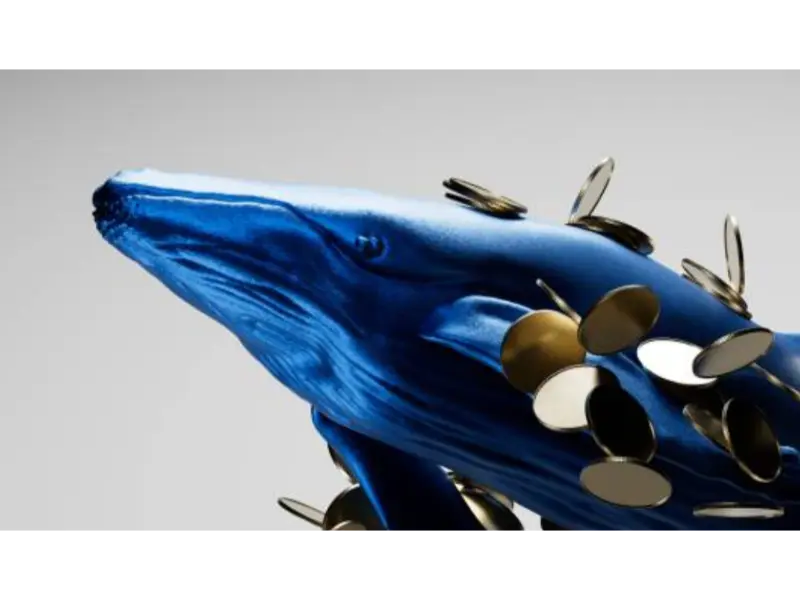

- Bitcoin continues its decline from the $100,000 milestone, with whale investors significantly reducing their exposure.

- Analysts warn of potential market volatility as declining whale activity impacts Bitcoin’s momentum.

What happened: Whale sell-offs hinder Bitcoin’s $100K goal

Bitcoin’s much-anticipated rise to $100,000 has hit another roadblock, as the leading cryptocurrency struggles to maintain momentum. A key driver of this decline is reduced exposure by whale investors, who play a critical role in influencing Bitcoin’s price movements. This reduction in large-scale holdings has created a ripple effect, leading to a decline in market confidence and increased selling pressure.

Market analysts point to dwindling trading volumes and lower institutional interest as additional factors contributing to the downward trend. While Bitcoin remains the top cryptocurrency by market capitalization, the retreat of high-net-worth investors suggests a cautious approach amid broader macroeconomic uncertainty.

This latest drop reflects the volatile nature of the cryptocurrency market, with Bitcoin’s price still far from its much-anticipated $100,000 target. However, some experts believe the decline could offer opportunities for long-term investors, as the market adjusts to these new dynamics.

Also read: Quantum computing to fortify Bitcoin signatures: Adam Back

Also read: Bitcoin prices hit new highs this week as various factors drive gains

Why it is important

Bitcoin’s struggle to reach $100,000 is more than a psychological milestone; it represents a critical indicator of market sentiment and institutional confidence in cryptocurrencies. The reduction in whale activity—a key metric often linked to market health—underscores growing caution among major investors. Whales, known for their significant market influence, often signal the direction of broader trends. Their reduced exposure could indicate a shift in sentiment, contributing to increased price volatility.

This development also highlights the fragility of Bitcoin’s momentum, as it faces headwinds from declining institutional participation and reduced trading volume. For retail investors, the retreat of whale investors raises questions about the short-term stability of Bitcoin’s price trajectory.

Despite these challenges, Bitcoin’s decline could also present opportunities for long-term investors looking to accumulate at lower prices. As the cryptocurrency market continues to evolve, Bitcoin’s performance remains a focal point for investors and analysts, shaping the broader narrative of digital asset adoption and market maturity.