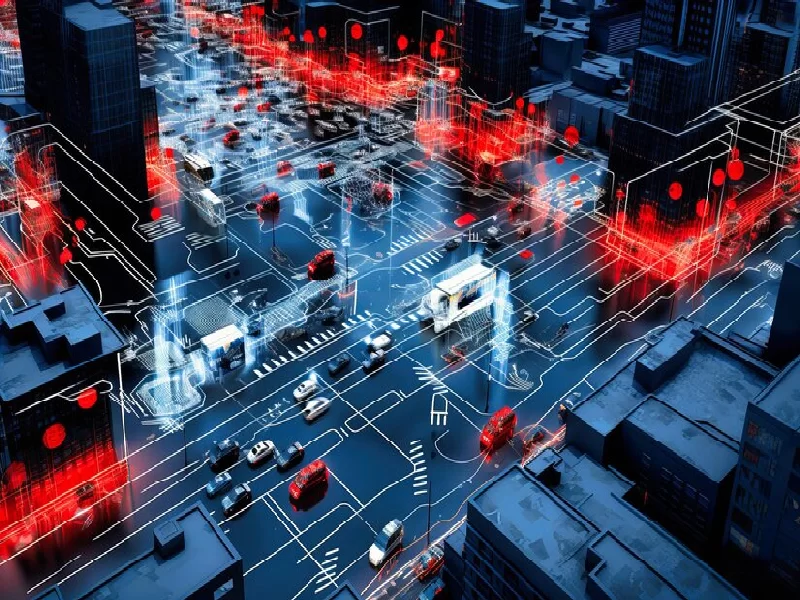

- Cyber for Auto by HSB addresses the rising threat of cyber-attacks on personal vehicles amid the surge of connected vehicles on U.S. roads.

- The solution safeguards private data stored in vehicles connected to cloud-based and wireless networks, offering coverage against malware, viruses, ransomware, and identity theft.

- With the increasing integration of technology in vehicles, Cyber for Auto aims to provide comprehensive protection, addressing consumer concerns about cybersecurity risks in the automotive sector.

HSB, a Munich Re subsidiary, has unveiled Cyber for Auto, a new coverage tailored to protect against cyber threats targeting personal cars and trucks.

Cyber threats targeting personal cars and trucks increased

The coverage has been designed to address the escalating threat of cyber-attacks on personal vehicles amidst the proliferation of connected vehicles on U.S. roads.

Cyber for Auto is specifically designed to cover attacks on personal data connected and stored in a vehicle. It aims to safeguard private information stored in personal vehicles and connected to cloud-based and wireless communication networks. This innovative solution comes at a time when automakers continue to integrate new technologies into vehicles, leaving them vulnerable to exploitation by hackers and cybercriminals.

With sensors, computers, and other connected technology becoming commonplace in passenger vehicles, the risk of cyber-attacks is on the rise. By syncing their smartphones with vehicles, drivers inadvertently expose personal data and connected technology to potential cyber threats, including online extortion and identity theft.

Also read: AuthMind Secures $8.5 Million Fund to Fight Cyber Threats

Cyber for Auto aims to offer comprehensive coverage in people’s daily life

A recent survey conducted by HSB revealed significant concerns among consumers regarding cybersecurity in vehicles. While hacking into vehicles may not yet be widespread, the increasing integration of technology raises concerns about the potential for ransomware, identity theft, and other cybercrimes targeting personal vehicles.

HSB Cyber for Auto offers comprehensive coverage against cyber-attacks, including malware, viruses, and ransomware demands.

Additionally, it provides identity recovery coverage and services, extending beyond vehicle-stored information to any compromised personally identifying information. This coverage aims to provide drivers with peace of mind in an increasingly connected automotive landscape.

James Hajjar, chief product and risk officer for the Treaty Division of HSB, part of Munich Re, stated, “Automakers continue to integrate new technologies into today’s vehicles. With each added system or connection, there are new vulnerabilities that hackers and other cyber criminals can exploit. Cyber for Auto helps insurers and their customers stay ahead of these new cyber exposures.”