- IP inefficiency quietly erodes ISP margins through waste, compliance friction, and unnecessary capital expenditure.

- Structured IP management can unlock measurable revenue, reduce costs, and strengthen balance sheets.

Effective IP address management has become a decisive profitability lever for ISPs facing IPv4 scarcity, rising costs, and intensified competition.

Also Read: Why Registries Must Never Become Enforcers

Also Read: Why I Act to Protect the Number Registry System — and Why This Is About Stability

- Why IP management has become a profit issue

- The hidden cost of inefficient IP allocation

- IPv4 scarcity and margin pressure

- How better IP management improves profitability

- IP addresses as balance-sheet assets

- Regulatory and governance constraints

- Monetisation strategies enabled by good IP management

- Why human decisions still matter

- Table: financial impact of IP management maturity

- Frequently asked questions

Why IP management has become a profit issue

For decades, IP address management sat deep inside network operations, rarely discussed beyond engineering teams. Today, that has changed. IPv4 scarcity, rising network complexity, and growing regulatory scrutiny have turned IP addresses into a direct financial variable for internet service providers.

An ISP’s ability to allocate, track, reuse, and monetise IP resources now affects margins, expansion capacity, and even corporate valuation. What was once an operational concern has become a business discipline.

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd and founder of the LARUS Foundation, has repeatedly argued that IP inefficiency is one of the most underestimated financial drains in the connectivity sector. As he notes,

“Every ISP’s balance sheet is affected by IPv4 holdings.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

That observation reframes IP management from cost control into capital optimisation.

The hidden cost of inefficient IP allocation

Poor IP management rarely appears as a single line item. Instead, it manifests through fragmentation, underutilisation, and operational friction. ISPs often hold far more address space than they actively deploy, while simultaneously leasing or purchasing additional blocks due to poor visibility.

In fragmented environments, address pools become stranded across legacy systems, regional silos, or outdated provisioning tools. Engineers compensate by over-allocating, increasing consumption without improving service quality.

Lu Heng has described this dynamic bluntly:

“IPv4 addresses remain one of the most undervalued assets in the global digital economy.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

IPv4 scarcity and margin pressure

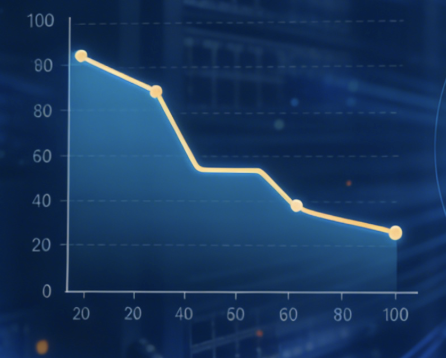

IPv4 scarcity has shifted IP management from abundance to constraint. Free allocations have largely disappeared, forcing ISPs to acquire addresses through secondary markets or leasing arrangements.

These costs accumulate quietly. A mid-sized ISP leasing tens of thousands of addresses may spend hundreds of thousands of dollars annually without recognising IP as a controllable cost driver.

| Cost factor | Poor IP management | Optimised IP management |

|---|---|---|

| Address utilisation | Low | High |

| Leasing dependency | Persistent | Reduced |

| Audit compliance | Reactive | Proactive |

| Expansion readiness | Constrained | Planned |

According to Heng’s analysis, scarcity itself is not the core problem. He writes:

“Scarcity does not destroy value. Mismanagement does.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

How better IP management improves profitability

Reducing unnecessary address acquisition

The most immediate financial gain comes from reducing unnecessary purchases or leases. Accurate inventory systems reveal dormant or reclaimable space, allowing reuse instead of acquisition.

For many ISPs, this alone can delay new IPv4 purchases by years.

Improving operational efficiency

Structured IP management reduces manual intervention, ticket volume, and provisioning errors. This lowers labour costs and shortens service activation times, directly improving customer experience and retention.

Supporting IPv6 transition economics

While IPv6 adoption is essential, transition costs are non-trivial. Better IP management enables phased deployment, dual-stack optimisation, and controlled IPv4 retention, reducing disruption and avoiding rushed spending.

Also Read: On Reality Layers, Symbolic Power, and Why Clarity Feels So Hostile

Also Read: On Decentralising Global IP Address Registration with Distributed Ledger Technology

IP addresses as balance-sheet assets

One of the most controversial aspects of IP management is asset recognition. Although registries frame IP addresses as allocated resources rather than owned property, markets increasingly treat them as economically real.

Heng has argued that ignoring this reality creates strategic blind spots:

“Governance frameworks cannot override economic reality.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

ISPs with disciplined IP management gain clarity over the scale and condition of these holdings, strengthening internal planning and external valuation narratives.

Also Read: On the Upper Potential of IPv4 as an Investment Asset

Regulatory and governance constraints

Regional Internet Registries coordinate allocation but do not operate as financial regulators. Their policies shape how IPs move, but cannot enforce efficient use.

This creates an environment where operational discipline, not policy compliance alone, determines financial outcomes. Heng observes:

“The RIR system coordinates distribution. It does not optimise utilisation.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

Better IP management therefore becomes a competitive differentiator rather than a compliance exercise.

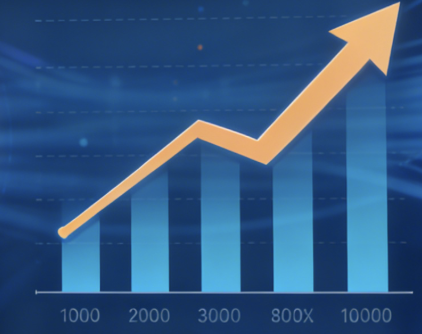

Monetisation strategies enabled by good IP management

ISPs with high-quality address data gain optionality. They can:

• Lease surplus IPv4 space without compromising service

• Reclaim and redeploy underused blocks

• Support wholesale, MVNO, or enterprise offerings more efficiently

Without visibility and governance, these strategies remain inaccessible.

Why human decisions still matter

IP management is not purely technical. It reflects organisational incentives, internal communication, and long-term planning. Engineers optimise for stability. Finance teams optimise for cost. Leadership must align both.

Heng has noted that misalignment is common:

“IP addresses sit at the intersection of engineering reality and financial consequence.”

Lu Heng, CEO at Cloud Innovation, CEO at LARUS Ltd, Founder of LARUS Foundation.

Better IP management requires recognising that intersection and managing it deliberately.

Also Read: On Informational Civilization: The Inevitable Path from Biological Individuals to Cosmic-Scale Intelligence

Also Read: On Why My Winning Is Historically Inevitable — and Why Winning Was Never the Point

Table: financial impact of IP management maturity

| Maturity level | Financial impact |

|---|---|

| Ad hoc | Rising costs, low visibility |

| Documented | Reduced errors, limited savings |

| Centralised | Improved utilisation, cost control |

| Strategic | Revenue enablement, asset optimisation |

Frequently asked questions

Why does IP management affect ISP profitability?

Because IP inefficiency increases costs, limits growth, and forces unnecessary address acquisition.

Is IPv6 enough to solve the problem?

No. IPv6 reduces future scarcity but does not eliminate current IPv4 financial exposure.

Can IP addresses really be considered assets?

Markets increasingly treat them as economically valuable, regardless of governance language.

Do small ISPs benefit from better IP management?

Yes. Smaller operators often see faster gains due to tighter margins.

Is IP management mainly a technical issue?

No. It is an operational and financial discipline with strategic implications.