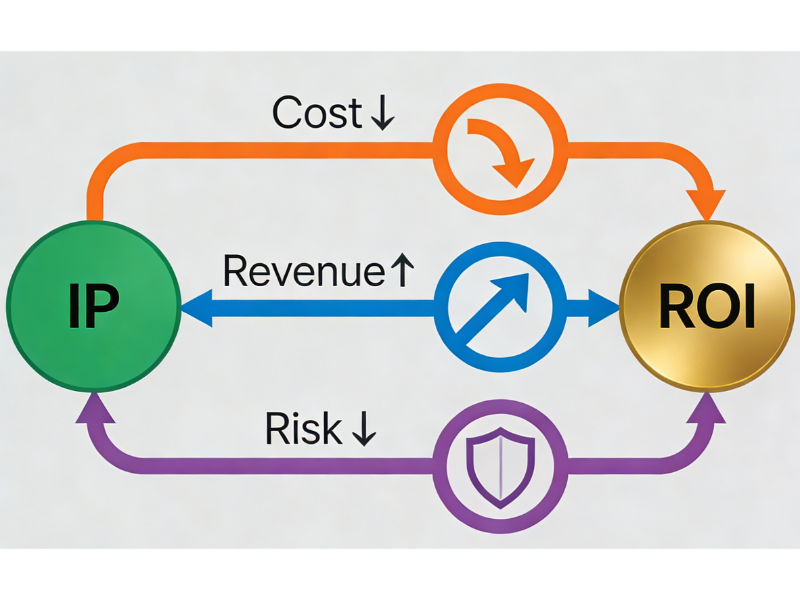

This activity can contribute to ROI, but it also embeds assumptions that are rarely examined. Address space behaves economically, but it is governed administratively. It can be transferred, but only under certain conditions. Its reputation can affect deliverability and routing, regardless of who currently uses it.

Lu Heng has written about this shift in behaviour and perception, noting that scarcity has altered how organisations relate to address space even when they do not consciously frame it as an asset:

“As IPv4 addresses became scarce, they started to influence business decisions in ways that were previously unnecessary. Organisations may not record address space as a traditional asset, but they increasingly factor it into network planning, cost control and even revenue considerations. This change has been gradual, which is why its impact on enterprise operations is often underestimated.”

——Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

The key point is not that IP addresses suddenly became valuable, but that their constraints became visible.

Also Read: Lu Heng warns ICP-2 revision threatens internet governance

Governance shapes outcomes more than ownership

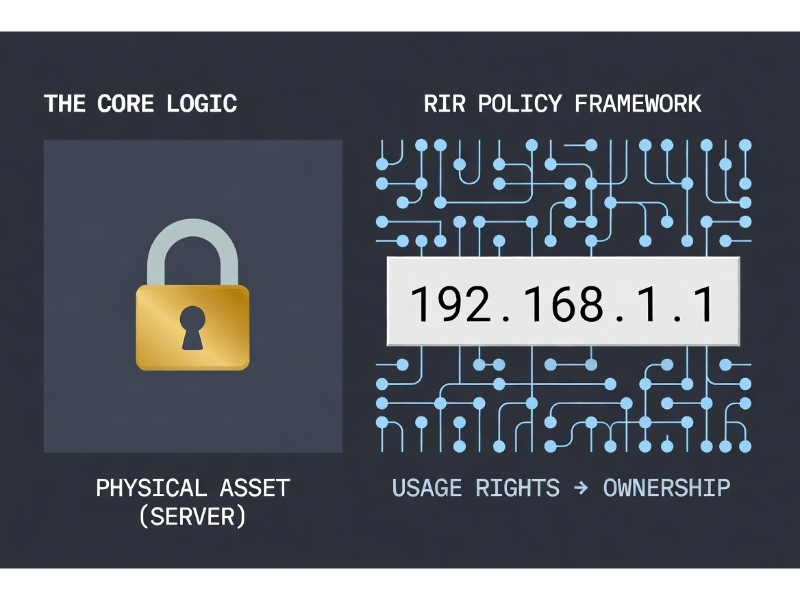

Unlike physical infrastructure or licensed spectrum, IP addresses are not governed by a single global authority. They are allocated and managed through Regional Internet Registries, which operate under policy frameworks developed through community consensus rather than statutory enforcement.

This governance model has long been regarded as one of the internet’s strengths. It enabled rapid growth, avoided geopolitical fragmentation and allowed technical coordination across borders. For everyday operations, it continues to function smoothly.

For enterprises, however, it introduces a layer of nuance that does not always align with corporate expectations. Address space is held under usage rights rather than outright ownership. Transfers require justification and approval. Historical usage can affect reputation, regardless of current intent.

These characteristics rarely disrupt operations outright, but they shape the conditions under which enterprises scale and generate returns.

Also Read: Case study: How enterprises generate recurring income from IPv4

How assumptions differ from reality

To understand why IP addresses can influence ROI in subtle ways, it helps to compare how enterprises often assume the system works with how it actually operates.

| Enterprise assumption | Operational reality |

|---|---|

| IP addresses are neutral technical identifiers | Address space can carry historical reputation and routing implications |

| Address availability scales with demand | IPv4 availability is constrained and often requires transfer or leasing |

| Control implies ownership | Usage rights are governed by policy, not property law |

| Connectivity is guaranteed infrastructure | Stability relies on coordination, not enforceable guarantees |

| Address management is purely technical | Decisions can have financial and operational consequences |

This gap between assumption and reality does not automatically translate into failure. It does, however, explain why IP-related issues can surface unexpectedly in cost, timing or risk calculations.

Also Read: How IPv4 asset strategy supports long-term enterprise growth

Coordination, not enforcement, keeps the system running

One reason these dynamics are poorly understood outside technical circles is that the IP address system does not resemble traditional regulated infrastructure. There is no central authority with enforcement power over global address use. Stability emerges because most participants continue to cooperate.

Geoff Huston has repeatedly highlighted this characteristic when discussing internet resource management and its limits:

——Geoff Huston, Chief Scientist at APNIC, APNIC Policy SIG remarks 2023

For enterprises accustomed to operating within regulated markets, this reliance on coordination can be easy to overlook.

Also Read: Why CFOs, not just CTOs, should care about their IP inventory

Why this rarely reaches the boardroom

Despite its growing relevance, IP address strategy seldom features in executive discussions. One reason is that problems at this layer tend to emerge gradually rather than catastrophically. Another is organisational structure: responsibility for address management usually sits within IT or network operations, far removed from financial planning.

There is also a language barrier. Internet governance and address policy are often discussed in technical terms that discourage broader engagement. As long as systems continue to function, there is little incentive to revisit underlying assumptions.

The result is not neglect, but a blind spot. ROI models incorporate connectivity as a given, without fully accounting for the conditions that sustain it.

The growing link between address space and returns

As enterprises continue to digitise operations, the relationship between IP addresses and financial performance becomes tighter. E-commerce platforms depend on reachability and reputation. SaaS providers depend on stable routing and deliverability. Cloud-native businesses depend on scalable address management across regions.

In some cases, address space contributes directly to revenue. In others, it reduces costs or enables growth. More often, it simply determines how smoothly digital operations can expand.

These effects are incremental rather than dramatic. Over time, incremental effects shape returns.

An infrastructure layer that stayed out of the way

The longevity of the IP address system is a testament to its design. A governance framework created decades ago continues to support a global digital economy. That success is precisely why its limits are easy to miss.

What has changed is not the system itself, but the weight enterprises now place upon it. Address space has become intertwined with commercial outcomes in ways that were never anticipated when the system was designed.

Understanding that shift does not require radical conclusions. It requires recognising that something once treated as neutral infrastructure now carries economic significance.

Looking forward without predictions

IP addresses are unlikely to dominate executive agendas any time soon. For many organisations, they will remain a background concern, managed operationally rather than strategically.

But as scarcity, complexity and dependency continue to grow, the influence of address space on ROI becomes harder to ignore. Not because the system is failing, but because expectations have changed.

For enterprises built on digital foundations, that reality is already part of the balance sheet, whether it is acknowledged or not.

FAQs

1. Are IP addresses owned by enterprises?

In most cases, enterprises do not own IP addresses in the same way they own physical assets or intellectual property. Address space is allocated under usage rights governed by Regional Internet Registry policies. These rights allow organisations to use and, in some circumstances, transfer address blocks, but always within a framework of rules and oversight. This distinction matters because it means control over address space is conditional rather than absolute, shaped by policy, historical usage and ongoing compliance rather than property law.

2. Can IP addresses generate revenue?

Yes, in certain circumstances IP addresses can contribute directly to revenue, most commonly through leasing unused address space or optimising existing holdings to reduce operational costs. However, this revenue is typically incremental rather than transformative. More importantly, monetisation increases an organisation’s dependency on the governance framework that underpins address transfers and leasing. Revenue generation does not change how the system is administered; it simply raises the stakes of continued access and compliance.

3. Is the IP address system unstable?

The global IP address system is generally stable and has demonstrated remarkable resilience over decades of internet growth. Its stability, however, comes from coordination rather than enforceable guarantees. There is no central authority that can compel behaviour across jurisdictions or ensure uniform outcomes. Under normal conditions, this model works well. Under stress, differences in policy interpretation, jurisdiction and incentives can introduce friction, even if outright failure remains unlikely.

4. Why don’t companies discuss this more openly?

One reason is that IP-related issues tend to emerge gradually and are often resolved operationally rather than strategically. Responsibility for address management usually sits within technical teams, far from executive decision-making. There is also a perception that connectivity is a solved problem, reinforced by the system’s long history of reliability. As a result, the financial and strategic implications of address space rarely surface in boardroom discussions unless triggered by a specific incident.

5. Does IPv6 remove these concerns?

IPv6 significantly expands address availability and reduces scarcity-related pressure, but it does not eliminate governance considerations. IPv6 addresses are still allocated through the same coordination-based framework, and enterprises often operate in dual-stack environments where IPv4 remains operationally critical. Adoption challenges, compatibility requirements and transitional complexity mean that IPv6 changes the dynamics of scarcity, but not the underlying reliance on policy, coordination and shared assumptions.