- AI, big data, and cloud computing make wealth management more efficient, personalised, lower in cost, and accessible to more investors.

- Robo-Advisers vs. Human Advisers: Robo-advisers are cost-effective and suitable for beginner investors, while human advisers provide personalised support for complex needs.

- The future of wealth management involves robo-advisers handling basic tasks, while human advisers focus on high-end planning, achieving a balance of efficiency and personalisation.

The rapid development of technology has brought revolutionary changes to wealth management services. The application of technologies such as artificial intelligence, big data analytics, and cloud computing has made wealth management services more intelligent and personalised, while also expanding investment channels and product varieties. This technological advancement not only improves the efficiency of investment decisions but also reduces service costs, allowing more investors to enjoy professional wealth management services.

With the development of financial technology, robo-advisers are changing the landscape of the investment advisory industry. Many investors are beginning to consider whether an automated robo-adviser or an experienced human adviser is more suitable for them. Which one best meets an individual’s unique investment needs and goals? Comparing robo-advisers and human advisers has become a key topic in financial management.

Also read: What is artificial intelligence?

Background and introduction to robo-advisers

Robo-advisers, also known as intelligent investment advisers, represent a major innovation in the fintech field. Originating from digital online investment analysis tools in the 20th century, robo-advisers are based on concepts such as modern portfolio theory and the capital asset pricing model. They use passive investment strategies to maximise returns at a specified risk level or to minimise risk at a set return level. Through complex algorithms and data analysis, robo-advisers provide more accurate and personalised investment advice. Initially, they primarily served investment advisers, helping to analyse portfolios, risks, and returns. With the rapid advancement of fintech, the intelligent stock investment industry has gradually emerged.

After the financial crisis, the general public in the United States began recognising the importance of saving and wealth preservation. However, the first robo-advisory companies, such as SigFig and Betterment, had already been established in 2007. Since 2015, robo-advisory services are no longer solely dominated by emerging tech companies; traditional financial institutions have also entered the field, and robo-advisory services are expanding into the broader wealth management sector. The Industrial and Commercial Bank of China has stated that using artificial intelligence for wealth management can make you a wealth management expert. With the accumulation of residents’ wealth and growing demand for investment advisory services among middle- and lower-income groups, these shifts in market demand have driven the development of smart investment advisory services.

Use artificial intelligence for financial management and become a financial expert!

Industrial and Commercial Bank of China (ICBC)

Also read: How can AI help with financial management and investment?

The pros of a robo-adviser

Low cost: Robo-advisers usually charge lower management fees, and they are an economical choice for small investors.

Convenient operation: Robo-advisers typically provide services through online platforms or mobile applications, enabling users to manage investments at any time and from anywhere, making it convenient for investors in the digital age.

High efficiency: Automated algorithms can quickly analyse market data and make investment decisions, improving the efficiency of financial services.

Objectivity: Robo-advisers provide financial advice based on preset algorithms, reducing the influence of human emotions and biases on investment decisions.

Transparency: Robo-advisers usually clearly present their investment strategies and fee structures, allowing users to easily understand where their investments are going.

24/7 access: Since robo-advisers rely on automated systems and algorithms, they do not require human intervention and can therefore monitor the market and manage investments around the clock.

The cons of a robot-adviser

Technical dependency: Robo-advisory services are entirely reliant on technology, and any technical failure or algorithm error could affect the quality of service.

Market adaptability: In cases of severe market fluctuations or extreme conditions, robo-advisers may not be able to adjust strategies as flexibly as human advisers.

Limited ability to address complex situations: For high-net-worth clients with special requirements or investors needing comprehensive financial planning, robo-advisers may not meet the demands of complex asset allocation and diversified investment goals.

Lack of human interaction: For investors who wish to communicate with advisers and need emotional reassurance, the impersonal, algorithmic nature of robo-advisers may fall short, especially during market fluctuations or crises, when comfort and explanations are needed.

Limited personalisation: Although robo-advisers attempt to offer personalised services, they may not understand clients’ personal circumstances and needs as thoroughly as human advisers.

Security and privacy concerns: Robo-advisers involve handling personal financial data, making data security and privacy protection crucial considerations for users.

Pop Quiz

Which of the following is NOT an advantage of using a robo-adviser?

A. 24/7 access

B. Emotional reassurance

C. High efficiency

D. Objectivity

The correct answer is at the bottom of the article

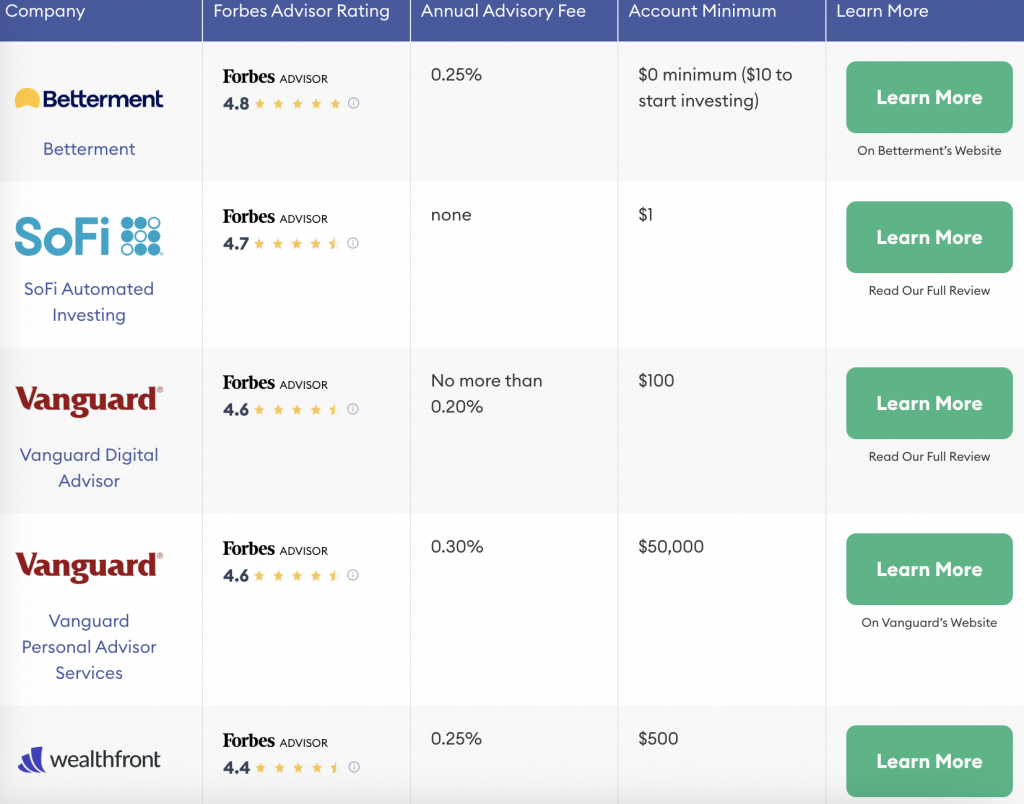

Best robo-advisers for 2024

- Betterment. Best Robo-Advisor for Everyday Investors

- SoFi Automated Investing. Best Robo-Advisor for Low Fees

- Vanguard Digital Advisor. Best Robo-Advisor for Beginners

- Vanguard Personal Advisor Services. Best Robo-Advisor for High Balances

- Wealthfront. Best Robo-Advisor for DIY Financial Planning

Also read: Best Robo-Advisors Of November 2024

What is a human financial adviser?

Human financial advisers (also known as personal advisers or financial consultants) are professionals with qualifications and experience who assist clients with financial planning and investment management. These advisers typically possess extensive financial knowledge and provide customised investment advice and comprehensive financial management services tailored to the client’s personal circumstances, financial goals, and risk tolerance. Drawing on their expertise in finance, investment, and economics, they offer personalised financial planning and investment advice.

These advisers typically hold professional certifications, such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst), and are equipped to provide comprehensive services, including retirement planning, tax strategies, and portfolio construction, based on the financial situation, risk preferences, and goals of different clients. Through in-depth communication, they understand clients’ needs, helping them achieve financial goals while managing risks. The value of human financial advisers lies in their expertise, experience, and the trust-based relationships they build with clients. Bank of China (Hong Kong) stated, “Exclusive Consultant, Just for You. The professional advisory team of ‘Private Wealth’ is always there for you when you need it, providing comprehensive planning early on to maximise the benefits of your wealth.”

Exclusive Consultant, Just for You

The professional advisory team of “Private Wealth” always there for you when you need it, providing comprehensive planning early on to maximise the benefits of your wealth.

Bank of China (Hong Kong)

The pros of a human financial adviser

Personalised service: Human financial advisers can provide customised financial plans based on the client’s individual circumstances and needs.

Professional knowledge and experience: Human financial advisers typically possess extensive knowledge in finance, taxation, and investment, enabling them to help clients analyse market trends and develop more in-depth investment strategies.

Comprehensive financial planning: Human financial advisers not only focus on investment management, but can also provide comprehensive financial services such as tax optimisation, estate planning, and retirement planning, safeguarding the overall financial health of their clients.

Flexibly handling complex situations: Human financial advisers can address diverse needs, such as cross-border asset allocation and tax strategies for high-net-worth individuals, making them suitable for complex investment and financial scenarios.

Emotional support and trust: During market fluctuations or periods of high uncertainty, financial advisers can provide comfort and confidence to clients, helping them avoid impulsive decisions and thereby protecting long-term investment returns.

The cons of a human financial adviser

High cost: The service fees of human financial advisers are usually high, which may limit access for some investors.

Information asymmetry and trust issues: In some cases, financial advisers may recommend high-yield but high-commission products, leading clients to question the fairness of these recommendations.

Reliance on personal ability: The quality of service provided by human financial advisers depends on their professional skills and experience. There may be significant differences in the competence of various advisers, so clients need to choose carefully.

Information updates: Compared to automated services, human financial advisers may not update market information and portfolios as frequently.

Emotional influence: Human financial advisers may be affected by personal emotions, which can sometimes impact their objectivity and decision-making abilities.

Summary of the results

According to the summary in the aforementioned article, robo-advisers are suitable for beginner investors, those with limited budgets, and users who prefer convenient, automated management. They are particularly suited to investors with lower risk tolerance and relatively simple investment goals.

Human financial advisers are ideal for high-net-worth clients, those with complex financial planning needs, investors sensitive to market fluctuations, and those seeking emotional support.

When making a choice, users can consider their financial needs, budget, investment goals, and personal requirements to select the type of adviser that suits them best. Some platforms even offer a combination of automated and human advisers, allowing investors to benefit from convenient, automated management alongside personalised human consultation.

The future of robo-advisers and human financial advisers

In the future, robo-advisers and human financial advisers will form a complementary relationship within the wealth management industry, jointly meeting the diverse needs of clients. Robo-advisers, leveraging algorithms and data analysis, can provide low-cost, automated investment management services, making them suitable for novice or small-scale investors. With advances in artificial intelligence technology, robo-advisers will become more intelligent, capable of dynamically adjusting strategies based on market changes and client behaviour, offering users a more personalised service experience.

Meanwhile, human financial advisers will play an irreplaceable role in addressing complex financial needs, providing emotional support, and delivering comprehensive financial planning. For high-net-worth clients or investors with complex financial requirements, the expertise, market insights, and communication skills of human financial advisers cannot be replicated by robots. In the future, robo-advisers will manage basic investment tasks, while human financial advisers will focus on high-end services and strategic planning, achieving a complementary advantage. This model of human-technology collaboration will drive the wealth management industry into a new era of greater efficiency, flexibility, and diversity.

Quiz Answer

B. Emotional reassurance