- The EGX is undergoing digital transformation to meet modern investor demands.

- Regulatory updates and market reforms aim to improve liquidity and attract foreign investment.

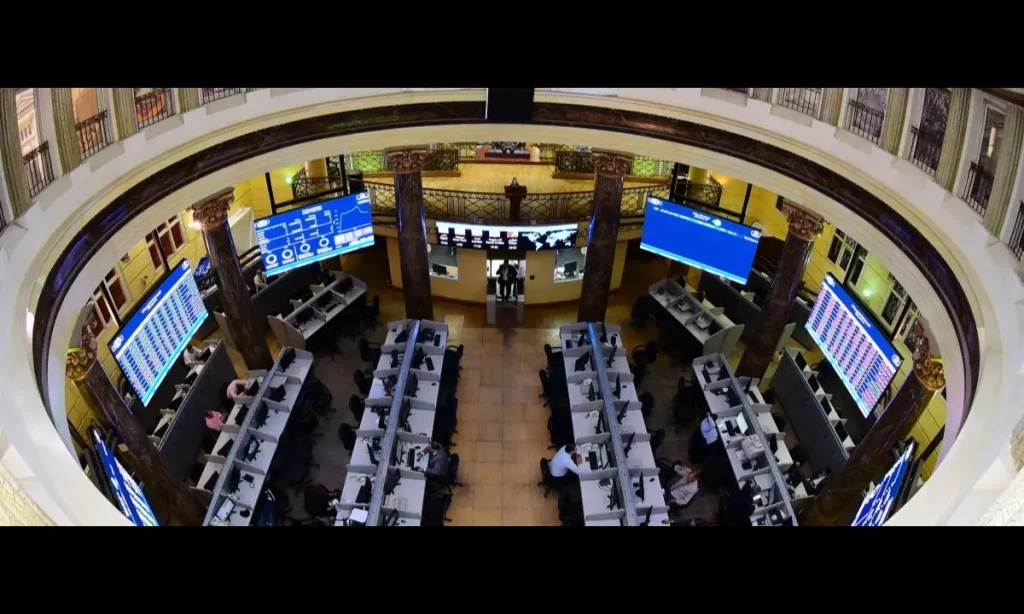

A modernisation drive for The Egyptian Stock Exchange

The Egyptian Stock Exchange (EGX), established in 1903, is a critical component of the country’s financial infrastructure. It acts as a market for securities, where companies can raise capital by issuing stocks, and investors can buy and sell shares. Despite the EGX’s rich history, it has faced several challenges in recent years, including economic instability, inflation, and regional uncertainties.

However, the EGX is currently undergoing a transformation aimed at increasing its global competitiveness. The exchange’s recent adoption of modern technologies and regulatory reforms aims to attract both domestic and foreign investors. The Egyptian government is keen to strengthen the country’s financial markets and integrate them further into the global economy.

One of the most significant developments at the EGX has been its embrace of digital technologies. In recent years, the exchange has focused on improving its trading systems, making them more accessible and efficient. The implementation of the EGX’s new electronic trading platform has significantly reduced transaction costs, increased trading speed, and improved transparency.

Additionally, blockchain technology is being explored for settlement processes, ensuring faster and more secure transactions. These digital upgrades have also been paired with a push for financial inclusion, as the EGX aims to attract younger, tech-savvy investors who can trade via mobile apps and online platforms.

Also read: IQ Fiber brings 10‑gig network to Savannah

Also read: Rawafed Libya: Advancing Libya’s Digital Infrastructure

Challenges and market reforms

While these innovations have helped modernise the EGX, challenges remain. The exchange has faced volatility driven by regional political instability and domestic economic challenges, including high inflation and currency devaluation. These factors have caused some fluctuation in trading volumes and market confidence.

To address these issues, the Egyptian government has introduced several reforms to improve market liquidity and attract foreign investment. These include tax incentives for foreign investors, a more streamlined listing process for companies, and stronger protections for minority shareholders. The EGX has also worked on improving its corporate governance practices, ensuring that listed companies adhere to international standards.

Despite these obstacles, the EGX’s commitment to modernisation, coupled with regulatory reforms, places it in a strong position to regain momentum and continue evolving as a key player in the region.