- Airtel Africa has partnered with SpaceX to introduce Starlink’s direct-to-cell satellite technology across 14 African markets starting in 2026.

- The initiative aims to reach underserved regions but raises questions about cost, regulatory uncertainty and the role of terrestrial infrastructure.

What happened: Satellite-to-Mobile Connectivity Partnership

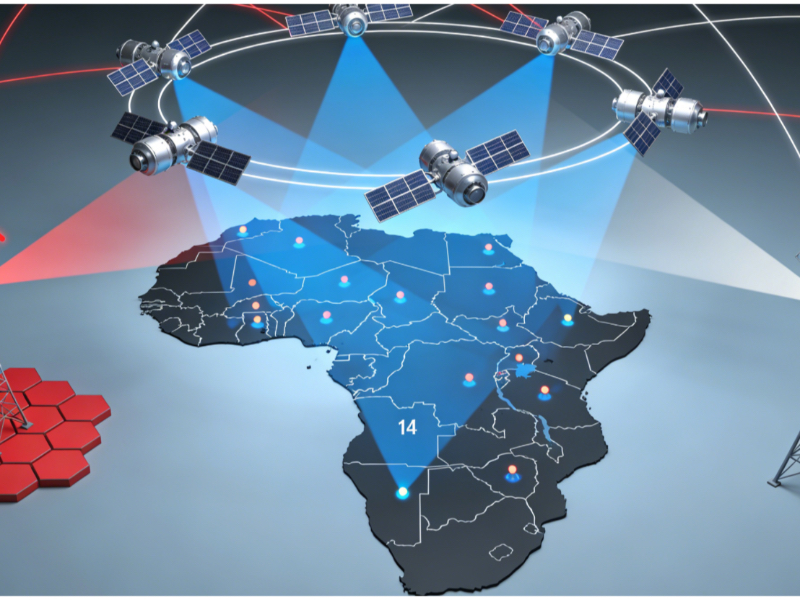

Airtel Africa has announced a partnership with U.S. aerospace and satellite provider SpaceX to deploy Starlink’s Direct-to-Cell satellite connectivity across its 14 African markets beginning in 2026. The service will initially support text messaging and select data applications for compatible smartphones, particularly in areas where traditional terrestrial networks are limited or absent.

Under the agreement, compatible devices will communicate directly with SpaceX’s low-Earth orbit Starlink satellites, bypassing the need for ground-based cell towers in certain regions. The technology also includes support for Starlink’s first broadband direct-to-cell system, which promises significantly higher data speeds — potentially up to twenty times faster than earlier satellite-to-mobile solutions. Rollout timelines and service specifics are subject to regulatory approval in each country within Airtel’s operating footprint.

Airtel Africa’s 14 markets encompass a large and diverse customer base. In total, the operator serves hundreds of millions of subscribers, a community that includes many people in rural and remote areas where mobile network infrastructure remains limited or incomplete. Satellite-first connectivity initiatives are increasingly seen among African telecoms as a way to bridge persistent gaps in coverage and to support network resilience.

Also read: Airtel partners with SpaceX to bring Starlink to India

Also read: One NZ reaches 2M satellite messages milestone with SpaceX

Why it’s important

The partnership reflects a broader industry trend toward hybrid connectivity models that combine terrestrial networks with satellite links to expand reach. For Airtel Africa, the arrangement could help position the company as a more robust provider in areas where building traditional cellular infrastructure is prohibitively expensive or logistically difficult. However, meaningful questions remain about the costs to end users, especially in markets where affordability is already a significant barrier to internet access.

By using satellite direct-to-mobile technology, Airtel and SpaceX may reduce the need for some physical towers and backhaul infrastructure. Yet this approach also highlights dependence on external technologies — specifically U.S.-based satellite systems — and the potential implications for African digital sovereignty and control over critical communications infrastructure. Regulatory hurdles could further complicate the introduction of these services, as approvals must be obtained separately in each of the 14 countries.

Moreover, the initial focus on basic text and limited data services — rather than fully fledged broadband — suggests a cautious rollout of satellite-to-mobile technology that might serve niche needs at first rather than fully replace ground networks. This could prompt debate about the long-term sustainability and equity of connectivity solutions that depend on costly satellite hardware and licensing frameworks.

Overall, while the Airtel-Starlink alliance could boost access in hard-to-reach parts of Africa, observers will be watching how regulatory challenges, cost structures and the balance between satellite and terrestrial infrastructure shape its real-world impact.