- IPv4 addresses are no longer just technical resources—they’re scarce, income-generating assets with real balance sheet value.

- Even as IPv6 grows, enterprise reliance on IPv4 remains deep and durable—making strategic management essential for CFOs.

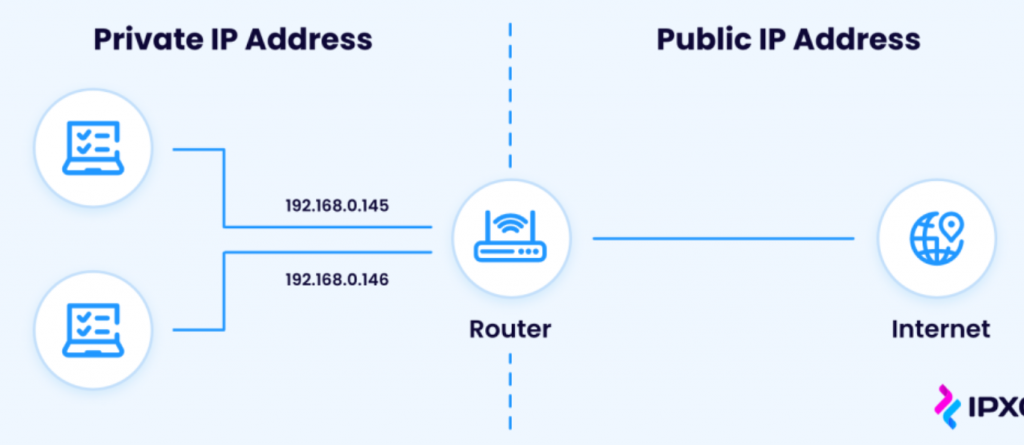

IPv4 addresses have evolved from a foundational networking protocol into a scarce, transferable asset class with tangible financial value. Since the global exhaustion of unallocated IPv4 space—completed at the IANA level in 2019 and across all Regional Internet Registries (RIRs) by 2023—these 32-bit identifiers have taken on characteristics more akin to infrastructure capital than technical overhead. For Chief Financial Officers (CFOs), this shift demands a new lens: IPv4 is no longer just an IT resource but a strategic balance-sheet asset requiring disciplined valuation, governance, and risk oversight.

IPv4 as Digital Infrastructure Capital

The market has already priced in scarcity. According to LARUS (larus.net), a neutral, registry-aligned provider of IP market intelligence, the average transaction price for IPv4 addresses in Q4 2025 was $38 per address, reflecting sustained demand despite two decades of IPv6 development. This is not speculative hype—it is driven by operational reality.

Even as IPv6 adoption increases, IPv4 remains deeply embedded in core business systems. Google’s public IPv6 adoption dashboard shows that as of February 2026, 52.8% of global users still access its services over IPv4. More importantly, many critical enterprise functions—payment gateways, legacy SaaS integrations, industrial control systems, and third-party APIs—continue to rely on stable IPv4 endpoints. These dependencies are not easily migrated, especially where vendor support or regulatory compliance requires fixed IP whitelisting.

This makes IPv4 less like depreciating software and more like spectrum licenses or data center real estate: non-revenue-generating enablers of revenue-critical operations. Under IFRS and U.S. GAAP, such assets can be capitalized when acquired separately and used to support economic activity—precisely the case for organizations purchasing IPv4 blocks to scale cloud or hosting services.

What CFOs Should Look For When Valuing IPv4

1. Utilization Efficiency and Opportunity Cost

The first financial question is straightforward: Are our IPv4 holdings fully utilized? Idle addresses represent stranded capital. The RIPE NCC’s “IPv4 Address Space Report” (December 2023) found that 23% of allocated IPv4 prefixes in its region showed no BGP routing activity over a six-month period—indicating significant underuse among legacy holders.

For companies with large historical allocations (e.g., /16 or /19 blocks), partial leasing or selective divestment can unlock liquidity without compromising operations. However, CFOs must assess strategic exposure: certain sectors—financial services, healthcare, and government contracting—often require long-term, static IPv4 ranges for auditability and security. Premature sales may incur higher replacement costs later.

2. Recurring Yield Through Compliant Leasing

Leasing unused IPv4 space offers a low-risk path to generate yield. LARUS reports an average lease rate of $0.48 per address per month in Q4 2025, translating to 12–16% annualized returns based on current market values. Critically, these leases are increasingly structured under RIR-compliant frameworks (e.g., ARIN NRPM 8.3 or RIPE NCC’s transfer policies), ensuring legitimacy and reducing regulatory risk.

From an accounting perspective, such leases function as operating leases—providing predictable cash flow without triggering complex revenue recognition rules. However, CFOs must ensure contracts include clear terms on duration, audit rights, and revocation in case of policy violations or operational need.

3. Long-Term Relevance Despite IPv6 Growth

While IPv6 adoption is rising—particularly in consumer-facing networks and government mandates—the Internet Society’s 2024 State of IPv6 Deployment Report emphasizes that IPv4 will remain operationally necessary for the foreseeable future. Over half of all internet-connected devices, including IoT sensors, point-of-sale systems, and embedded industrial hardware, lack IPv6 capability. Even dual-stack environments often default to IPv4 for reliability.

Moreover, ARIN’s 2024 transfer statistics show over 12 million IPv4 addresses changed hands, with more than 90% of transactions initiated by buyers—proof of structural, not speculative, demand. This underscores a key insight: IPv6 adoption complements but does not replace IPv4 in most enterprise architectures today.

Rather than modeling obsolescence, CFOs should treat IPv4 as a long-duration operational asset—similar to fiber optic cable or power infrastructure—with a useful life extending well beyond 2030. Impairment testing should reflect realistic usage scenarios, not theoretical end-of-life dates.

Case Study: Operational Asset Management in Practice

A European cloud infrastructure provider illustrates best practice. It retained ownership of its legacy /19 block while leasing idle portions under RIPE NCC-compliant agreements. By classifying IPv4 as operational infrastructure—not a trading asset—it avoided earnings volatility and maintained alignment between engineering needs and financial strategy. Lease income offset network maintenance costs, effectively turning a cost center into a modest yield generator.

This approach reflects how mature organizations manage other forms of digital infrastructure: through cross-functional oversight, regular utilization audits, and integration into enterprise risk frameworks.

Governance, Not Speculation

The IPv4 market is now institutionalized. Transactions are documented, RIR-approved, and increasingly disclosed in financial filings. The U.S. Securities and Exchange Commission’s 2023 guidance on cyber and infrastructure risk encourages companies to disclose dependencies on “finite digital resources,” and firms like Equinix now reference IP asset strategy in 10-K risk factors.

CFOs should establish clear governance:

- Joint ownership between finance, legal, and network teams.

- Annual reviews of utilization and market value.

- Compliance with RIR transfer policies to avoid invalidation.

- Transparent accounting treatment aligned with asset use.

Conclusion: Managing Scarcity as Strategy

IPv4’s value lies not in its novelty but in its irreplaceability within current internet architecture. Even as IPv6 expands, the installed base of IPv4-dependent systems ensures continued demand for years to come. For CFOs, the task is not to predict the end of IPv4—but to manage it wisely as a finite, high-utility asset.

In doing so, they align with a broader trend: the financialization of digital infrastructure. Just as fiber routes, data centers, and spectrum are managed as capital, so too should IPv4 addresses be evaluated—not as relics of the past, but as pillars of present-day connectivity.

As LARUS aptly notes in its 2025 market outlook, “IPv4 is no longer abundant, but it is still essential.”