- China has launched an antitrust investigation into Nvidia, focusing on its 2019 acquisition of Mellanox Technologies, in response to escalating US restrictions on chip exports.

- The probe centers on Nvidia’s compliance with antimonopoly laws in China, particularly regarding the continued supply of critical technologies under the terms of the acquisition.

What happened: China’s antitrust probe into Nvidia highlights growing tensions in semiconductor industry

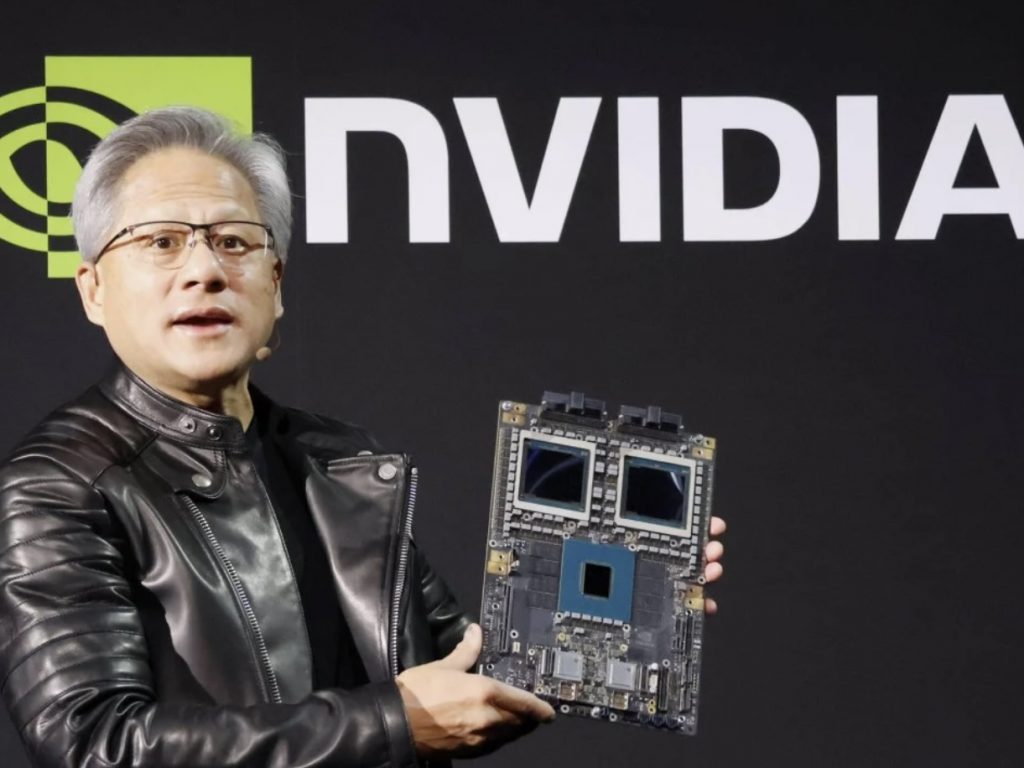

China’s State Administration for Market Regulation (SAMR) has initiated an antitrust investigation into Nvidia, focusing on the company’s $6.9 billion acquisition of Mellanox Technologies. This investigation follows Nvidia’s compliance with U.S. export restrictions, which limit the export of advanced chips to China. The acquisition, which was approved by China in 2020, came with the condition that Nvidia continue to supply Mellanox’s products to the Chinese market based on fair and non-discriminatory principles. The probe raises concerns about Nvidia’s market practices in China, adding to the ongoing tensions between the U.S. and China over semiconductor technologies.

Also Read: Nvidia develops new AI chip for China amid US export control

Also Read: Nvidia approves Samsung’s HBM3 for China market GPUs

Why it’s important

This investigation underscores the growing friction between China and the U.S. in the semiconductor sector. The U.S. has imposed increasing restrictions on the export of cutting-edge technologies, citing national security risks, particularly regarding military applications. Nvidia, a major player in the semiconductor industry, has been caught in the middle, complying with U.S. regulations while maintaining its business relationships in China. The antitrust probe may jeopardize Nvidia’s access to the Chinese market, which is vital for its AI and gaming businesses.

Additionally, the use of antitrust laws as a retaliatory tool against the U.S. highlights the strategic value of the semiconductor industry, where geopolitical issues directly impact market dynamics. This situation could set a precedent for how economic and regulatory measures are employed in the ongoing “chip war,” affecting future business operations and international relations within the tech sector.