- Huawei’s new CloudMatrix AI accelerator claims 20% better performance than Nvidia’s H100 in specific workloads

- The launch intensifies the US-China tech rivalry amid ongoing semiconductor restrictions

What happened: Huawei’s bold move into AI accelerator market

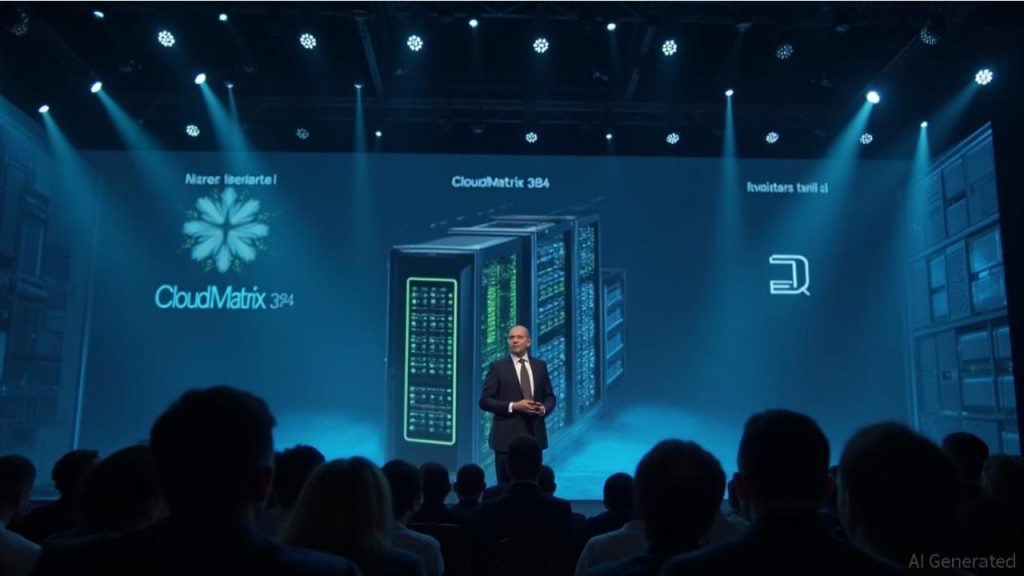

Huawei has officially unveiled its CloudMatrix AI accelerator, positioning it as a direct competitor to Nvidia’s industry-dominating data center GPUs, particularly the H100. According to Huawei’s benchmarks, the CloudMatrix delivers 20% higher performance in certain AI training workloads while consuming 15% less power than Nvidia’s flagship chip. The announcement comes at a critical time for the AI hardware market, where Nvidia has faced supply constraints due to U.S. export controls limiting its ability to sell advanced AI chips to Chinese firms.

Huawei’s entry into the AI accelerator space is not just a product launch—it’s a strategic move in the broader U.S.-China tech rivalry. The company has reportedly secured testing agreements with major Chinese cloud providers, including Alibaba Cloud and Tencent, signaling strong domestic industry support. This development is particularly significant because Huawei has been operating under strict U.S. sanctions since 2019, which cut off its access to advanced semiconductor manufacturing technologies. Yet, the company appears to have made progress in developing competitive AI hardware despite these restrictions.

Also read: Huawei’s AI lab denies copying Alibaba’s Qwen model

Also read: US tightens chip exports to Huawei and SMIC

Why it’s important

Huawei’s CloudMatrix launch represents more than just another AI chip—it’s a potential turning point in the global AI hardware market, which has long been dominated by Nvidia. While Nvidia still holds an estimated 80% market share in AI accelerators, Huawei’s progress suggests that China is making strides in reducing its reliance on U.S. technology. This is especially crucial given the ongoing geopolitical tensions and export controls that have disrupted supply chains for Chinese tech firms.

However, industry experts remain cautious. “Raw performance numbers are just one part of the equation,” says Wayne Lam, principal analyst at TechInsights. “Nvidia’s real advantage lies in its CUDA software ecosystem, which has become the industry standard for AI development. Huawei will need more than just hardware specs to compete at scale.”

Another critical factor is manufacturing capability. Huawei relies on SMIC (Semiconductor Manufacturing International Corp.) for chip production, which is still behind industry leaders like TSMC in cutting-edge process nodes. If Huawei can’t secure access to next-gen fabrication technologies, its long-term competitiveness could be limited.

This development also raises broader questions about market fragmentation. If China continues to develop its own AI hardware stack—separate from Nvidia’s—it could lead to a bifurcated AI ecosystem, where software and models optimized for one platform may not work efficiently on another. This could slow down global AI collaboration and innovation.