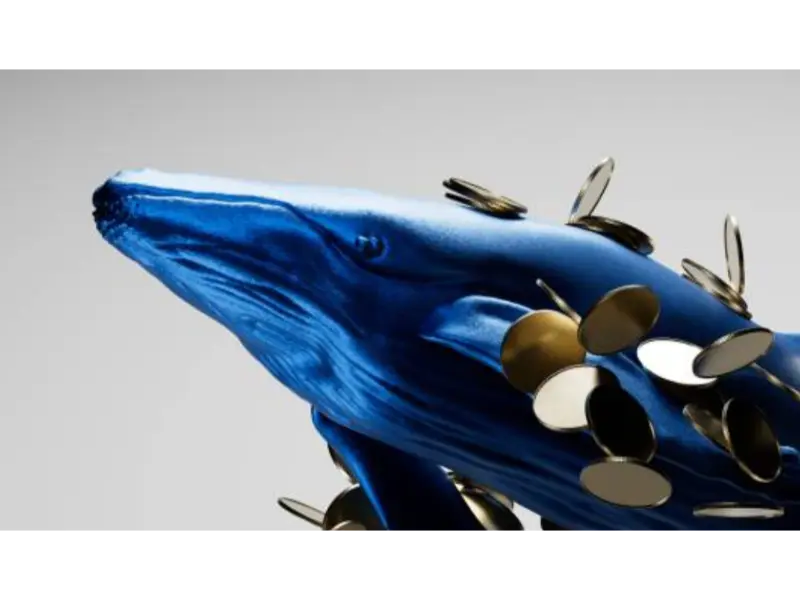

- Unidentified whales acquired an estimated 240,000 to 420,000 bitcoins in 2024, according to CryptoQuant’s CEO.

- The large-scale purchases have sparked speculation about institutional involvement and potential impacts on Bitcoin’s price trajectory.

What happened: Whale Bitcoin buys spark market speculation

CryptoQuant CEO Ki Young Ju revealed that unidentified whales have acquired between 240,000 and 420,000 bitcoins in 2024, significantly impacting market dynamics. These large-scale purchases represent billions of dollars in investment and highlight growing interest in Bitcoin as a long-term asset.

While the identities of the buyers remain unknown, analysts suggest the involvement of institutional players or high-net-worth individuals taking advantage of market dips. Whale activity often influences Bitcoin’s price due to the sheer volume of transactions, and this year’s acquisitions are no exception.

The accumulation has fueled speculation about future price movements, with some experts suggesting that these purchases signal confidence in Bitcoin’s long-term potential. However, the concentration of assets among whales also raises concerns about market manipulation and price volatility, underscoring the complexities of Bitcoin’s decentralized ecosystem.

Also read: Michael Saylor gives $299M Bitcoin gift to MSTR holders

Also read: Odds rise for Magnificent 7 company investing in Bitcoin

Why it is important

The revelation that whales purchased up to 420,000 bitcoins in 2024 is a significant development in the cryptocurrency market. Such large-scale acquisitions indicate heightened interest in Bitcoin as a strategic investment, particularly among institutional players and wealthy individuals. The volume of these purchases suggests long-term confidence in Bitcoin’s potential as a store of value and hedge against economic uncertainty.

However, whale activity often brings both opportunities and challenges. On one hand, significant accumulation can signal bullish sentiment, encouraging smaller investors to follow suit. On the other hand, the concentration of Bitcoin among a few large holders raises concerns about market manipulation and increased price volatility, especially during periods of selling pressure.

This development underscores the influence of whale activity on Bitcoin’s price trajectory and market dynamics. As more data emerges, the crypto community will continue to monitor these purchases for insights into broader market trends and the role of institutional investors in shaping Bitcoin’s future.