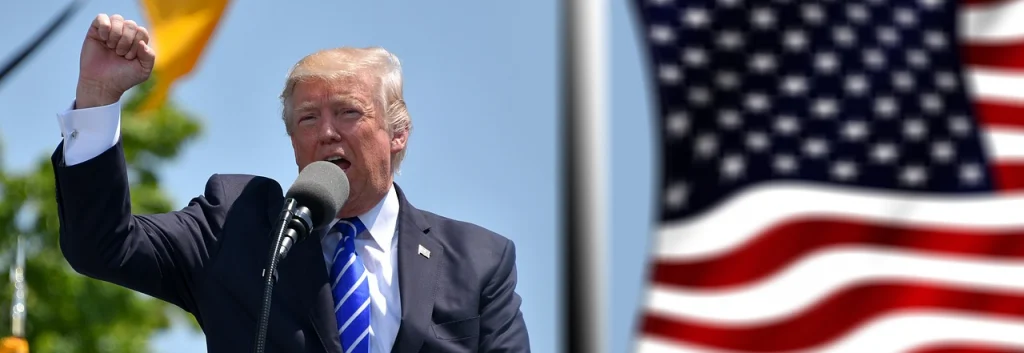

- Bitcoin has surged to record highs following Trump’s post-election shift towards a pro-crypto stance, signalling increased investor optimism.

- Trump cryptocurrency policies, such as reducing interest rates and easing regulatory constraints, could position the U.S. as a global crypto hub.

A day after Trump’s election win, the price of Bitcoin, the most well-known cryptocurrency, skyrocketed to an all-time record, going slightly above $89,000 at one point. The cryptocurrency industry in the U.S. had been facing pushback during Biden’s administration, but Trump, on the other hand, seemed to singlehandedly boost the optimism of cryptocurrency investors, without even stepping foot inside the White House again yet.

A change of heart: How Trump’s stance on digital assets evolved

Things haven’t always been this way, however. Once deeming cryptocurrency as a scam, the newly elected President’s stance on the issue has since evolved into one that is not only more affirming of cryptocurrency’s potential but also publicly declaring the demotion of Securities and Exchange Commission chair Gary Gensler, who had made many enemies in the crypto industry due to his insistence that most cryptocurrency transactions operated against federal laws. However, despite all the grandiose displays of support for cryptocurrency and the taunting of opposition, the budding industry was not listed among the 20 core goals on the Republican Party’s official website, nor was it mentioned in his recent interview with Elon Musk in August. To separate the promises from the reality of the situation, let’s dissect the policy changes that Trump has proposed and their potential implications on the cryptocurrency industry as it stands today. With the immediate impact felt just a day after his election, there may be more highs in store for cryptocurrency advocates.

“As we can already see with Bitcoins new alt time high the perception is very positive, and the general investors perspective is that Trump’s shift to pro-crypto is genuine and not only a pre-election maneuver.”

Patrick Gruhn, founder of Perpetuals.com

As Patrick Gruhn, founder of Perpetuals.com, notes, “As we can already see with Bitcoins new alt time high the perception is very positive, and the general investors perspective is that Trump’s shift to pro-crypto is genuine and not only a pre-election maneuver.” The Bitcoin movement signals the investors’ trust in Trump’s evolving position on digital currency, which has sparked increased confidence in other cryptocurrencies as well, with Bitcoin soaring to record highs of over $89,000 post-election

Trump’s evolving position on digital currency, while still murky in its final shape, suggests he may be positioning himself as a more crypto-friendly force than many initially expected. His dramatic reversal from skepticism to support has been influenced by his broader economic philosophy, which favors deregulation and innovation. As Blake Morgan, Managing Partner at Mineral Vault, explains, “Investors are viewing his support as a potential turning point, signaling that the U.S. might finally offer the regulatory clarity the crypto industry has been crying out for.”

Trump’s alignment with digital currency enthusiasts capitalizes on a rapidly expanding market that has drawn significant interest from institutional investors and tech moguls like Elon Musk.

‘Made in the USA’: Trump’s plan to bring crypto mining back to American soil

Trump has expressed his vision for crypto in more than just fleeting soundbites. His bold statement, “If crypto is going to define the future, I want it to be mined, minted, and made in the USA,” echoes a long-standing ambition to return manufacturing and innovation to American soil. While this sentiment appeals to national pride and economic self-sufficiency, this ambition faces several challenges, particularly regarding the environmental and energy demands associated with crypto mining. As cryptocurrency mining consumes a massive amount of electricity, the question arises: Can the U.S. energy grid handle the surge in demand that would come with such a heavy push towards domestic mining?

Reader Quiz:

What does Trump’s stance on cryptocurrency regulation mean for investors, according to industry insiders?

A) It suggests a more regulated and controlled environment for crypto.

B) It could lead to decreased investment as regulations tighten.

C) It hints at a period of growth with increased institutional support.

D) It means crypto mining will be restricted due to environmental concerns.

(Answer to be revealed in the final section)

As Trump pushes for “energy dominance,” the debate over energy consumption in the crypto industry intensifies. Mining operations have been criticized for their environmental impact, and under Biden’s administration, the U.S. has proposed measures like a 30% electricity tax on miners. However, Trump views the U.S. mining industry as a critical pillar for future national energy security. He suggests that U.S.-based miners not only contribute to Bitcoin’s network but also help stabilize the energy grid—by utilizing renewable energy sources and providing grid flexibility

The growing competition from Europe, the UAE, Singapore, and the UK cannot be overlooked. However, the U.S. remains well-positioned due to its extensive talent pool and entrepreneurial ecosystem. As Gruhn noted, “If the U.S. under Trump’s administration changes the policies and agency enforcement actions as anticipated, then this goal is really feasible. Even though there is a lot of political competition like Europe’s MiCA regulation or developments in the UAE, Singapore, and the UK, the U.S. is better positioned than those regions because of its extremely well-experienced talent pool of developers, entrepreneurs, and investors.” He continued, “The main issue for the U.S. crypto industry was a hostile environment under the Biden administration, which made it very hard for the industry to grow. For example, SEC enforcement actions in the U.S. have had impacts on the growth of such businesses in other regions like Europe, where such enforcement actions create additional scrutiny from regulators and might delay or even prevent license approval.”

The tension between political pressures and the industry’s growth prospects is likely to continue as crypto evolves globally. The real question remains: Will Trump’s stance on crypto and energy policies be enough to make the U.S. a global leader in cryptocurrency, or will the industry’s environmental challenges and regulatory complexities undermine its potential for long-term success?

Lower rates, higher risks? How Trump’s interest rate plans could boost crypto

Moreover, Trump’s proposal to lower interest rates could have far-reaching consequences for the crypto market. Lowering rates traditionally makes traditional investments less appealing, pushing capital toward higher-risk assets, such as digital currencies. This could be particularly advantageous for cryptocurrency, which has long been seen as a hedge against inflation. The question then becomes whether such a shift would encourage more institutional capital to flow into the space, further legitimizing crypto as an asset class or if it would lead to a short-term price spike followed by volatility as regulatory frameworks shift. Historically, market instability—whether driven by technological innovation or policy uncertainty—has been a consistent feature of the cryptocurrency landscape.

The possibility of Trump’s administration pushing for both lower interest rates and a more favorable regulatory landscape could be a powerful combination for the crypto market. As Gruhn explained, “A lower interest rate in conjunction with more favorable crypto regulations in the U.S. will likely drive more investors into crypto assets. Generally, lower interest rates alone are already positive for digital assets, and in combination with more legal certainty and more reasonable SEC enforcement actions, it will allow way more money to flow into the crypto industry. I think we see this right now already getting partially priced in as part of the current crypto price rally.”

The current crypto rally could be an early indicator of how markets are positioning themselves in anticipation of these shifts. According to recent data from the CoinDesk Bitcoin Price Index, Bitcoin has gained more than 50% in value since the start of 2024, reflecting optimism regarding both macroeconomic factors, like potential rate cuts, and the regulatory changes that may accompany a Trump-led administration. However, even if institutional capital flows into the space, the volatility that has historically defined crypto markets may remain a challenge, especially as political and regulatory shifts unfold.

A new era for crypto? Trump’s vision for a digital economy

The global nature of cryptocurrency means that any shift in U.S. policy could have ripple effects worldwide. As the world’s largest economy, a U.S. pivot toward crypto could push other nations to recalibrate their regulatory approaches, forcing competitors to adapt or risk falling behind in the race to control the digital future. For investors, especially those considering cryptocurrency as a long-term play, Trump’s policies could offer a potential windfall—or a new set of risks.

As Trump says, “We will have regulations, but from now on, the rules will be written by people who love your industry, not hate your industry.” This statement, though still largely ambiguous, presents an interesting paradox. On one hand, it suggests an environment that could foster growth, but on the other, it raises questions about what happens when the forces of deregulation and innovation collide with the risks of an unregulated market. Will this lead to a flourishing of new ideas and technologies, or will it simply open the door for more volatility and financial instability?

For now, investors and crypto businesses alike are left to watch and wait. As with all things Trump, the path ahead is uncertain, the cryptocurrency market may be riding high on the back of Trump’s rhetoric, but it remains to be seen how his policies will unfold.

Quiz Answer:

C) It hints at a period of growth with increased institutional support.