- US BNPL leader Affirm announces a $4 billion capital partnership with Sixth Street.

- The collaboration aims to expand Affirm’s market reach and solidify its financial services.

What happened: Major capital injection for Affirm

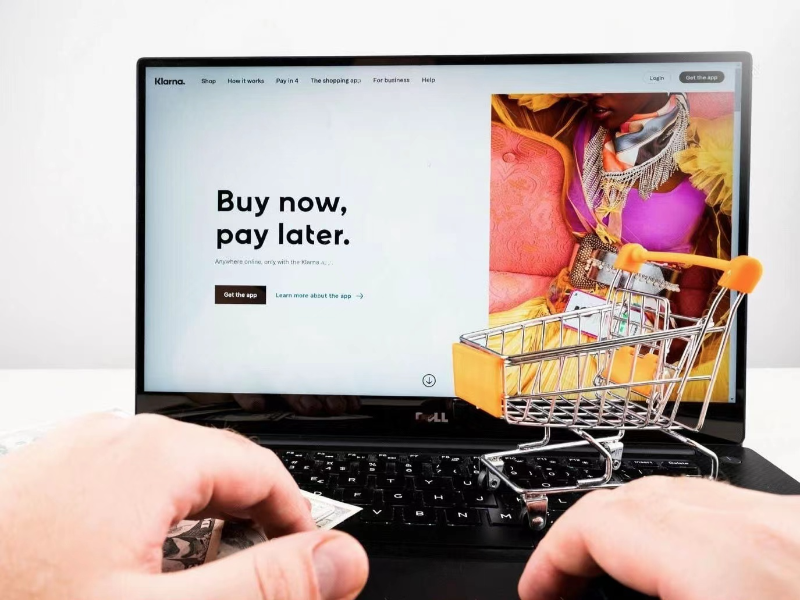

US-based Buy Now, Pay Later (BNPL) fintech company Affirm has secured a significant $4 billion capital partnership with Sixth Street, a leading global investment firm. This partnership is set to empower Affirm to further its mission of providing flexible payment options to consumers and merchants, enhancing its position as a key player in the BNPL market. The capital injection will support Affirm’s ongoing growth, allowing the company to expand its services, invest in new technologies, and potentially enter new markets. This collaboration also signifies Sixth Street’s confidence in Affirm’s business model and the BNPL sector’s potential for significant growth.

Also read: Scalapay partners with Trustfull to prevent fraud in BNPL

Also read: What is Zilch Technology? Inside the BNPL service provider

Why it is important

This partnership is a significant development in the financial technology industry, particularly within the BNPL space. The $4 billion investment not only provides Affirm with the financial backing needed to compete more aggressively but also underscores the viability and attractiveness of BNPL services to major investors. The alliance with Sixth Street is expected to accelerate Affirm’s innovation in payment technology, enabling the company to offer more competitive and customer-centric solutions. This deal is also indicative of the growing trend of large-scale investments in fintech, reflecting the sector’s resilience and potential for innovation amidst economic shifts. For consumers and merchants, the expanded capabilities of Affirm mean greater access to flexible payment options, which can drive financial inclusion and support economic growth.